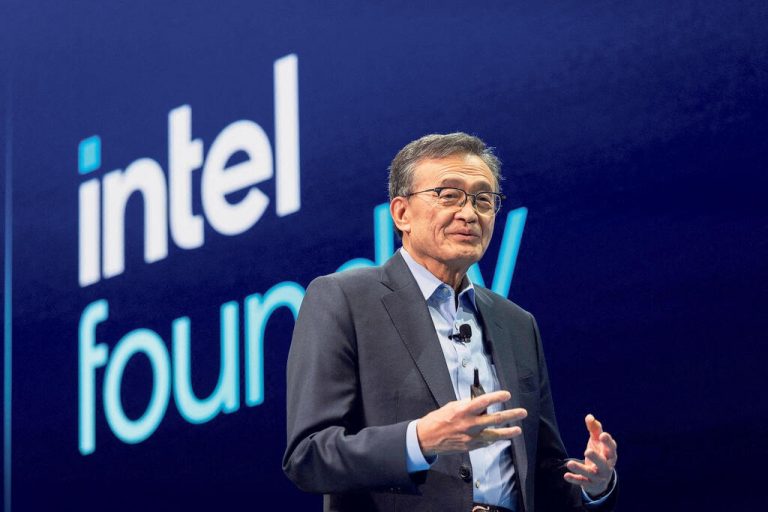

Intel shares extended their sharp rally on Friday, climbing 6% after Chief Executive Officer Lip-Bu Tan met with U.S. President Donald Trump. This meeting underscored how central the struggling chipmaker has become to Washington’s industrial strategy.

The stock’s move adds to a dramatic turnaround that has seen Intel’s market value more than double since the U.S. government took an equity stake in the company in August, an intervention that signaled a far more assertive approach to reshaping America’s semiconductor supply chain.

“The United States Government is proud to be a Shareholder of Intel,” Trump said in a Truth Social post following the meeting, a statement that captured the unusual nature of the relationship.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Sitting U.S. presidents rarely celebrate direct ownership in publicly traded firms, but Intel’s role in advanced chip production has placed it in a different category altogether.

Trump praised Tan as “very successful” and pointed to Intel’s latest chip as evidence of domestic manufacturing momentum, saying it was “designed, built, and packaged right here in the U.S.A.” The remarks served both as political messaging and as reassurance to investors watching closely for signs that Intel’s long-awaited manufacturing turnaround is gaining traction.

Tan, who took the helm amid mounting pressure to stabilize the company, responded on X that he was honored and “delighted to have the full support and encouragement” of Trump and U.S. Secretary of Commerce Howard Lutnick. He also confirmed that Intel’s Core Ultra Series 3 processors, the company’s first major product built on its Intel 18A manufacturing process, are now shipping.

Intel 18A is widely viewed as a make-or-break node for the company after years of delays and missed targets that allowed rivals to pull ahead. Success would strengthen Intel’s push to rebuild its foundry business, attract external customers, and justify the tens of billions of dollars being poured into new fabrication plants across the United States.

The market reaction suggests investors see the White House meeting as more than a courtesy call. It reinforces the idea that Intel now sits at the intersection of national security, economic policy, and technological leadership, giving it a degree of political insulation rarely enjoyed by private-sector manufacturers.

The government’s stake was negotiated last August, when the White House invested $8.9 billion for 433.3 million shares at $20.47 each. That position is now valued at roughly $19 billion, turning the deal into a paper gain and strengthening the administration’s case that direct intervention can deliver both strategic and financial returns.

Intel shares are up nearly 20% so far this year, adding to gains driven by optimism that government backing, tighter cost controls, and progress on next-generation chips could stabilize a company that has spent years losing ground to overseas rivals.

The broader backdrop remains one of intense global competition. Advanced chips underpin artificial intelligence systems, military hardware, data centers, and consumer electronics, making control over production capacity a strategic priority for major powers. U.S. policymakers have grown increasingly uneasy about reliance on foreign manufacturers, particularly in East Asia, and Intel is seen as a key domestic counterweight.

Trump’s comments also align with his broader push to frame manufacturing revival as a national achievement, with Intel positioned as proof that high-end industrial capacity can be rebuilt on U.S. soil. For the company, that narrative offers tangible benefits, including policy support, access to capital, and long-term government alignment.

Still, the road ahead remains demanding as Intel must execute flawlessly on its manufacturing roadmap, scale production efficiently, and compete in fast-moving markets where rivals continue to innovate aggressively. Investor enthusiasm rests heavily on the assumption that the latest technical milestones can be sustained and translated into commercial success.

However, the White House meeting has reinforced a simple message to markets that Intel is no longer just another chipmaker fighting for relevance. It has become a strategic asset, backed at the highest levels of government, with its future tied closely to America’s ambitions in advanced technology and industrial renewal.