Huobi, the 17th largest crypto exchange, has seen its native token collapse by 90% in a flash crash during Thursday trading.

At 3:45 pm, $HT was trading at $4.70. By 4:10 pm, it was down to $1.83. By 6:00 pm, it was back up $3.90, 30% lower than it had started the day.

Huobi Token (HT) is the native cryptocurrency of the Huobi Global exchange, based on the Ethereum blockchain and launched in January 2018. It is used to reduce commissions for trading, purchase VIP-status plans, vote on exchange decisions and receive crypto rewards.

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

The decline led to over $200,000,000 of market cap gone from $HT within an hour, only to recover by over 1000% minutes after. The flash crash of the token today led to some interesting theories online.

According to a tweet by a Kaiko researcher, sales worth $2 million were reported in the five minutes leading up to the crash, which is significantly higher than the usual $600,000 buys on the HT-USDT pair. Despite a 24% decline over the past 24 hours, the token has rebounded and is currently trading at $3.70 on Huobi.

Some speculated that the downturn has more to do with broader negative market sentiment. IdleHeroesTT said: “exchanges are a blessing and a curse. Genuinely feel like cryptos upwards price movement can only truly continue (asides from macro events) when we have a reliable, regulated on-ramp for fiat. Sad to see it has come to this point.”

Exchanges are a blessing and a curse. Genuinely feel like cryptos upwards price movement can only truely continue (asides from macro events) when we have a reliable, regulated on-ramp for fiat. Sad to see it has come to this point.

— Snugtoes – Lukas (@IdleHeroesTT) March 9, 2023

This price volatility is particularly noteworthy since HT is one of the larger cryptocurrencies, with a market capitalization of approximately $630 million after the rebound. Justin Sun, founder of the Tron blockchain and a significant holder of the token, is also a key figure in the exchange’s strategy, making it a closely watched asset by crypto traders.

Recently, Justin Sun expressed confidence that Huobi, one of Asia’s leading blockchain platforms, will be granted a Virtual Asset Service Provider (VASP) license by Hong Kong’s Securities and Futures Commission (SFC). Upon that news two weeks ago, the HT token surged 24% in price.

The new licensing regime was enacted on March 1 to ensure compliance with Anti-Money Laundering and Counter-Terrorism Funding, as outlined by the Financial Action Task Force.

Huobi was the first crypto exchange to apply for the license and has held talks with the SFC to advise on developing an appropriate digital asset framework. Though Sun had previously denied involvement with Huobi, he has since confirmed that he has taken on an advisory role with the exchange.

Report by Nansen, a blockchain data infrastructure, indicates that Justin Sun had moved $60 million Ethereum stablecoin from Huobi into the Aave chain.

The withdrawal happened 11 hours before he tweeted in consolidation which HT flash crashed. Sun however apologized for the impact of the leveraged liquidation on the market caused by a few users, and in order to further improve the multi-currency liquidity of the HuobiGlobal platform, we will set up a liquidity fund with an investment of 100 million US dollars.

We will continue to improve the liquidity depth of main cryptocurrencies and HT token, strengthen leverage risk warnings and liquidity capabilities. Regarding this incident, we will keep the community updated on the follow-up progress.

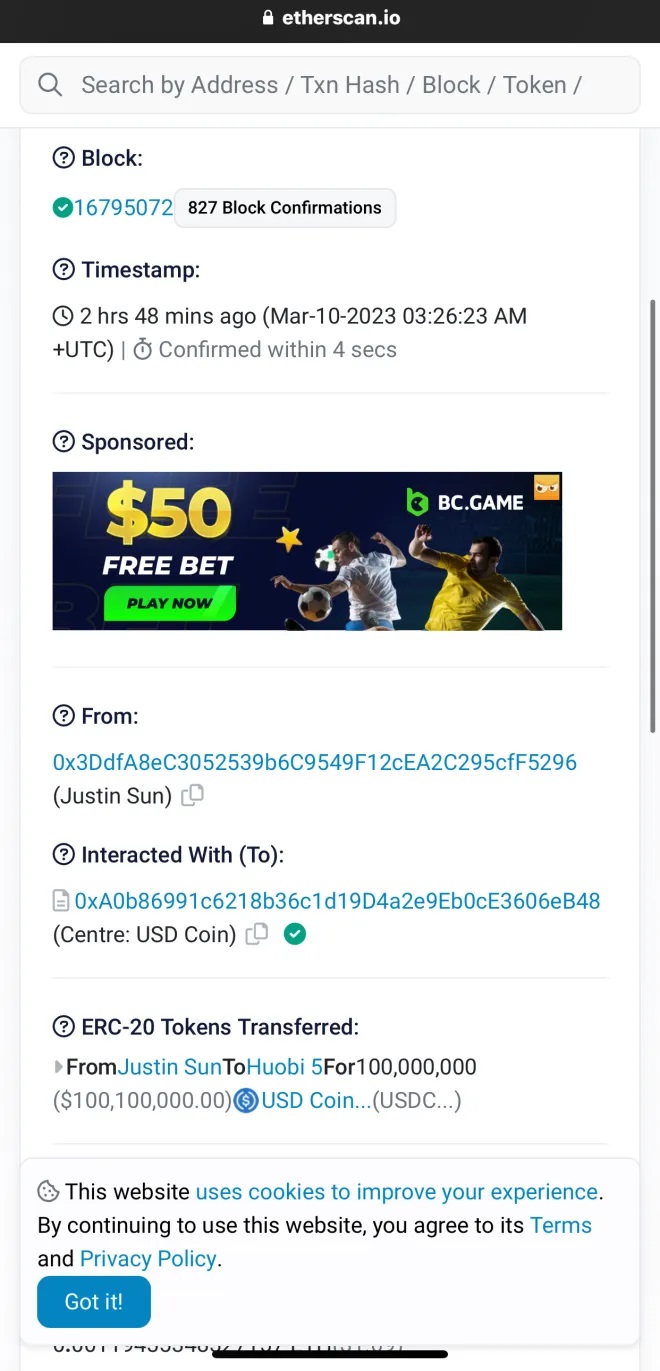

Apparently, Justin Sun made a $100 million transfer to Huobi, details can be viewed on Etherscan.