Starting crypto mining in 2025 has become far more accessible thanks to legal, easy-to-use cloud mining sites that remove the need for hardware, high electricity bills, and technical setup. If you’re searching for how to start crypto mining or the best cloud mining sites for fast and easy profit, this guide walks you through the essentials and highlights the most trusted platforms to begin earning.

What Is Cloud Mining and Why It Matters in 2025

Cloud mining allows you to rent computing power from professional mining farms. Instead of running your own machines, you purchase a plan, and the platform delivers daily crypto rewards directly to your wallet.

With Bitcoin’s rising difficulty and hardware costs, cloud mining offers a simple entry point for beginners who want quick setup, predictable payouts, and passive income.

How to Start Crypto Mining: Quick Beginner Steps

1. Join AutoHash

Register on AutoHash, a Swiss-supervised cloud mining platform with transparent terms and renewable-energy farms.

2. Pick Your Mining Plan

Choose a short, AI-optimized contract that matches your budget and preferred hashrate.

3. Activate and Earn Daily BTC

Start your plan and receive automated daily payouts—no hardware, no setup, fully managed by AutoHash.

6 Best Cloud Mining Sites for Fast and Easy Profit

Below are the most reliable platforms offering strong performance, transparent terms, and beginner-friendly dashboards.

1. AutoHash — Swiss-Supervised, AI-Optimized Cloud Mining

AutoHash stands out for its Swiss oversight, renewable-energy mining farms, and AI engine that allocates hashrate for maximum output. It is one of the few platforms offering clear legal compliance plus a $100 bonus for new users.

? Click to visit AutoHash and start mining for free now!

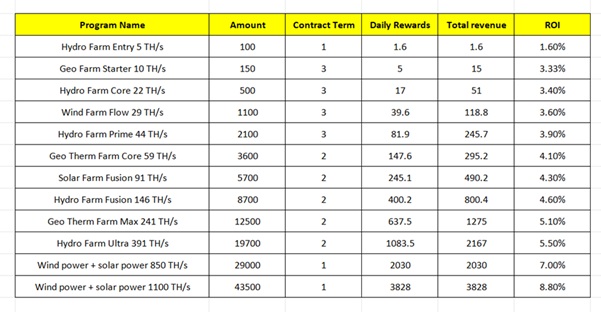

AutoHash monetization plan example:

Why users choose it:

- AI-enhanced mining efficiency

- Swiss regulatory environment

- Fast Bitcoin payouts

- Renewable energy farms

- User-friendly mobile dashboard

- Supports BTC, DOGE, LTC

2. BitDeer — Institutional-Grade Mining Infrastructure

BitDeer operates some of the largest industrial mining facilities in the world. Contracts range from beginner-level to high-power plans suitable for advanced users.

Highlights:

- Transparent hosting costs

- Long-term BTC contracts

- Access to diverse mining pools

- Reliable, stable infrastructure

3. ECOS Mining — Regulated Mining in Armenia’s Free Economic Zone

ECOS delivers consistent performance backed by a regulated environment. Its simple plan calculator and clear pricing make it popular for users starting crypto mining.

Highlights:

- Operates legally within a government-supervised zone

- Beginner-friendly contract options

- Low minimum entry cost

- Stable, predictable BTC output

4. NiceHash — Buy Live Hashpower with Full Flexibility

NiceHash is different from fixed-contract platforms. Instead, you buy live hashpower on a marketplace, making it ideal for users who want strategy and flexibility.

Highlights:

- Real-time pricing

- Switch mining algorithms anytime

- No long-term lock-ins

- Supports multiple crypto assets

5. Hashing24 — Simple BTC Hosting for Long-Term Miners

Hashing24 focuses on straightforward Bitcoin hosting with reliable output. It’s a good entry-level choice for users who want minimal setup and stable daily earnings.

Highlights:

- Clear BTC-only plans

- Stable long-term payouts

- Easy onboarding

- Transparent fee structure

6. ViaBTC Cloud — Multi-Coin Mining With Large Global Pools

ViaBTC is a well-known global mining pool offering cloud contracts for multiple crypto assets. It’s a strong option for users who want diversification beyond Bitcoin.

Highlights:

- Supports BTC, LTC, BCH, and more

- Competitive pool performance

- Good for multi-asset mining

- Proven operational history

Is Cloud Mining Still Worth It in 2025?

Yes—when using legal, transparent cloud mining sites. Platforms that rely on real data centers and publish clear costs can provide stable earnings, especially for users who want passive income without running hardware.

Final Thoughts: Start Crypto Mining the Smart Way

If you’re wondering how to start crypto mining or looking for the best cloud mining sites for fast and easy profit, the key is choosing trusted services with clear legal standing and transparent operations. Platforms like AutoHash, BitDeer, ECOS, NiceHash, Hashing24, and ViaBTC make it possible for beginners to earn daily crypto with minimal effort.

Start small, choose short-term plans, and scale as you gain confidence—smart cloud mining can become a steady passive-income stream in 2025.