PaidHR, a Nigerian startup that streamlines HR and payroll tasks and workflows across borders, has secured $1.8 million in a seed funding round to expand its innovative payroll and HR technology platform for African businesses.

The funding round was led by Accion Venture Lab and included participation from Zrosk, Chui Ventures, and Zedcrest Capital. It builds on the company’s earlier fundraising efforts, which saw $1.1 million raised through pre-seed and undisclosed rounds in 2023.

With this fresh capital, PaidHR plans to accelerate product development, grow its customer support team, and deepen market penetration across Africa’s enterprise and SME sectors. The company also aims to enhance features around financial wellness, regulatory compliance, and HR analytics—crucial areas for Africa’s dynamic and diverse business landscape.

Co-founder Seye Bandele emphasized the company’s mission to build infrastructure reflective of African business realities. “We are committed to simplifying operations for SMEs and enabling them to scale across the continent,” he said.

Amee Parbhoo, Managing Partner at Accion Venture Lab, praised PaidHR’s ability to blend automation with financial tools such as earned wage access and dollar savings. “They’re not just improving operational efficiency—they’re creating new pathways for financial inclusion,” she noted.

Founded in 2021 by Seye Bandele and Lekan Omotosho, PaidHR helps businesses become more efficient, freeing up their time to focus on strategic work.

The software helps organizations with onboarding, HRIS, Payroll compliance management, performance tracking, asset management, and earned wage access to help businesses streamline their operations.

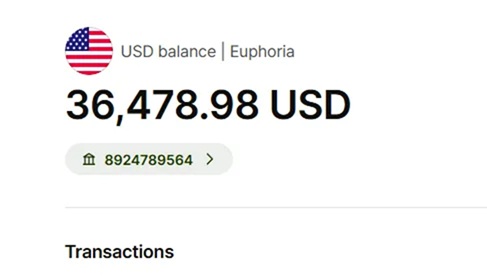

Earlier this year, the startup rolled out PaidHR wallet, an all-in-one financial solution designed to give employees full control over their earnings all in one place.

The wallet processes over ?1.3 billion ($835,134) in monthly transactions, with employees choosing to keep wages on the platform for spending or saving. PaidHR aggregates licensed partners for services like bill payments, earning a small margin (e.g., 2% on 10% of transactions).

Here are some of its key features:

Instant Salary Access: Employees can receive their salaries directly into the PaidHR Wallet without bank delays or extra charges. You can switch your account details to your Wallet ID for instant deposits.

Earned Wage Access (EWA): Allows employees to access up to 50% of their earned wages before payday to cover expenses without interest or hidden fees. No repayment is required as it’s deducted from the next salary.

Free Wallet-to-Wallet Transfers: Employees can send money to colleagues or others within the PaidHR Wallet instantly and at no cost, ideal for splitting bills or quick transfers.

Bill Payments: Pay utility bills, airtime, data, and cable TV subscriptions directly from the wallet with zero transaction fees. Most wallet spending goes toward high-frequency expenses like airtime, data, power bills, and transportation.

Global Money Transfers: Supports international transfers to over 120 countries in 49 currencies via a Dollar account, simplifying cross-border payments.

Despite these financial features, PaidHR remains an HR-focused platform, not a fintech, with subscription fees as its primary revenue source.

PaidHR’s impact is reflected in its impressive growth trajectory. Despite launching during a global pandemic, the company achieved a 72.46% year-over-year growth rate in 2023, a testament to its resilience and relevance. By 2024, PaidHR had processed over ?30 billion in salaries for more than 100 businesses, nearly doubling the ?11.473 billion processed in 2023. This growth underscores the trust businesses place in PaidHR as a reliable partner for HR and payroll management.

Serving over 200 businesses, including 100 African companies, PaidHR has impacted approximately 25,000 employees across the continent. Its client base includes notable enterprises like Flutterwave, highlighting its ability to cater to both small and medium-sized businesses (SMEs) and large organizations. The platform’s user-friendly interface and responsive customer support have earned it a Net Promoter Score (NPS) that outperforms the SaaS industry average of +36, with clients praising its ease of navigation and efficiency.

PaidHR’s impact is a story of innovation, resilience, and purpose. By simplifying HR and payroll processes, the company has saved businesses time and resources while empowering employees with financial flexibility.

Its growth from a Gusto-inspired idea to a profitable HR-tech platform serving over 200 businesses and 25,000 employees is remarkable. With $1.8 million in fresh funding and ambitious expansion plans, PaidHR is set to transform the future of work in Africa, one payroll at a time.

Like this:

Like Loading...