As the United States tightens its trade policy under President Donald Trump, cautious optimism is rippling through the nation’s industrial base. For companies that have long insisted on making their products in America, the renewed focus on domestic manufacturing feels like vindication — albeit tempered by uncertainty.

Ric Cabot, CEO of Vermont-based sock manufacturer Darn Tough, is one such executive. His company, which has earned national attention for its high-performance socks backed by a lifetime guarantee, has spent years doing what many others abandoned: manufacturing entirely in the U.S.

“For the first time, and hopefully not for the last time, domestic manufacturing is in a good spot,” Cabot said in an interview with Business Insider. “But you gotta commit. You gotta commit to making it here. It isn’t easy. Nobody outsources anything for quality.”

That last line is more than a quip. It underscores a fundamental belief among domestic producers: offshoring may cut costs, but quality and control suffer in the process. With the Trump administration’s tariff-heavy trade strategy, companies like Darn Tough may finally have the market conditions to prove that point, even if they remain wary of the pace and unpredictability of the White House’s approach.

Tariffs and Their Double-Edged Sword

Under the Trump administration’s evolving trade agenda, tariffs are being wielded as tools to encourage reshoring — or the return of manufacturing to U.S. soil. Treasury Secretary Scott Bessent said as much in a February interview, calling tariffs “a means to an end” aimed at restoring the country’s industrial might.

But for business leaders, the end may be clear, yet the means remain fraught.

“It’s not like we could just flip a switch, write a check, and turn on all that capability the next day,” said Bill Banta, CEO of Decked, an Idaho-based truck storage system maker that manufactures its products in Ohio and Utah. “Multimillion-dollar capital investments don’t work on short timelines — especially not with tariff threats looming.”

Banta, whose company has gradually built its own injection-molding machines and robotic welding infrastructure, acknowledged that the current moment is favorable for firms like his. Still, he warned that a poorly coordinated tariff policy could backfire, particularly if the cost of imported manufacturing equipment rises.

“It’s really hard to make long-term investments if you don’t know whether you’ll be hit with significant tariffs by the time that equipment lands in a U.S. port,” he said.

Darn Tough faces similar challenges. While its wool is sourced domestically and all production happens in Vermont, the specialized machines it uses to knit socks come from Italy. That means even companies committed to U.S. manufacturing are not immune from the fallout of global trade disruption.

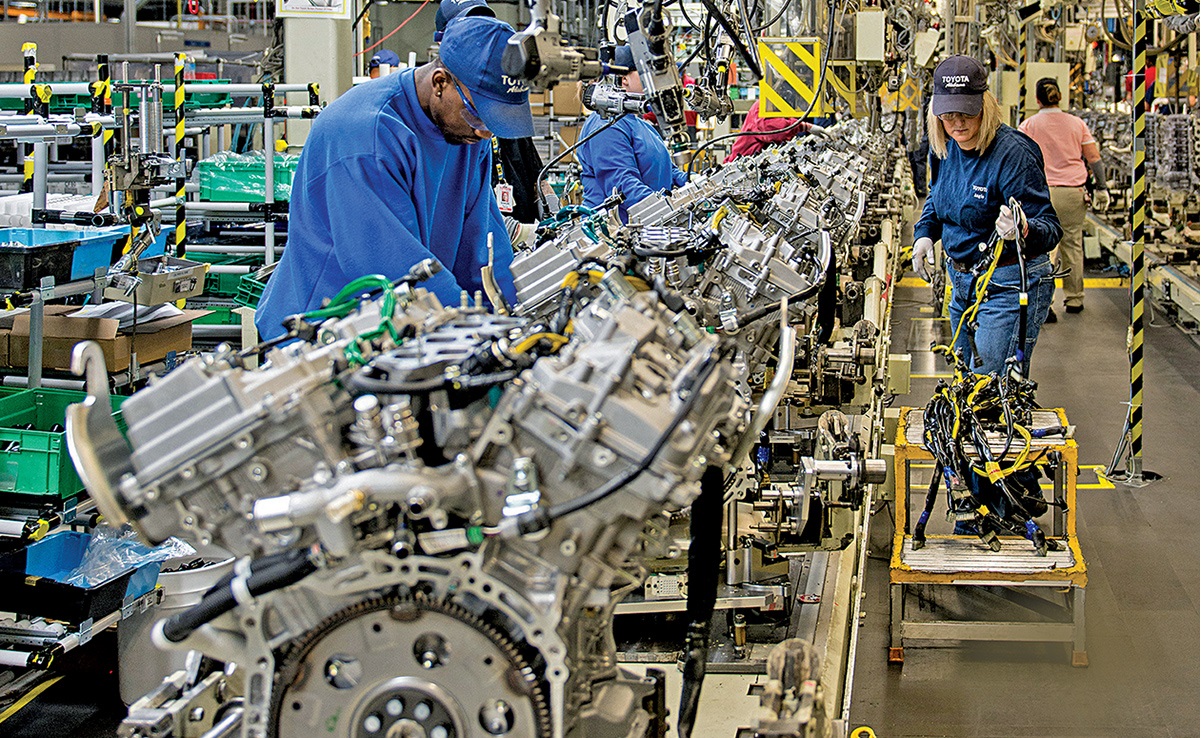

Undoing The Years of Manufacturing Neglect

For many executives, the current push to bring production back to America comes after decades of decline. Bayard Winthrop, CEO of California-based apparel maker American Giant, described the past 40 years as an era in which U.S. manufacturing was not just ignored but actively undermined.

“You can absolutely — particularly in knitwear — make very high-quality, very large volume knitwear in the United States,” Winthrop said. “They’ve just forgotten how to do it.”

American Giant’s model, like Darn Tough’s, relies on deep investment in U.S. supply chains and labor. But unlike multinationals that can shift supply networks around the globe, these companies are locked in, by choice and conviction, to the U.S. economy.

That commitment is starting to pay off. Darn Tough’s socks, which retail for around $25 a pair, may seem expensive next to $3 wool socks on Amazon. But with imported goods facing potentially higher tariffs, that price gap is narrowing. What once seemed like a niche product for quality-focused customers could soon be a mainstream buy for cost-conscious consumers.

A Long Road Back

Still, the CEOs agree: rebuilding America’s manufacturing base won’t happen overnight.

Cabot emphasized that making things domestically requires more than patriotic slogans — it requires time to train workers, develop supply chains, and build the kind of muscle memory that was lost when companies offshored en masse.

“We sort of jettisoned a whole demographic of people that worked in manufacturing,” Cabot said. “I just don’t see the reason why we can’t bring this back, but it’s going to take time.”

That time, and a predictable policy environment, are what leaders like Banta and Winthrop are now pleading for. They welcome the administration’s intent but worry about the execution.

“I don’t like the instability,” Winthrop said. “I certainly don’t think we ought to be treating our friendly allies, like Canada and Vietnam, the same way we’re treating China.”

He’s not alone in that concern. Many in the domestic manufacturing sector believe that while tariffs can be a useful tool, they must be deployed with precision. A blunt-force approach could hurt allies, drive up input costs, and make it harder — not easier — to build out U.S. capabilities.

Companies like Darn Tough, American Giant, and Decked are proving that American-made is viable. But they also serve as reminders that reshoring is a long game. It took decades to hollow out the industrial economy, and it will take more than tariffs and slogans to bring it back.

“The opportunity is real,” said Cabot. “But only if we’re serious about it — and only if we give it enough time to grow roots again.”