Meta ended 2025 by once again outspending its Big Tech peers in Washington, a development that marks how central federal policy has become to the company’s future as it navigates artificial intelligence regulation, online safety laws and renewed antitrust scrutiny.

The conglomerate raised its federal lobbying to $6.5 million in the fourth quarter of 2025, signaling how deeply the company now sees public policy as a core business risk and a strategic asset at the same time.

The spending increase, up from $5.8 million in the previous quarter, again placed Meta at the top of the Big Tech lobbying table, ahead of Amazon at $4.6 million and Google at $3.4 million. That ranking matters because it reflects more than financial muscle. It reveals which companies believe their future business models are most vulnerable to regulatory decisions emerging from Congress and federal agencies.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Meta’s footprint in Washington has reached a scale rarely seen in corporate lobbying. According to an analysis by nonprofit watchdog Issue One, the company now has roughly one lobbyist for every six members of Congress. That density gives Meta constant access to legislative offices, committees, and staffers, allowing it to track, influence, and respond to policy proposals in real time. In practical terms, it means Meta is positioned to shape the technical details of bills long before they reach the floor of the House or Senate.

Lobbying disclosures show Meta focused its fourth-quarter efforts on children’s online safety legislation, AI regulation, and controls on AI chip exports. Each of those areas carries direct commercial consequences. Kids’ safety rules affect product design, content moderation systems, and data practices across Facebook, Instagram, and WhatsApp. AI regulation could determine everything from model transparency requirements to liability frameworks for algorithmic harm. Export controls on advanced chips influence Meta’s access to the computing power needed to train and deploy large-scale AI systems.

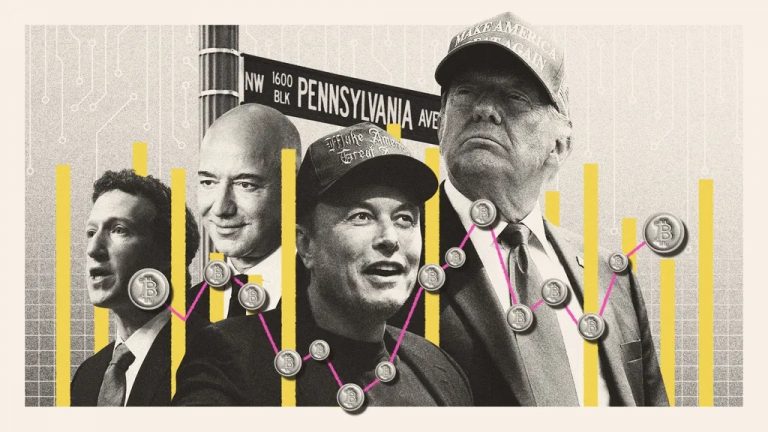

This policy push is happening against a complex political backdrop. President Donald Trump’s administration has taken a broadly pro-AI position, framing artificial intelligence as a strategic national priority tied to U.S. competitiveness, economic growth and geopolitical influence. That stance benefits large technology companies that already have the capital, data, and infrastructure to scale AI quickly. For Meta, which is investing heavily in data centers, custom chips, and AI models, a permissive regulatory environment lowers barriers to expansion and reduces compliance friction.

At the same time, regulatory risk has not disappeared. The Federal Trade Commission confirmed it will appeal Meta’s win in the long-running antitrust case tied to its acquisitions of Instagram and WhatsApp. That appeal keeps alive the broader question of whether U.S. regulators can unwind or restrict past tech mergers, a precedent that would reshape deal-making across the industry. The case is not only about legal exposure but about the structural integrity of Meta’s business model, which is built on platform integration and data sharing across services.

The wider lobbying landscape shows how the largest tech firms are converging around similar policy priorities while defending different commercial interests. Google’s activity on AI and children’s safety legislation reflects its exposure through search, YouTube, and cloud services. Amazon’s spending is tied to cloud computing regulation, competition policy, and labor rules. Apple and Microsoft, which spent $2.7 million and $2.4 million, respectively, in the same quarter, targeted patents, copyright, AI governance, and platform rules that affect software ecosystems and app distribution models.

What stands out is the gap between these established platforms and the newer AI-first companies. Nvidia cut its lobbying spend to $1.4 million in Q4 from $1.9 million in Q3, even as its chips remain central to global AI development. OpenAI reduced spending slightly to $890,000, while Anthropic dropped to $840,000 after hitting $1 million earlier in the year.

This imbalance shows that political power in Washington is still concentrated in legacy tech giants with diversified businesses, not in the newer firms driving AI innovation.

Strategically, Meta’s lobbying surge reflects a defensive and offensive posture at the same time. Defensively, the company is seeking to manage legal exposure, regulatory constraints, and reputational risk across content moderation, data protection, and competition policy. Offensively, it is trying to shape the emerging AI rulebook in ways that favor scale, capital intensity, and integrated platforms, conditions that naturally advantage companies of Meta’s size.

There is also a longer-term industrial policy dimension. As the U.S. government tightens controls on advanced semiconductor exports and frames AI as a strategic asset, corporate lobbying becomes intertwined with national security and foreign policy debates. Companies like Meta are not only influencing consumer tech regulation but also positioning themselves within the broader U.S. strategy on technological dominance, supply chains, and global standards-setting.

In that sense, Meta’s $6.5 million quarterly spend is less about individual bills and more about structural influence. It is seen as a recognition that the next phase of tech competition will be shaped as much in congressional hearing rooms and regulatory agencies as in laboratories and data centers.

Washington is becoming a core battleground for corporate strategy as AI, platform power, and digital safety move to the center of U.S. policy, and Meta is investing accordingly to ensure it remains one of the loudest voices in that fight.