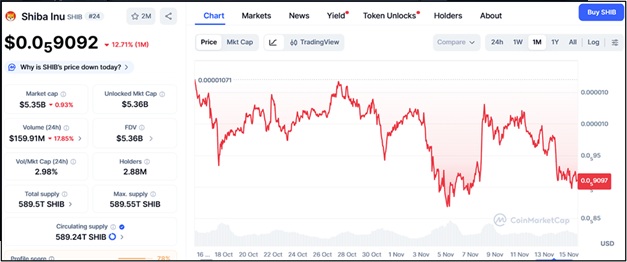

Meme coin market is heating up again, with Shiba Inu (SHIB) showing renewed strength and attracting traders looking to capitalize on short-term volatility. Trading around $0.000009092, SHIB’s bullish sentiment has returned—but analysts suggest investors might find even greater upside by rotating profits into next-generation AI projects.

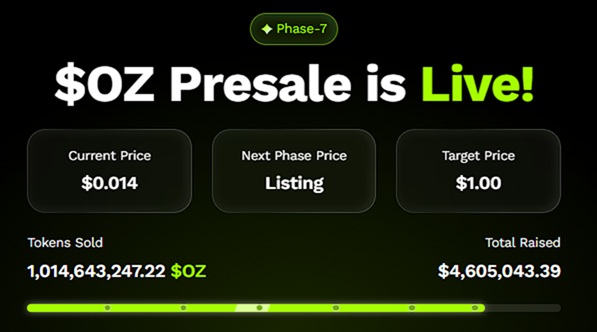

Ozak AI (OZ), an emerging AI-driven ecosystem, is drawing increasing attention thanks to its strong presale performance, real-world integrations, and potential for 50x–100x growth. As investors begin securing profits from SHIB’s latest rally, many are eyeing Ozak AI as the smarter move for exponential returns in 2025.

Shiba Inu and Ozak AI

Shiba Inu remains one of the most traded and recognizable meme coins in crypto. Trading at $0.000009092, SHIB shows healthy market momentum as whales accumulate positions ahead of a possible broader meme resurgence. Resistance is forming at $0.000009460, $0.000009870, and $0.000010240, where previous rallies have met selling pressure. Strong support remains intact near $0.000008730, $0.000008390, and $0.000008050, creating a strong base for potential continuation.

Analysts believe SHIB could deliver a modest 5x–10x during peak meme season, but beyond that, its upside may begin to plateau. This is prompting many traders to take partial profits from SHIB’s rally and redirect capital toward early-stage utility-driven tokens like Ozak AI, where the growth potential remains far greater.

Ozak AI (OZ)

Ozak AI (OZ) is quickly emerging as one of the most promising early-stage crypto projects of the year. Its ecosystem combines prediction agents, real-time market intelligence, and cross-chain AI automation—all designed to make blockchain systems faster, smarter, and more autonomous. The project’s momentum is undeniable: over 1 billion tokens sold and more than $4.5 million raised during the OZ presale.

Strategic partnerships with Perceptron Network, HIVE, and SINT enhance Ozak AI’s credibility, connecting it to real-time 30 ms data signals, trust-based verification systems, and AI-driven agent toolkits. Analysts describe Ozak AI as the perfect bridge between artificial intelligence and decentralized data networks—two of the fastest-growing sectors in tech. With AI narratives dominating the next cycle, Ozak AI’s fundamentals place it in a prime position for massive returns once it lists.

Why SHIB Traders Are Rotating Profits Into Ozak AI

Seasoned meme traders are known for spotting early market rotations, and the current trend is clear: profits from meme coins like SHIB are flowing into AI projects. Three key factors explain this shift:

- Massive upside potential: SHIB’s rally may continue, but its large market cap makes 50x–100x gains unlikely. Ozak AI, on the other hand, is still in its early valuation phase, where exponential returns remain achievable.

- AI narrative strength: Artificial intelligence is becoming the dominant macro trend in both crypto and traditional tech, making Ozak AI’s growth story even more appealing.

- Real utility over speculation: Unlike meme tokens, Ozak AI offers working technology—prediction agents, automation systems, and on-chain intelligence—all designed for real-world use.

As this rotation intensifies, Ozak AI is absorbing liquidity from meme-driven assets, becoming the focal point of early-cycle investment strategies.

Shiba Inu’s rally shows that community-driven momentum still works—but smart money is already moving into the next big narrative. Ozak AI offers that perfect mix of hype, real utility, and early-stage positioning. Analysts believe investors flipping their SHIB profits into Ozak AI could see their ROI multiply dramatically as the AI–crypto intersection matures through 2025.

SHIB’s run may be strong, but Ozak AI’s forecast looks explosive—making it the ideal target for traders aiming to turn meme gains into long-term wealth.

About Ozak AI

Ozak AI is a blockchain-based crypto venture that offers a technology platform that focuses on predictive AI and advanced records analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI permits real-time, correct, and actionable insights to help crypto fanatics and companies make the precise choices.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi