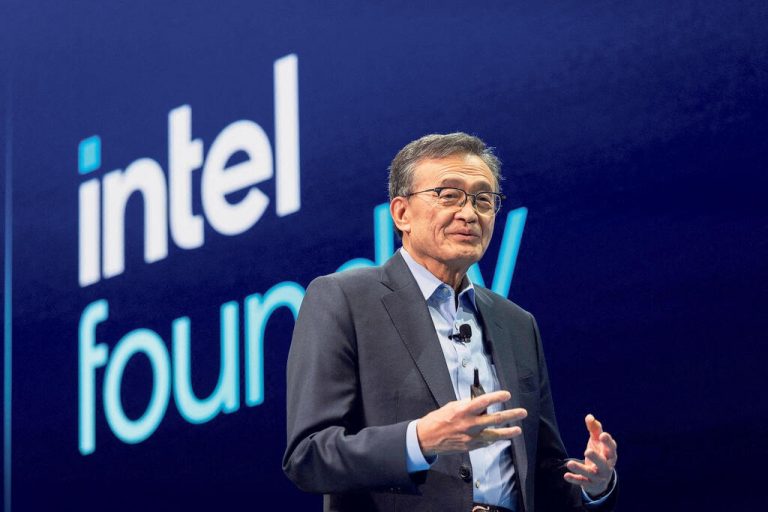

Intel’s chief executive, Lip-Bu Tan, is facing mounting pressure after U.S. President Donald Trump publicly demanded his resignation over alleged ties to Chinese technology companies.

The rare presidential intervention comes at a delicate moment for the American semiconductor giant, which is in the middle of a multi-year turnaround plan designed to reverse years of decline in market share and technological leadership.

In his first public reaction since the controversy erupted, Tan acknowledged the calls for him to step down but maintained that his priority remains executing Intel’s strategic overhaul. That plan, unveiled last year, includes billions in investments to upgrade manufacturing facilities, expand advanced chip production in the United States, and develop cutting-edge process technologies to catch up with Taiwan Semiconductor Manufacturing Company (TSMC) and overtake Nvidia in performance and efficiency.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

“I want to be absolutely clear: Over 40+ years in the industry, I’ve built relationships around the world and across our diverse ecosystem – and I have always operated within the highest legal and ethical standards,” he wrote in a memo to employees on Thursday.

Tan said that Intel is working with the White House to address the situation and that he supports the president’s dedication to “advancing U.S. national and economic security.” He said Intel’s board is “fully supportive” of the company’s transformation plan.

Trump’s remarks, however, have shifted the spotlight from Intel’s operational challenges to questions of political loyalty. Two major Intel shareholders and a former senior employee told reporters that the president’s public criticism could force Tan into a drawn-out battle to reassure Washington and the investment community about his leadership. That political fight, they warned, risks derailing the aggressive cost-cutting and operational discipline necessary for Intel’s recovery.

“It is distracting,” said Ryuta Makino, analyst at Gabelli Funds, which owns over 200,000 Intel shares, according to LSEG data.

“I think Trump will make goals for Intel to spend more, and I don’t think Intel has the capabilities to spend more, like what Apple and Nvidia are doing.”

Intel has suffered repeated product delays, loss of manufacturing supremacy, and growing competition from Asian and U.S. rivals. Its once-dominant position in personal computer and server chips has been eroded by AMD, while TSMC has pulled ahead in producing smaller, more efficient chips for the world’s biggest tech companies.

David Wagner, a portfolio manager at Aptus Capital Advisors, which holds Intel shares via index funds, said Tan’s initial response lacked the strength needed to contain the fallout.

“Either defend your leader, which will be the beginning of a difficult road ahead, or consider making a change,” Wagner warned. “Having this play out over a few months is not something that Intel can afford.”

The episode underscores how deeply the semiconductor industry has become entangled in Washington’s broader push to curb China’s access to advanced technologies. The Biden administration—and now Trump—has backed sweeping restrictions on chip exports to China, while offering subsidies to encourage domestic manufacturing under the CHIPS and Science Act.

Allegations of close business ties to Chinese firms have become politically toxic for U.S. tech executives, adding a layer of geopolitical risk to corporate decision-making.

Backstory: Intel’s Struggles and Trump’s Tech Agenda Against China

Intel’s troubles did not begin with Trump’s intervention. Once the undisputed leader in microprocessors, the company has stumbled in recent years as rivals surged ahead in advanced chip design and manufacturing. Delays in rolling out its 7-nanometer process technology—while TSMC and Samsung advanced to 5nm and beyond—cost Intel valuable contracts from major clients. The company also suffered from declining PC demand, missed opportunities in mobile chips, and a slow pivot toward artificial intelligence hardware, where Nvidia has dominated.

Tan’s turnaround plan has been an attempt to reverse these losses by ramping up U.S.-based manufacturing, securing foundry contracts, and investing billions in new facilities in Arizona and Ohio. But these efforts have been costly, and profitability remains under pressure.

Trump’s latest attack fits into his broader technology agenda against China, which has intensified since his return to office. He has pushed for tighter controls on U.S. tech firms operating in or supplying Chinese companies, citing national security risks. Under his administration, several high-profile crackdowns have taken place, from restrictions on AI chip exports to investigations into semiconductor partnerships with Chinese entities.

That hardline stance has found broad political support in Washington, but it has also placed U.S. tech giants in a bind, forcing them to balance lucrative Chinese markets with increasing political scrutiny at home. For Intel, already fighting to regain its competitive edge, this political crossfire threatens to add yet another layer of instability to a company struggling to reclaim its place in the global semiconductor hierarchy.

For Tan, the challenge now is to keep Intel’s recovery on track while navigating a political storm that could intensify if the White House presses for leadership change. Industry analysts warn that if his focus shifts to survival rather than execution, Intel’s multi-billion-dollar restructuring could lose momentum, potentially ceding even more ground to rivals at a time when the global chip race is accelerating.