Hardware is no more fashionable in the world of technology. It is slow growth and there is no leverageable marginal cost improvement with scale, unlike software which gives a positive continuum near-zero marginal cost efficiency. The implication is huge: Wall Street does not like purveyors of hardware and broad infrastructure that much. And companies have the memos: spin hardware off and focus on where the alpha is. That alpha lives in software and technology services.

HP did it many years ago, spinning off its printing and broad hardware business to focus on the soft things of technology – consulting, services, and more. IBM is running that playbook as it breaks into two publicly traded companies. It is what it is – IBM does not want to be left behind.

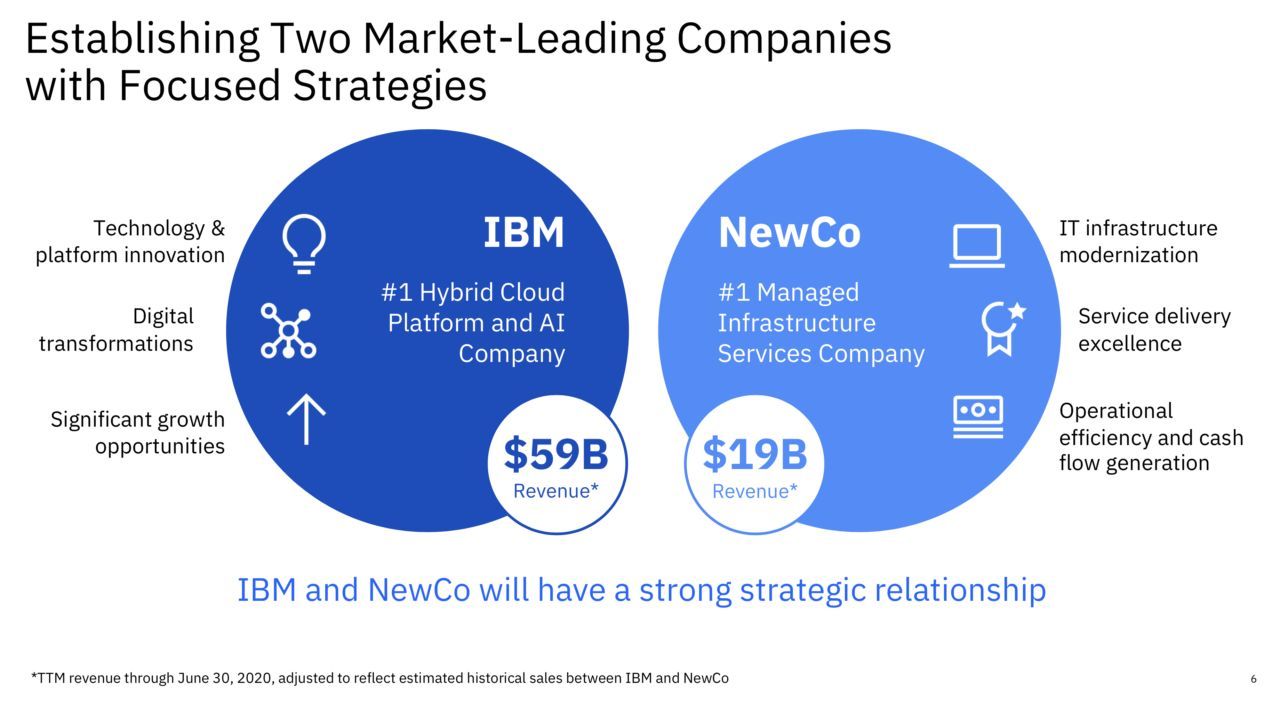

In an unprecedented decision, International Business Machines (IBM) is splitting itself into two public companies. The computing company announced on Thursday it’s spinning off some of its low-margin lines of business into a new company which will be named later. The move is part of its attempt to focus on the more lucrative cloud computing.

“We divested networking back in the ‘90s, we divested PCs back in the 2000s, we divested semiconductors about five years ago because all of them didn’t necessarily play into the integrated value proposition,” IBM’s CEO Arvind Krishna said during an investor call.

IBM hopes to become a leader in hybrid-cloud software and services that allow clients to store data. That looks promising in this age of digital evolution of markets and industrial sectors. It is what it is – invent, adapt or perish.

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

But do not be confused, IBM would not have followed this path if the stock is doing well. Over the last few years, IBM has returned the worst results in big tech despite top-grade assets under its control. IBM is worth about $113 billion while Facebook is valued at $753 billion. For years, IBM has used many tricks to boost its market cap but nothing has worked.

This one is expected to boost shareholder value. Yes, you can unlock more multiples in the AI & cloud business than a company with the hardware business. Magically, the two parts will become better than a standalone IBM. More than 90% of the time, it works. For IBM shareholders, this is the right call as investors will stop considering the “machine” in IBM (International Business Machine) name and see the firm as a leverageable growth tech firm with nothing holding it.

LinkedIn Comment on Feed

They’ve tried but its time to retire. In less than 10 years TCS has pushed them from 1st to 3rd place. This indicates that the consumer no longer sees them as being progressive innovators

My Response: It remains an enterprise company. But IBM has many legacy systems. A great company. But that does not mean it is a good place to invest money. Like BBNaija, we are in the age of fashionista. If you list BBNaija in the Nigeria Stock Exchange, you may be surprised its market cap will topple our best banks! Why? Young people will invest in it. It is what it is.

---

Register for Tekedia Mini-MBA (Sep 15 – Dec 6, 2025), and join Prof Ndubuisi Ekekwe and our global faculty; click here.

Only Apple figured out how to sell expensive hardware and remain the most valuable company, that is why it remains special and most admirable. IBM has become an afterthought whenever big tech companies are mentioned, it’s a hole that is very difficult to climb out from.

The big lesson here is that, irrespective of what you produce or sell, just find a way to make your brand remain on everyone’s lips, for the right reasons, and you will remain solid.

Rather than selling products and services, sell vision, sell dreams, sell aspirations, sell hope; these are the most valuable ‘products’ out there, forget sophistication and functionalities, they are secondary considerations.