A growing number of investors enter the crypto market to pursue 50x returns as they try to match seasoned whales who achieve substantial profits during erratic market situations. There are two factors that explain the remarkable market performance of Ethereum (ETH) and BNB investors. However, the evolving nature of the crypto market reveals Remittix (RTX) as a promising new project which shows potential to continue the success of previous high-return cryptocurrency ventures.

Identifying Key Technical Signals: The Ethereum Playbook

Time after time Ethereum has demonstrated its capacity to withstand challenges. The whale investor class has used strong price rebounds that emerge from vital support regions throughout history. The ascending trendline traces its origins back to the COVID-19 market crash multiple years ago.

The trendline established its strength through two significant events: LUNA collapse and Bybit hack that resulted in Ethereum price increases of 1,400% and 270%. Whales initiate buying ethereum after ETH reaches this essential support level because price tends to bounce back strongly and create suitable conditions for bullish momentum.

Ethereum maintains fundamental investor interest despite critics who prefer Proof-of-Work protocols and believe that Proof-of-Stake fragmented the network operation. A major acquisition of Ether occurred when whales purchased significant ETH volumes after it fell to $2,000 because they expected an intensely rising market.

Whales purchased over 120,000 Ether tokens worth approximately $236 million within three days based on on-chain data analysis. Such aggressive buying underscores the belief that the market still underestimates Ethereum’s long-term potential. The research analysts at Standard Chartered believe ETH will climb to $4,000 value by 2025 which enhances the belief of “whales” in the cryptocurrency market.

source: Ali Martinez on X

BNB’s Consistent On-Chain Growth

Analysts study Binance Coin (BNB) to show how small investments transform into enormous profits through time. The expansion of BNB since 2017 stems from various elements which include improved exchange usability through its robust network growth and timely platform innovations. The consistent growth of BNB has allowed whale wallets to accumulate the token.

The weekly volume of decentralized exchanges on BNB Chain rose by 66.7% according to CoinMarketCap. The BNB Chain’s increased influence within the DeFi market becomes evident through recent data since its Pascal Hardfork upgrade series alongside various other system enhancements. The network steps continue attracting whale investors because they understand the enduring potential of this system which dominates on-chain trading operations.

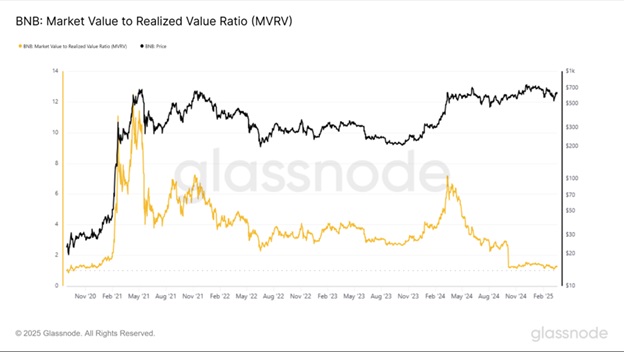

The on-chain performance of BNB long-term holders is monitored through Coin Days Destroyed (CDD), Net Unrealized Profit/Loss (NUPL) analysis and Market Value to Realized Value (MVRV) ratio assessments. Data points connected to heightened selling activity show “fear” periods but BNB has managed to escape significant price drops.

source: glassnode

Examining these data indicators leads whales to determine necessary continuation of their accumulation activities. The token’s owners seize market price declines as chances to acquire at beneficial prices because they trust that the BNB Chain development alongside widespread market conditions will maintain upward price movement.

The Next Crypto Set to Boom: Remittix on the Rise

Remittix (RTX) has recently attracted significant interest as people predict it will experience major growth throughout this year. The payment solution Remittix targets the remittance sector by providing efficient rapid cross-border payments to replace costly traditional financial systems.

The current Remittix token sale indicates high market demand from investors. The project stands strong for substantial expansion after collecting $14+ million from the sale of its 521 million tokens priced at $0.0734 each.

The core value proposition of Remittix functions by resolving an actual financial problem which was similar to Ethereum establishing decentralized application infrastructure and BNB facilitating unified trading integration. As Remittix achieves its stated roadmap all early investors could realize the kinds of profits that were reserved for the earliest supporters of ETH and BNB.

Going by the historical examples of Ethereum and BNB whales demonstrates how purchase discipline combined with market endurance and commitment to sound fundamentals brings outstanding profits.

Since the crypto market experiences continuous change new initiatives launch into the market with potential to outdo former triumphs. Remittix demonstrates qualities that indicate it will emerge as a leading candidate to challenge existing payment networks due to its effective solution for international money transfers.

Remittix Holds the Ultimate Key to Growth

People searching for explosive growth in their investments should closely follow Remittix (RTX) because its potential appears promising. Remittix differentiates itself as a promising market opportunity because it combines substantial funding with rising community backing alongside its clear mission direction through a market that seeks its next major disruption. The successful execution of Remittix’s potential can make it establish leadership as crypto’s upcoming major winner similar to how Ethereum and BNB succeeded.

Discover PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Giveaway: https://gleam.io/FHtn5/250000-remittix-giveaway