Lumerin, a startup that aims to democratize access to Bitcoin mining, has announced that it will launch its decentralized hashpower market on Arbitrum, a layer-2 scaling solution for Ethereum. The market will allow anyone to buy and sell hashpower contracts, which are agreements to mine Bitcoin for a certain period of time and receive a share of the rewards.

Bitcoin hashpower market is a term that refers to the amount of computing power that is used to secure the Bitcoin network and process transactions. Hashpower is measured in hashes per second (H/s), which is the number of possible solutions to a cryptographic puzzle that miners have to solve in order to create new blocks and earn rewards.

Lumerin’s vision is to create a more inclusive and sustainable Bitcoin mining ecosystem, where anyone can participate without having to invest in expensive and energy-intensive hardware. By leveraging Arbitrum’s low-cost and high-throughput transactions, Lumerin hopes to offer a fast and secure way to trade hashpower on the blockchain.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (begins Nov 15th).

Lumerin’s hashpower market will use a novel mechanism called Proof-of-Hashrate (PoH), which verifies the amount of hashpower delivered by the sellers and ensures fair payouts to the buyers. PoH works by requiring the sellers to submit proofs of their mining activity, such as block headers or Merkle proofs, to a smart contract on Arbitrum. The contract then validates the proofs and distributes the rewards according to the terms of the hashpower contract.

The hashpower market is influenced by various factors, such as the price of Bitcoin, the difficulty of mining, the availability and cost of electricity, the innovation and competition among mining hardware manufacturers, and the regulation and taxation of mining activities in different jurisdictions.

One way to measure the hashpower market is by looking at the total hash rate of the Bitcoin network, which indicates how much computing power is being used at any given time. According to Blockchain.com, the Bitcoin network’s hash rate reached an all-time high of 197.6 exahashes per second (EH/s) on October 23, 2021. This means that miners were collectively performing 197.6 quintillion (197.6 x 10^18) hashes per second.

Another way to measure the hashpower market is by looking at the distribution of hash rate among different mining pools, which are groups of miners that share their resources and split the rewards. According to BTC.com, as of September 26, 2023, the top five mining pools by hash rate were AntPool (18.9%), F2Pool (16.8%), Poolin (15.4%), Binance Pool (11.2%), and Foundry USA (7.4%). These pools represent a diverse range of regions, such as China, North America, Europe, and Southeast Asia.

The hashpower market is constantly evolving and changing, as miners seek to optimize their profitability and efficiency. Some of the recent trends and developments in the hashpower market include:

The migration of hashpower from China to other countries, following the crackdown on cryptocurrency mining by the Chinese authorities in June 2021. According to Cambridge Bitcoin Electricity Consumption Index, China’s share of global Bitcoin mining power dropped from 65% in April 2020 to 46% in April 2022, and then to less than 10% in July 2023.

The adoption of renewable energy sources for Bitcoin mining, such as hydroelectricity, solar power, wind power, and geothermal energy. According to a report by the Bitcoin Mining Council, a voluntary organization of Bitcoin miners, 56% of global Bitcoin mining was powered by sustainable energy in Q2 2021, up from 36.8% in Q4 2020.

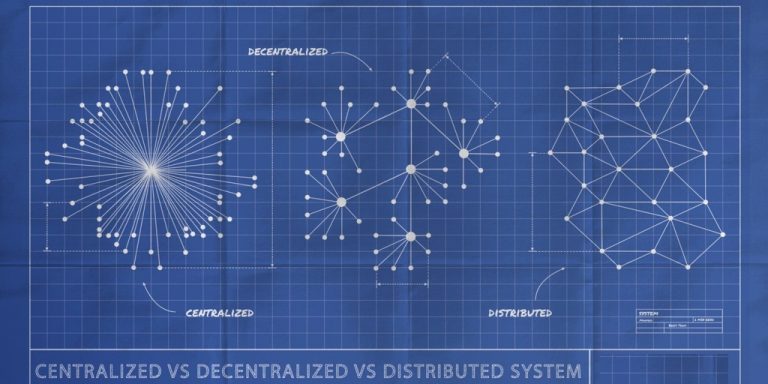

The emergence of new players and business models in the hashpower market, such as cloud mining services, mining-as-a-service platforms, hash rate futures contracts, and decentralized mining pools. These innovations aim to lower the barriers to entry and increase the liquidity and efficiency of the hashpower market.

Lumerin’s co-founder and CEO, said that launching on Arbitrum was a strategic decision that aligned with their mission of making Bitcoin mining more accessible and efficient. “Arbitrum is one of the most promising layer-2 solutions in the Ethereum ecosystem, and we are excited to leverage its scalability and security features to offer our users a seamless and trustless hashpower trading experience. By launching on Arbitrum, we hope to lower the barriers to entry for Bitcoin mining and create a more decentralized and resilient network,” she said.

The hashpower market is an important aspect of the Bitcoin ecosystem, as it affects the security, scalability, and sustainability of the network. The hashpower market is also a reflection of the innovation and competition that drives the Bitcoin industry forward.

Lumerin plans to launch its hashpower market on Arbitrum in Q4 2023, and will initially support SHA-256 mining, which is used by Bitcoin and other cryptocurrencies. The startup also intends to expand its offerings to other mining algorithms and coins in the future, as well as introduce more features and services for its users.