The Nigerian Oil and Gas Industry Content Development Act of 2010 has become a cornerstone for shaping how companies operate in the country’s most strategic sector. Its intent is simple but profound. The law compels international oil companies, indigenous firms and joint ventures to prioritize Nigerian participation across contracting, workforce, fabrication and technology transfer. Fifteen years on, patterns have emerged in how companies both comply with and report on local content. These patterns reveal much about corporate strategies, regulatory effectiveness and the evolving relationship between global operators and local communities.

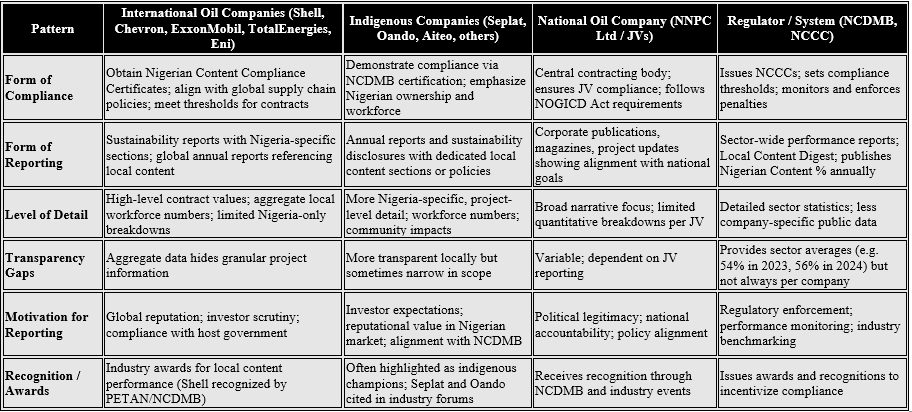

A first pattern is the divide between international oil companies and indigenous players. Multinationals such as Shell, Chevron, ExxonMobil, TotalEnergies and Eni have embedded local content reporting into their global sustainability frameworks. Their annual sustainability or corporate responsibility reports contain sections on Nigeria highlighting training programs, contract awards to Nigerian suppliers and percentages of Nigerian staff. Shell’s disclosures of billions of dollars awarded to local companies in 2023 is a case in point. These companies often report through polished global documents rather than Nigeria-only reports. This approach aligns with their international standards but sometimes limits the granularity of Nigerian data available to the public.

Indigenous companies present a second pattern. Firms like Seplat Energy, Oando and Aiteo include local content discussions in their annual or sustainability reports. Because these firms are listed in Nigerian and international markets they face pressure from regulators and investors to demonstrate compliance. Seplat is particularly explicit in linking its growth with Nigeria’s local content objectives. Oando has gone further by publishing a Local Content Policy alongside its sustainability materials. Indigenous players often highlight their advantage of being Nigerian-owned and operated while emphasizing workforce development and community engagement. Their disclosures are generally more Nigeria-specific and tailored to a local audience.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

A third pattern lies with the national oil company. NNPC Limited is not only subject to local content rules but also acts as a joint venture partner and contracting entity for most projects in the country. Its publications and magazines showcase Nigerian Content Development and Monitoring Board awards and contract recognitions. Because NNPC sits at the center of the value chain its reporting is less about investor relations and more about demonstrating alignment with government policy and accountability to the Nigerian public.

Legal and regulatory engagement forms a fourth pattern. Court decisions such as the 2017 Addax case confirmed the authority of the regulator to impose penalties for non-compliance. This created a culture in which companies not only comply but also report in order to demonstrate transparency and avoid disputes. Compliance reporting therefore is not voluntary storytelling. It is closely tied to regulatory oversight through Nigerian Content Compliance Certificates issued by the Board. These certificates have become tangible evidence that a company has met prescribed thresholds on projects.

A fifth pattern is the gap between sector-level statistics and company-specific metrics. NCDMB reports regularly state that Nigerian Content stood at 54 percent in 2023 and rose to 56 percent in 2024. However only some companies disclose their own percentages. This creates uneven transparency. Sector averages look healthy but stakeholders often cannot trace the contributions of each operator. International oil companies prefer to emphasize aggregate impact while indigenous firms highlight project-level achievements. The result is a mosaic of compliance narratives rather than a uniform dataset.

Another pattern worth noting is recognition through awards. Both multinationals and indigenous players have been celebrated by industry associations and NCDMB for local content performance. Shell was recognized as the best local content operator of the year. Such recognition reinforces reporting habits because companies see reputational value in publishing their achievements. Awards also create competitive pressure among peers to enhance compliance and reporting.

These patterns point to a gradual maturation of local content as both a compliance requirement and a reporting norm. Fifteen years ago few companies disclosed Nigerian Content in detail. Today many include it in their flagship reports. However gaps remain. Company-level disclosures are inconsistent and sometimes superficial. The regulator still carries the main responsibility for providing reliable sector-wide data. Stakeholders including investors, communities and policymakers increasingly call for harmonized reporting standards that would allow better benchmarking across operators.

Looking forward the challenge is to transform local content reporting from compliance to strategy. For companies this means moving beyond percentages of contracts awarded and instead demonstrating how Nigerian participation strengthens resilience, lowers costs and creates innovation. For regulators it means ensuring that data is transparent and comparable so that progress can be tracked across time and between companies. For communities it means holding companies accountable not just for contracts but also for skills transfer and sustainable opportunities.