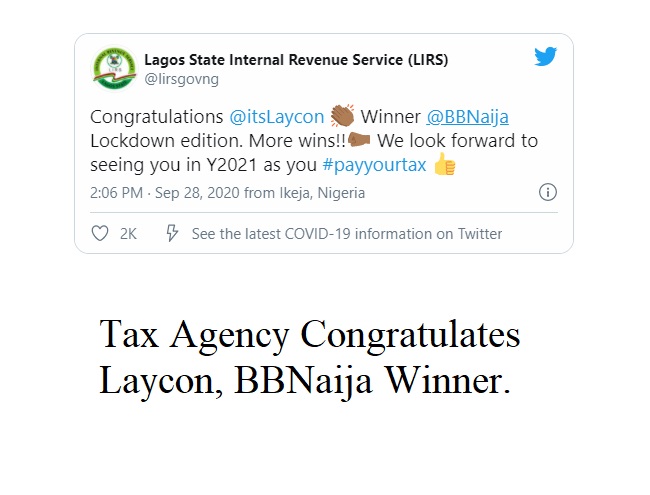

Tax Agency Congratulates Laycon, BBNaija Winner

Quote from Ndubuisi Ekekwe on September 29, 2020, 7:16 AM

The most dynamic agency in Nigeria remains the tax agency. Now, Laycon, over to your accountants as the taxman has been taking note of the goodies. This is coming after that blockbuster revelation that Lagos state government will begin to charge huge transaction tax on school fees : "In LASU [the state university], the stream two students who are meant to pay N150,000 as school fees will now be charged N7,500 as transaction charges payable to PAYTECH instead of N415 currently charged."

Governor Babajide Sanwo-Olu of Lagos State has given all tertiary education institutions in the state till September 30, to enrol on the platform of a private firm – Payment Technology Limited (Paytech) – for the collection of their internally generated revenues.

But unlike the current practices across the institutions which enable them (firms) to receive remittances at little or no cost, the new firm is proposing 10 per cent charges on all transactions done at the schools.

According to the firm’s proposal, while five per cent of every transaction will serve as ‘administrative’ charges, another five per cent of total monthly remittances will be deducted as the firm’s commission.

Naija and money these days - na real wahala. Sure, Laycon needs to pay. But I hope the government reduces the new education fees.

The most dynamic agency in Nigeria remains the tax agency. Now, Laycon, over to your accountants as the taxman has been taking note of the goodies. This is coming after that blockbuster revelation that Lagos state government will begin to charge huge transaction tax on school fees : "In LASU [the state university], the stream two students who are meant to pay N150,000 as school fees will now be charged N7,500 as transaction charges payable to PAYTECH instead of N415 currently charged."

Governor Babajide Sanwo-Olu of Lagos State has given all tertiary education institutions in the state till September 30, to enrol on the platform of a private firm – Payment Technology Limited (Paytech) – for the collection of their internally generated revenues.

But unlike the current practices across the institutions which enable them (firms) to receive remittances at little or no cost, the new firm is proposing 10 per cent charges on all transactions done at the schools.

According to the firm’s proposal, while five per cent of every transaction will serve as ‘administrative’ charges, another five per cent of total monthly remittances will be deducted as the firm’s commission.

Naija and money these days - na real wahala. Sure, Laycon needs to pay. But I hope the government reduces the new education fees.

Uploaded files:Quote from Francis Oguaju on September 29, 2020, 8:12 AMI think he will be due for tax from whatever he earns afterwards, or they are going to tax prize money? The organisers pay for most of these charges, before the show even begins.

As for education tax, won't that amount to double taxation? Students don't make money, it's still coming from the same people that are taxable.

Very soon, most people will simply retire to their villages and operate from there; it's looking more realistic these days...

I think he will be due for tax from whatever he earns afterwards, or they are going to tax prize money? The organisers pay for most of these charges, before the show even begins.

Register for Tekedia Mini-MBA edition 17 (June 9 – Sept 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register to become a better CEO or Director with Tekedia CEO & Director Program.

As for education tax, won't that amount to double taxation? Students don't make money, it's still coming from the same people that are taxable.

Very soon, most people will simply retire to their villages and operate from there; it's looking more realistic these days...