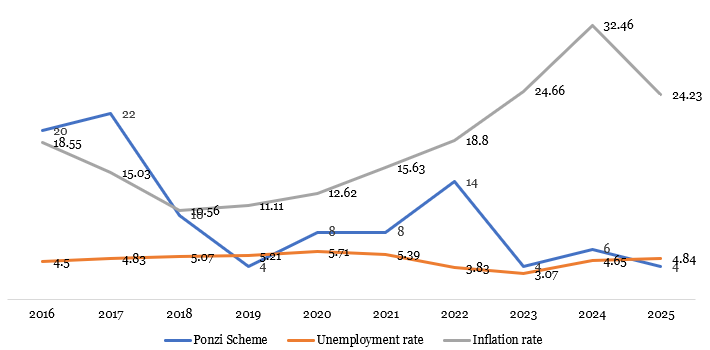

The cost of living crisis in Nigeria deepened in March 2025, with headline inflation jumping to 24.23%, according to the latest report by the National Bureau of Statistics (NBS).

The new figures mark a sharp rise from 23.18% recorded in February, underlining persistent pressure on consumer prices amid a weakened naira, worsening insecurity in food-producing belts, and increasing fuel costs.

Although economic managers have continued to downplay fears of hyperinflation, the latest data tells a different story—one that reflects the difficult choices millions of Nigerians are now forced to make daily as they navigate shrinking incomes, stagnant wages, and surging prices of food, transport, and basic goods.

“On a month-on-month basis, the headline inflation rate in March 2025 was 3.90%, which is 1.85 percentage points higher than the rate recorded in February (2.04%),” the NBS stated, signaling that not only are prices high, they’re also rising faster.

Even when volatile food and energy prices are stripped out, inflationary pressures remain unrelenting. Core inflation considered a more stable measure, rose to 24.43% year-on-year, up from 20.06% in March 2024. On a monthly basis, it increased by 3.73%, compared to 2.52% in February.

This trend reveals the structural nature of Nigeria’s inflation problem, even after the rebasing by the NBS to “reflect actual economic growth.” The price increases are no longer just seasonal or driven by one-off shocks—they are entrenched across both the food and non-food segments of the economy.

Urban vs. Rural Divide Widens

The inflation burden is not felt equally. Urban areas, which depend more on imported goods and transportation, saw a year-on-year inflation rate of 26.12% in March, significantly higher than the 20.89% recorded in rural areas. Month-on-month, urban inflation rose by 3.96%, compared to 3.73% in rural regions.

What this means is that residents in cities like Lagos, Abuja, and Port Harcourt are seeing sharper price increases, particularly in transportation, fuel, rent, and processed food.

The Unending Food Inflation

Food inflation remains the dominant driver of Nigeria’s cost-of-living crisis. Though the NBS pegs it at 21.79% year-on-year in March, the real experience for most Nigerians tells a more troubling story. The average cost of everyday staples such as fresh ginger, garri, Ofada rice, honey, crabs, potatoes, plantain flour, pepper, and periwinkle continued to climb, with little respite in sight.

Month-on-month, food inflation rose to 2.18%, up from 1.67% in February. The steady rise comes at a precarious time: the start of the planting season, when food supply typically tightens. But this year, insecurity in the Middle Belt and other agricultural hubs, coupled with high logistics costs, threatens to worsen the crisis.

Why Prices Keep Rising

According to analysts, inflation in March was shaped by a mix of opposing forces. Samuel Oyekanmi, Head of Research at Norrenberger, pointed to a tug-of-war between easing and inflationary trends.

“The continued effect of rebasing and favourable base effects are expected to exert a moderating influence,” Oyekanmi told NairaMetrics. “However, depreciation of the naira in the second half of March and the increase in petrol prices could raise costs across transport and goods.”

However, the naira’s brief rally in February gave some hope for a cooldown in imported inflation. But that optimism faded towards the end of March when the currency began to slide again against the dollar. With Nigeria relying heavily on imports, from food to industrial raw materials, even a slight weakening of the naira quickly reflects on shelf prices.

Meanwhile, petrol prices stayed largely flat for most of March but ticked upward in the final week of the month, triggering fresh concerns over transport and haulage costs. With diesel and petrol accounting for a large portion of food distribution expenses, any increase reverberates nationwide.

The NBS’s ongoing rebasing of inflation weights and methodology has added to the concern of capturing economic data accurately. While the revised metrics are aimed at better reflecting actual household consumption, some economists argue that the changes may momentarily suppress the full picture of Nigeria’s inflation reality.

But even with that technical adjustment, inflationary momentum has not slowed. The month-on-month increase of 3.90% in headline inflation, the highest in months, shows that whatever marginal easing occurred earlier in the year is being wiped away.

CBN’s Policy Dilemma

The data now puts the Central Bank of Nigeria (CBN) in a tight corner. With inflation racing ahead of interest rates and savings yields, pressure is mounting for further monetary tightening. But raising the benchmark interest rate too aggressively risks stalling an already fragile recovery and worsening access to credit for businesses.

Economists say that while the CBN has little choice but to continue hiking rates to control inflation, monetary tools alone may not be enough.

With the planting season starting under the shadow of insecurity, and exchange rate volatility threatening to worsen import bills, the outlook remains grim. The possibility of inflation breaching 25% in the coming months cannot be ruled out—especially if fuel prices are adjusted upward again or food shortages worsen due to disruptions in key farming regions.

Ordinary Nigerians, already burdened with transport fare hikes, shrinking food baskets, and stagnant salaries, continue to ask when relief will come.