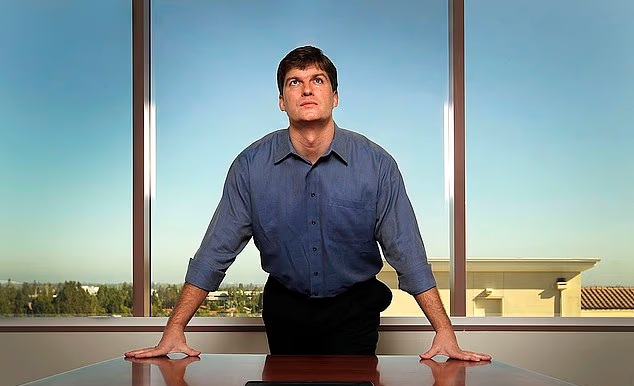

Michael Burry, the contrarian investor immortalized in The Big Short for predicting the 2008 housing collapse, has escalated his war against the artificial intelligence sector.

In a scathing new critique published Tuesday, Burry revealed he is actively betting against both Nvidia and Palantir, while dismissing a recent defense from the world’s most valuable chipmaker as “disingenuous” and ridden with logical fallacies.

Writing on his newly launched Substack in a post titled “Unicorns and Cockroaches: Blessed Fraud,” Burry dismantled a memo Nvidia reportedly sent to Wall Street analysts. The document, intended to refute Burry’s earlier skepticism, was characterized by the investor as a collection of “straw man” arguments that failed to address his core thesis regarding the sustainability of the AI infrastructure build-out.

The “Straw Man” Exchange

The conflict centers on a memo Nvidia circulated to sell-side analysts—first reported by Barron’s—which attempted to debunk Burry’s bearish claims regarding stock-based compensation, buybacks, and depreciation cycles.

Burry expressed disbelief at the quality of the rebuttal, stating it “almost reads like a hoax.” He specifically took aim at Nvidia’s defense regarding the depreciation of its own property, plant, and equipment (PP&E). Burry clarified that his criticism was never about Nvidia’s internal accounting, as the company is a “fabless” chip designer with minimal capital expenditures.

“No one cares about Nvidia’s own depreciation,” Burry wrote. “One straw man burnt.”

Instead, Burry’s primary concern lies with the “hyperscalers”—tech giants like Microsoft, Amazon, and Meta—who are purchasing Nvidia’s chips. Burry argues these companies are artificially boosting short-term profits by depreciating these assets over five to six years. However, given the rapid pace of innovation, Burry warns these chips could become functionally obsolete between 2026 and 2028, paving the way for massive future writedowns.

“The hyperscalers have been systematically increasing the useful lives of chips and servers… as they invest hundreds of billions of dollars in graphics chips with accelerating planned obsolescence,” Burry noted.

To bolster his argument, Burry pointed to a recent admission by Microsoft CEO Satya Nadella. In an interview, Nadella revealed he had slowed data center construction earlier this year to avoid overbuilding infrastructure for a single generation of chips, acknowledging that future generations would require different power and cooling specifications.

Nvidia’s Defense: Utilization and Buybacks

Nvidia’s memo, however, paints a different picture of the hardware lifecycle. The company argues that its customers depreciate GPUs over four to six years based on “real-world longevity and utilization patterns.” Nvidia cited its A100 chips, released in 2020, noting they continue to run at high utilization rates and retain significant economic value well beyond the two-to-three-year window critics like Burry have suggested.

The memo also addressed financial engineering accusations. Nvidia clarified that it has repurchased $91 billion in shares since 2018, countering Burry’s figure of $112.5 billion by suggesting the investor incorrectly included taxes related to Restricted Stock Units (RSUs).

“Employee equity grants should not be conflated with the performance of the repurchase program,” the memo stated. It further rejected claims of “circular financing”—the idea that Nvidia pumps up revenue by investing in startups that then buy its chips—stating such investments represent a negligible fraction of its revenue.

The Palantir Feud

Beyond Nvidia, Burry confirmed he continues to hold put options against data analytics firm Palantir, another darling of the AI rally.

The disclosure follows a public spat with Palantir CEO Alex Karp, who earlier this month called Burry’s bets “batshit crazy” during a televised interview. Burry retorted on X (formerly Twitter) that he wasn’t surprised Karp “couldn’t crack a simple 13F,” referencing the regulatory filings that disclose hedge fund holdings.

Palantir shares have skyrocketed 26-fold since the start of 2023, valuing the company at approximately $390 billion—nearly 90 times its projected annual revenue of $4.4 billion. Burry’s bets against Palantir and Nvidia, which had a combined notional value of $1.1 billion in earlier filings, actually cost his fund, Scion Asset Management, only around $10 million each, according to his latest post.

Burry’s renewed offensive comes at a fragile moment for the AI trade. Nvidia shares have slumped 14% from their November 3 high as investors increasingly question whether the trillions of dollars in anticipated infrastructure spending will yield proportionate returns.

“I am looking forward because I see problems that are relevant to investors today,” Burry wrote, hinting that his comments have struck a nerve deeper than he anticipated. “I have been drawn into something much bigger than me.”