Bitcoin’s Algorithmic Investment Risk

Quote from Ndubuisi Ekekwe on January 30, 2018, 3:55 AM

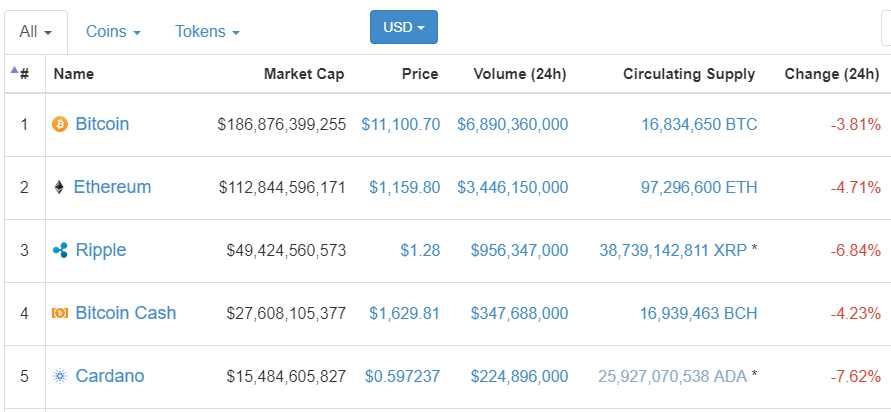

In trying to make sense of cryptocurrency investment, I have to examine how an investor who has put money in cryptocurrencies could perform. Largely, in currency investment, the expectation is that if one currency falls, some would gain, at least within the top five global currencies. In other words, it is not common for all the five top currencies to fall at the same time. So, if US dollars fall, Japanese Yen could be gaining. Or it could be Euro benefitting. But you do not have a case when all the top five currencies would fall at the same time. But for the crypto, that is exactly what is happening: all the top five are falling at the same time.

For crypto, this is risk - an algorithmic risk in cryptocurrency investment. These currencies are wired with the same fudge factor and they go in sync. And that means, you cannot really hedge among them. That makes the products deficient as investments.

The brilliance in real currency trading is that you are trading in the powers of the national economies that control the respective currencies. As America rises, its currency tracks that trajectory. The same happens in China, Japan, etc. But in cryptocurrency, the currencies are decoupled from any national economy and that means the “bonded spirits” of the investors are what drive the rise and fall. Or simply, there is no hard fundamental anchoring any element of what happens there. That is a very huge risk. It is all vapors, and that is not good.

In trying to make sense of cryptocurrency investment, I have to examine how an investor who has put money in cryptocurrencies could perform. Largely, in currency investment, the expectation is that if one currency falls, some would gain, at least within the top five global currencies. In other words, it is not common for all the five top currencies to fall at the same time. So, if US dollars fall, Japanese Yen could be gaining. Or it could be Euro benefitting. But you do not have a case when all the top five currencies would fall at the same time. But for the crypto, that is exactly what is happening: all the top five are falling at the same time.

For crypto, this is risk - an algorithmic risk in cryptocurrency investment. These currencies are wired with the same fudge factor and they go in sync. And that means, you cannot really hedge among them. That makes the products deficient as investments.

The brilliance in real currency trading is that you are trading in the powers of the national economies that control the respective currencies. As America rises, its currency tracks that trajectory. The same happens in China, Japan, etc. But in cryptocurrency, the currencies are decoupled from any national economy and that means the “bonded spirits” of the investors are what drive the rise and fall. Or simply, there is no hard fundamental anchoring any element of what happens there. That is a very huge risk. It is all vapors, and that is not good.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Share this:

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to email a link to a friend (Opens in new window) Email

- Click to print (Opens in new window) Print