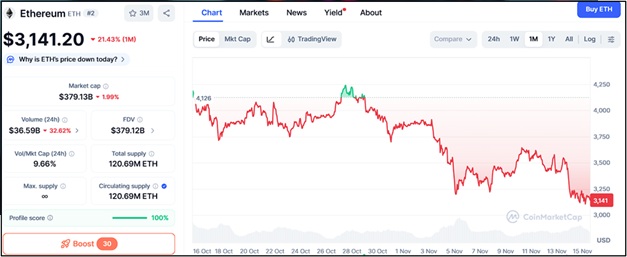

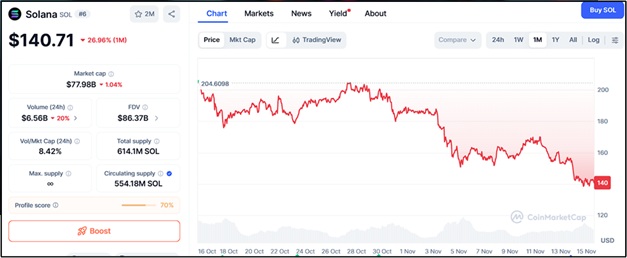

Investor behavior across the market is beginning to shift, as traders who traditionally focused on Ethereum and Solana are gradually exploring new high-upside AI-driven opportunities. Strong predictions surrounding Ozak AI (OZ) have accelerated this movement, especially as the token’s OZ presale growth, ecosystem partnerships, and predictive technology continue outperforming expectations. With ETH consolidating near $3,141 and SOL holding around $140, demand for early-cycle asymmetry is rising quickly, pushing capital toward Ozak AI as the next major breakout candidate.

Ethereum and Ozak AI

Ethereum remains the backbone of decentralized finance; however, price consolidation around $3,141 displays a slowing rhythm that often encourages investors to diversify. Resistance continues forming near the $3,240, $3,380, and $3,520, levels that have repeatedly stalled upward momentum during the last months. Support remains strong at $3,050, $2,920, and $2,810, in which long-time period buyers continuously step in to defend the fashion.

Even with Ethereum’s strong fundamentals, many investors are searching for higher upside plays while ETH moves sideways. Ozak AI is directly benefiting from this shift, as its blend of prediction engines, agent automation, and AI-driven analytics offers earlier exponential potential than Ethereum’s more mature growth curve.

Solana and Ozak AI

Solana maintains one of the most powerful momentum profiles among massive-cap cryptos due to its speed, scalability, and thriving ecosystem. Holding consistent round $140, SOL continues to face resistance close to the $146, $153, and $162, tiers where dealers generally restrict breakout attempts. Support sits near $134, $128, and $120, strengthened via consistent liquidity inflows and high network activity.

Even with its impressive performance this cycle, many traders feel Solana’s upside is becoming more linear. That sentiment shift is pushing investors toward early-stage AI-driven tokens like Ozak AI, which offer a distinctly different growth trajectory fueled by innovation rather than saturation.

Ozak AI Gains Momentum as AI Predictions Drive Investor Rotation

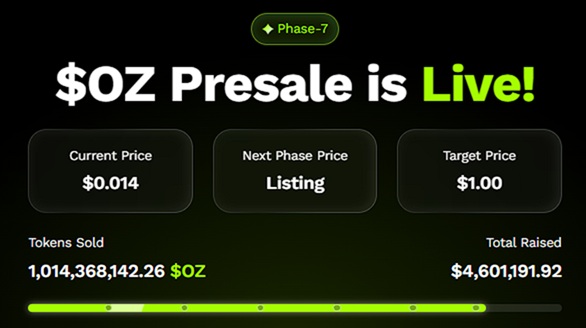

Ozak AI (OZ) is rapidly emerging as the most compelling candidate in the AI–blockchain segment, especially for traders seeking early exposure before mainstream adoption accelerates. Over 1 billion tokens sold and more than $4.5 million raised demonstrate strong conviction from retail and early institutional participants. Partnerships with Perceptron Network, HIVE, and SINT amplify its technological credibility, linking OZ to prediction agents, cross-chain intelligence, and high-speed signal systems.

Rising demand for AI-enhanced trading and market insights is reshaping investor expectations, with Ozak AI positioned at the center of this transformation. Continually improving sentiment, paired with rapidly expanding community presence, is fueling predictions that OZ could outperform several large caps in percentage returns once listings and utility rollouts begin.

Growing rotations from Ethereum and Solana toward Ozak AI signal a significant shift in market behavior. Heightened demand for AI-powered crypto tools and early-phase potential is positioning Ozak AI as one of the most promising breakout tokens of the next cycle, especially for investors seeking accelerated upside beyond the steady growth of major assets.

About Ozak AI

Ozak AI is a blockchain-based crypto venture that offers a technology platform that focuses on predictive AI and advanced records analytics for monetary markets. Through machine learning algorithms and decentralized network technologies, Ozak AI permits real-time, correct, and actionable insights to help crypto fanatics and companies make the precise choices.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi