A recent analysis of advertising and promotional messages from a cross-section of local and international brands, ranging from MTN Nigeria, CheckMyPeople, Appledirectng, and Bet9ja, to global players like Spotify Africa, Veriff, Grammarly, Google, McKinsey, and Chainlink, offers a compelling glimpse into how companies are cultivating loyalty, sparking growth, and rewriting engagement rules in Africa’s dynamic consumer market.

Whether it’s through security-focused platforms, scholarship access, productivity tools, or digital finance, these brands are tapping into shared values of empowerment, identity, and trust, all while sidestepping divisive themes and embracing positivity.

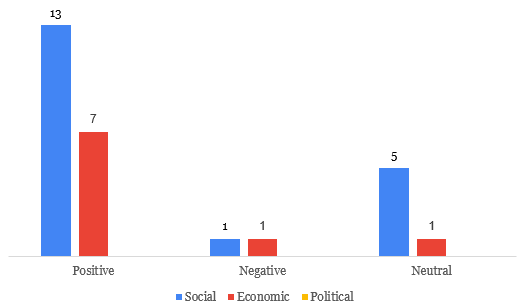

Exhibit 1: Sentiments in ads/promotional messages

Digital Trust in a Scam-Prone World

In Africa’s increasingly digital environment, where cyber threats, scams, and misinformation abound, brands that prioritize security and transparency gain a vital competitive edge. Platforms like Veriff, CheckMyPeople, and Yello Card have leaned into identity verification and user protection as core value propositions.

MTN Nigeria, with its wide reach, reinforces digital safety through secure connectivity campaigns, while Easy Software and Appledirectng emphasize ease, clarity, and confidence in digital transactions. In an era where reputations are built (or broken) in a scroll, these trust-focused narratives aren’t just ethical (they’re strategic).

Career Empowerment Goes Global

A notable trend across these brands is a deliberate focus on career mobility and skill-building. Scholarship and learning platforms such as Unicaf Scholarships, Udemy, Scholarship Region, and FTMO are democratizing access to global education and professional opportunities for African audiences.

Meanwhile, global consulting firm McKinsey is investing in mentorship and capacity-building content for young professionals across Africa. Even tools like Grammarly, which assist with writing and communication, are positioned as career enablers in today’s remote-first, globalized workplace. These brands understand that when users grow, engagement deepens. It’s not just about selling a product, it’s about shaping futures.

Smarter Tools, Higher Productivity

For today’s digital professionals, efficiency is everything. Brands such as Google, Freelance Platform, and Applaunchkit are marketing smart tools and automation features that promise to streamline workflows, optimize creativity, and simplify daily tasks.

This trend resonates especially with freelancers, remote workers, and small business owners, the backbone of Africa’s informal digital economy. By offering platforms that improve productivity without complexity, these brands are winning both relevance and loyalty.

Tech-Driven Playgrounds: Gaming, Crypto, and Digital Finance

The convergence of entertainment and finance is being led by players like Deriv, Tickmill, Chainlink, Bet9ja, and SuiPlay. These platforms blur the lines between fun and financial empowerment, targeting Africa’s booming youth population with high-risk, high-reward digital experiences.

Whether through decentralized finance (DeFi), online gaming, or forex trading, the core proposition is bold: anyone can play, win, and earn (often from a smartphone). This speaks to the continent’s hunger for alternative income streams, tech exploration, and financial inclusion.

Learning as a Way of Life

Educational messaging is not confined to academic platforms. From Udemy and Google to Mat3ra and Novonesis, a wide range of brands are weaving education and self-development into their core narratives. This reflects a broader shift: learning is no longer a phase, it’s a lifestyle. As consumers navigate rapid technological change, they are actively seeking knowledge, upskilling, and new credentials. Brands that make this journey easier are becoming lifelong companions.

Creativity, Identity, and Emotional Connection

Tech brands like Infinix, Techno, and Itel, alongside content-focused platforms like Spotify Africa, are enabling self-expression and digital identity-building. Through influencer collaborations, music, and lifestyle aesthetics, they help users signal who they are—and who they aspire to be. This taps into a powerful emotional undercurrent: in a world saturated with choices, identity and relatability matter. The most effective campaigns combine storytelling, aspirational tone, and cultural insight.

The Power of Positive Messaging

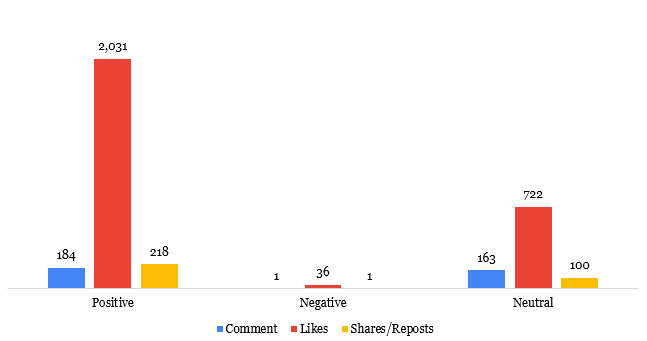

Exhibit 2: Sentiments in ads/promotional messages vs engagement patterns

According to 2025 data from Infoprations’ sentiment analysis, based on 4,662 comments, 45,032 likes, and 4,967 reposts across selected brand campaigns, positive sentiment overwhelmingly drives engagement. Messages that are optimistic, solution-oriented, or empowering receive higher interaction across all metrics. Neutral messages generate comments but less virality. Negative messages, on the other hand, receive little attention, likely because they clash with user expectations or brand safety strategies.

This data reveals a simple but powerful truth: positive, emotionally intelligent storytelling isn’t just good ethics. It is a great marketing.

Infoprations’ Understanding Digital Integrated Marketing Communications Team includes Abdulazeez Sikiru Zikirullah, Moshood Sodiq Opeyemi, and Bello Opeyemi Zakariyha