How do you raise funds before investors? What are the things they look for, in extremely young companies? It is very important to understand that a venture capitalist raises funds from limited partners (rich family offices, fund managers, pension funds, companies, etc).

So, just as a startup goes out to raise funds, even those you are trying to raise funds from also raise funds, to have money to invest in you. In other words, a venture investor is also a good fundraiser because he/she must raise funds first before the opportunity to invest funds will come. (Sure, there are those who have so much they can invest from their purses; not typical at the mainbowl.)

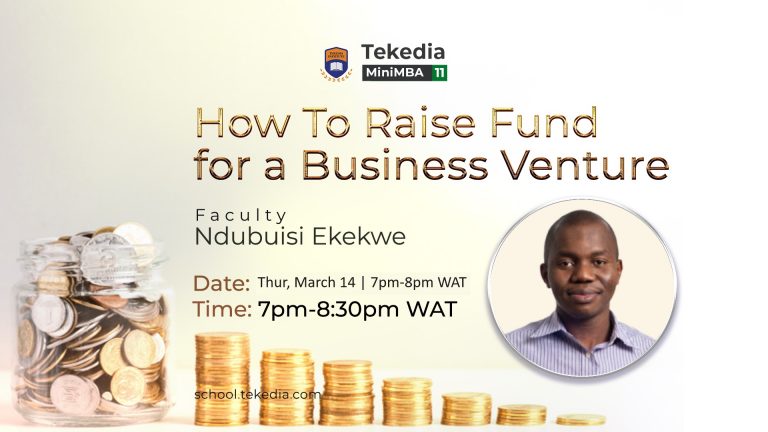

Join me at Africa’s finest business school for entrepreneurial capitalism as we examine How To Raise Capital for young scalable companies, tomorrow. Meanwhile, Tekedia Mini-MBA has opened registrations for the next edition, pick your seat here.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube