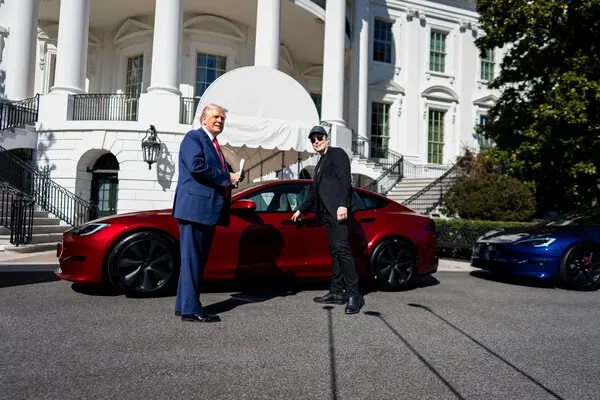

The public feud between Elon Musk and President Donald Trump has exposed how deeply dependent Musk’s companies are on the U.S. government — a reality Ark Invest CEO Cathie Wood says investors can no longer ignore.

In a video posted Friday to Ark Invest’s YouTube channel, Wood said the rapidly escalating tensions are showing the market just how much influence Washington holds over Musk’s empire, from aerospace to electric vehicles and medical tech.

“Elon, Tesla, and investors are beginning to understand more and more just how much the government has control here,” she said.

The Feud: From Policy Critique to Personal Fallout

The spat, now out in the open, began earlier last week after Musk slammed Trump’s latest legislative proposal — dubbed the “One Big Beautiful Bill” — as a “disgusting abomination” on his platform, X (formerly Twitter). Musk accused the package of being fiscally irresponsible, warning it would expand the national deficit at a time of mounting U.S. debt.

The comment struck a nerve. The bill, which bundles tax cuts and infrastructure provisions along with incentives for oil and gas development, had become a major policy plank for Trump’s economic plan.

By Thursday, the fallout had turned personal. Trump responded by publicly threatening to cut off Musk’s federal contracts, telling advisers he was “done with Elon” and hinting at reviews of Tesla’s tax benefits and SpaceX’s federal contracts.

Musk retaliated just hours later. In a post that stunned investors and Washington insiders, he announced SpaceX would begin “immediate decommissioning” of its Dragon spacecraft — the same capsule that had just returned NASA astronauts Suni Williams and Butch Wilmore from the International Space Station. The threat alarmed defense officials and space industry executives, as Dragon plays a critical role in both civilian and defense space logistics. Musk later retracted the statement, signaling what Ark Invest’s Wood called an attempt to “walk it back.”

Billions at Stake

The feud has significant financial implications. SpaceX has at least $22 billion in federal contracts, according to COO Gwynne Shotwell, ranging from NASA missions to satellite work for the U.S. Department of Defense. Tesla, too, has thrived in part thanks to government support, benefiting from electric vehicle tax credits, battery subsidies, and other green energy programs.

Even Neuralink, Musk’s controversial brain-computer interface company, must operate under the regulatory authority of the Food and Drug Administration. Tesla’s robotaxi project also depends on approval from regulators in Washington, a fact that could delay or derail deployment if relations continue to sour.

Wood said the market reaction — with Tesla shares falling more than 14% on Thursday — wasn’t just about volatility.

“This is a moment of reckoning for investors,” she said. “When you’re building world-changing companies, you also end up under the microscope of the world’s most powerful government.”

Musk and Trump: From Allies to Adversaries

Musk and Trump were once close, with Musk serving on White House advisory councils during Trump’s first term. They shared common ground on issues like deregulation, space exploration, and skepticism toward legacy media.

But relations cooled after Musk criticized Trump’s decision to pull the U.S. out of the Paris climate agreement in 2017. The final break came in 2022, when Trump mocked Musk at a rally, calling him “another bull**** artist” and urging the Tesla CEO to “stay out of politics.” Since then, their relationship has been teetering between uneasy alliance and outright hostility.

This week’s events appear to have pushed it into full collapse.

“I have no intention of speaking to him,” Trump told NBC News on Saturday. “He’s been very disrespectful. You cannot disrespect the office of the President.”

However, some members of Trump’s circle are holding out hope for reconciliation. Vice President JD Vance, speaking on Thursday during an appearance on the Theo Von podcast, said he thought Musk’s public criticism was “a huge mistake,” but added, “I hope he figures it out and comes back into the fold.”

Trying to Rebrand — or Disengage?

Cathie Wood speculated that Musk may be trying to distance himself from partisan politics and the perception that his companies are aligned too closely with any single administration.

“One of the hypotheses out there is that what has happened was partly — not entirely — orchestrated,” she said. “There has been some brand damage to Tesla, which he readily admits. I think he’s trying to disengage from the government and being associated with one party or the other.”

Musk himself hinted at a shift in direction back in April, announcing that he would step back from government-related partnerships to focus more on commercial ventures and AI development.

But as Wood pointed out, it may be too late for a clean break. “When you build a business model that scales with public money and public infrastructure, you don’t get to pick your regulators,” she said.

Despite the turmoil, Wood believes Musk will adapt. “He works really well under pressure,” she said. “He creates a lot of that chaos and pressure himself.”

However, the broader message to Silicon Valley is that while innovation can challenge governments, it often still relies on them — and crossing a sitting U.S. president can come with high costs.