As Oyo State approaches the 2027 governorship election, the political scene is already charged with strategic maneuvering, quiet alliances, and shifting loyalties. The race for Agodi, location of government secretariate, will not be defined by loud declarations or political theatrics alone. Instead, the decisive factors lie in the subtle yet powerful moves being made behind closed doors. Our analysis of the recent moves by political parties, party members and prospective candidates reveals the forces and players shaping the road to 2027, and offers an early glimpse into what it will take to emerge victorious.

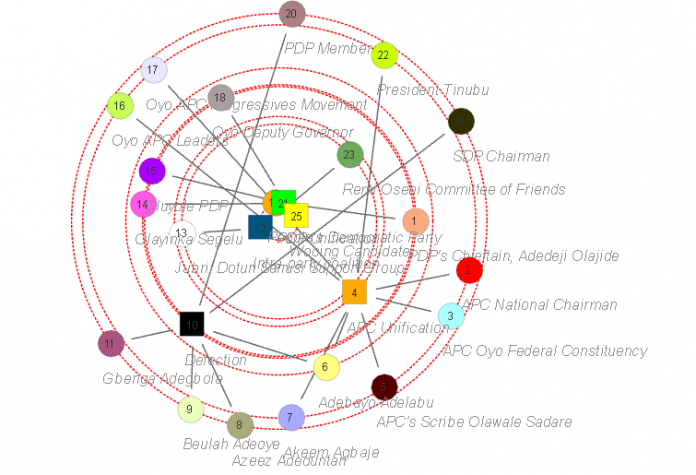

One of the most striking patterns is the sheer importance of unity within political parties. Coalition building and internal reconciliation have emerged as the most powerful levers of influence. They surpass the impact of individual politicians, no matter how prominent. The ability of a party to close ranks and present a common front holds more value than any single endorsement or campaign promise. This is especially true for the People’s Democratic Party, which shows signs of structural strength but remains vulnerable to internal conflict. If the PDP can maintain internal discipline and keep all factions aligned, it stands a strong chance of retaining power. However, a divided party would struggle to inspire voters or rally resources.

Exhibit 1: Strategic choices and alignments ahead of 2027 election

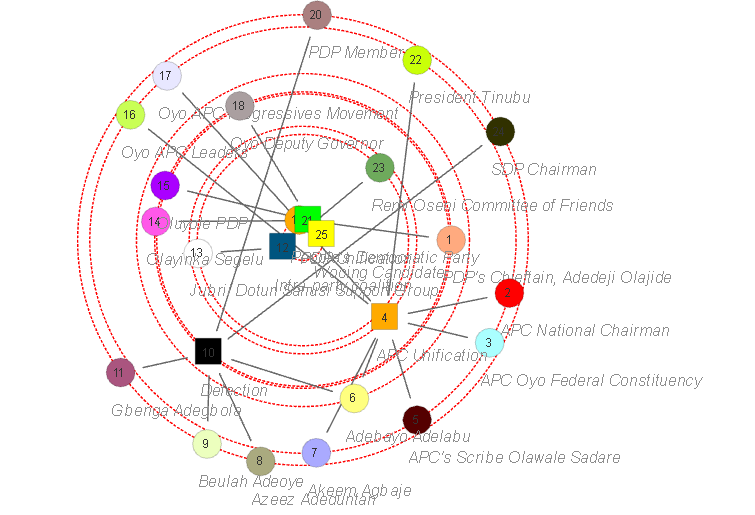

In the case of the All Progressives Congress, the situation is more complex. Several key figures within the APC command influence, but none dominates. The national chairman, state leaders, party scribe, and other prominent actors each hold similar levels of clout. This kind of balance suggests that decision-making could become sluggish, especially in moments when swift, unified action is required. The APC’s unification efforts, however, rank high on the list of influential strategies. If those efforts succeed, the party will pose a serious threat to any opposition. If they fall short, internal competition may dilute the party’s ability to mobilize and win.

Defections continue to play a central role in shaping political power. The act of switching party allegiance remains a powerful move that can shift momentum and recalibrate expectations. While defections can bring in new talent or boost a party’s image, they often come at a cost. Parties must weigh the short-term gains against the risk of appearing unstable or opportunistic. The fact that defections are seen as almost as influential as internal unification speaks to the fluid nature of political loyalty in Oyo State.

Among the emerging forces are individuals and groups that do not yet occupy the headlines but are quickly gaining ground. Figures like Jubril Dotun Sanusi and the Remi Oseni-led committee are becoming increasingly relevant. Their influence suggests that political momentum is not limited to traditional powerbrokers. These actors may play the role of unifiers, facilitators, or kingmakers, particularly if they can bridge gaps between rival factions. Another standout is Adebayo Adelabu. Though not fully aligned with the two major parties, his growing influence positions him as a potential swing figure. His movements and alliances may prove decisive in a closely contested race.

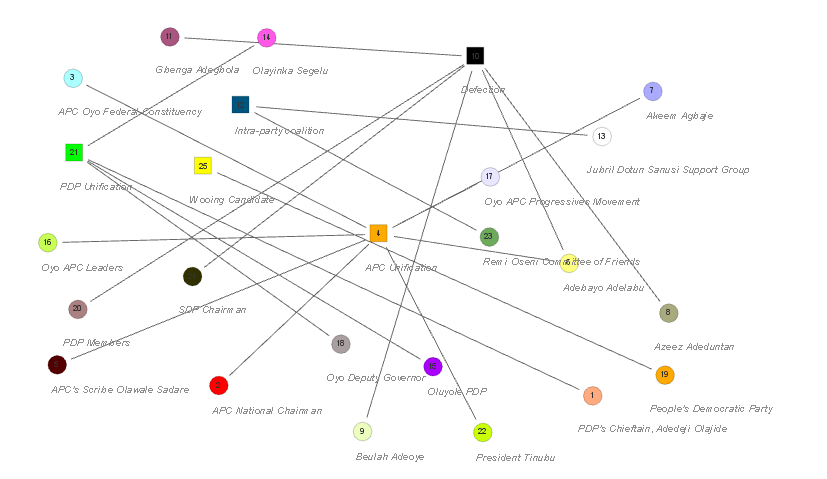

Exhibit 2: Actors and issues within power centrality arena

Another critical trend is the growing importance of strategic recruitment. Efforts to woo high-profile candidates are proving just as influential as the strategies of established political parties. In many ways, political campaigns are becoming more about individuals and less about ideologies. A well-timed endorsement or the entry of a respected candidate can tip the balance in an otherwise even race. This development highlights the personalization of politics, where voter appeal increasingly revolves around the credibility and reputation of individuals rather than the party platforms they represent.

While much attention is placed on state-level actors, local leaders and party structures still play a vital role. Figures connected to specific districts, such as those in Oluyole or the deputy governor, may not have overwhelming influence on their own, but their grassroots reach is essential. Mobilizing support at the local level remains a crucial part of any successful campaign, and state-level candidates ignore these networks at their peril.

Looking ahead, the path to Agodi in 2027 will be shaped not just by public opinion or media attention but by internal discipline, coalition strength, and strategic agility. The PDP may have a head start if it can maintain its unity, but it cannot afford to be complacent. The APC has the potential to rally a powerful campaign, though it must first resolve its internal power struggles. Meanwhile, independent figures and third-party actors will be watching for opportunities to step in and play decisive roles.

Ultimately, the most successful political strategy will be the one that listens closely, builds sincerely, and adapts quickly. Winning the governorship in 2027 will be less about dominating the airwaves and more about understanding the quiet shifts in loyalty, the weight of local alliances, and the strategic importance of timing. In the politics of Oyo State, power belongs to those who can unify, not just those who can command attention.