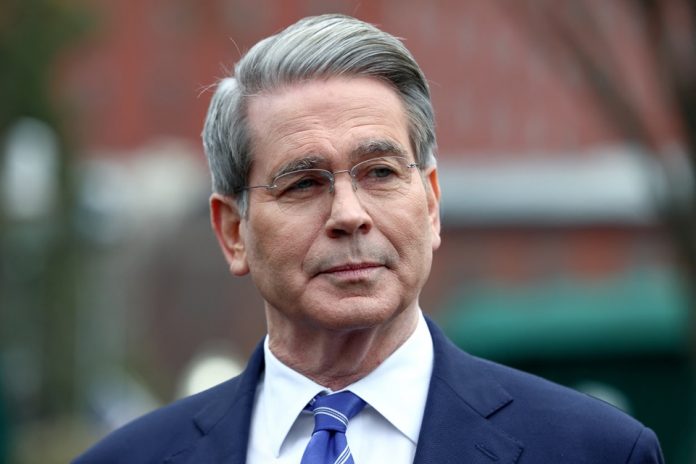

Average U.S. tax refunds are running 22% higher in the opening weeks of the 2026 filing season compared with the same period last year, Treasury Secretary and acting IRS Commissioner Scott Bessent told CNBC’s “Squawk Box” on Friday.

This is delivering an early political win for the Trump administration as it touts the benefits of its signature tax legislation ahead of the November midterms.

The 2026 tax season officially began on January 26, and the IRS has not yet released official weekly filing or refund statistics. Bessent did not specify how many days of returns his figure covers or the exact comparison period, leaving some room for interpretation. Still, the claim aligns with the White House’s narrative that the “big beautiful bill” passed in late 2025 is already putting more money back into taxpayers’ pockets.

For context, the IRS reported that the average individual refund through October 17, 2025 (late in the prior season) stood at $3,052. A sustained 22% increase would push the season-long average meaningfully higher, though final figures will depend heavily on the mix of returns filed later in the spring.

But tax experts caution that early-season refund data can be misleading. Andrew Lautz, director of tax policy at the Bipartisan Policy Center, noted in a January guide that “early data can be deceiving.”

In recent years, average refunds have started relatively modest and then “risen sharply” in mid-February once the IRS begins processing returns that include the refundable Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC). After that February peak, the average typically declines slightly through the April 15 deadline as higher-income filers—who are more likely to owe balances—file closer to the cutoff.

The larger refunds this year stem largely from changes in the 2025 tax law. Trump’s legislation expanded or introduced new tax breaks, including adjustments to the standard deduction, child tax credit, and certain business and investment provisions. Importantly, the IRS did not fully update paycheck withholding tables to reflect these changes, meaning many workers over-withheld during 2025 and are now positioned for bigger refunds when they file.

Garrett Watson, director of policy analysis at the Tax Foundation, previously told CNBC that there could be “a lot of variation between taxpayers.” Whether someone receives a larger refund, owes money, or breaks even depends on which new or expanded tax breaks apply to their situation, how accurately they withheld or made estimated payments, and other factors such as income changes, filing status, dependents, and itemized deductions.

The Earned Income Tax Credit and Additional Child Tax Credit — both refundable and often paid out in larger amounts starting in mid-February — are expected to drive the typical seasonal bump in the average refund figure. Lautz has noted that in prior years, this mid-February surge has been followed by a slight decline in the average through the April deadline.

The political stakes are high as President Trump has repeatedly promised that 2026 would deliver “the largest tax refund season of all time,” tying the expected surge directly to his tax overhaul. Larger refunds could provide a timely boost to consumer spending and household finances heading into the midterm elections, particularly for middle- and lower-income families who rely most heavily on refundable credits.

Economists note that while the early data is encouraging for the administration’s narrative, the ultimate economic impact will depend on how the refunds are used. If households spend the money rather than save or pay down debt, it could provide a modest stimulus to consumption in the second quarter. However, if many filers ultimately owe balances due to under-withholding or changes in their tax situations, the net effect could be more muted.

The IRS is expected to begin releasing official weekly filing statistics in the coming days, providing greater clarity on refund trends. The mid-February processing of EITC and ACTC returns will be a key inflection point for the season-long average.

Currently, Bessent’s claim of a 22% increase offers the first tangible signal that the 2025 tax changes may indeed be translating into larger refunds for many Americans. As more data rolls in and the April 15 deadline approaches, the full picture of how Trump’s tax overhaul is affecting household finances will come into sharper focus — with significant implications for consumer sentiment and the political landscape heading into the midterms.