The top 3 altcoins trending in the crypto market are Shiba Inu (SHIB), Dogecoin (DOGE), and RCO Finance (RCOF). With RCOF leading the rise of new memecoins and serving as the go-to solution for new launches.

Experts are quite optimistic about RCO Finance since it has elements that the market has never seen before, which will benefit all investors.

And if there is something extremely beneficial to investors, you can bet they will flock to it once they understand it. As a result, analysts predict that RCOF will be widely adopted in the near future, with its price showing massive growth potential in 2025.

Read on to find out more about the top 3 altcoins to invest in 2025.

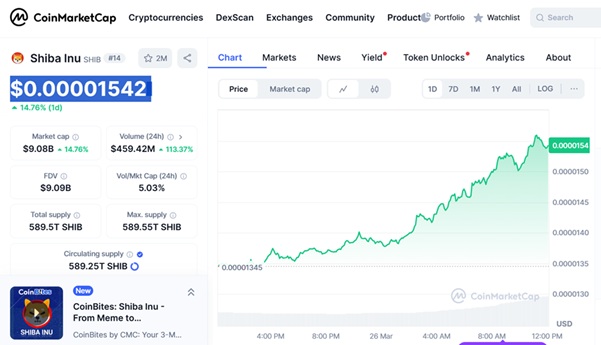

Shiba Inu Experiences Upward Trends

Shiba Inu has recently received bullish momentum following many days of price growth. The second-largest meme coin by market capitalization is up a remarkable 14% this week, outperforming most high-quality assets.

Despite the northward momentum, a Shiba Inu ecosystem team member believes SHIB will fetch far higher prices. Lucie, the ecosystem’s lead marketer, has stated that the doggy-themed meme coin may experience a 12x rise into uncharted territory.

If SHIB maintains the current price level, the study projects a rise to the eventual aim of $0.0001833. From the present market price of about $0.00001542, the asset would rise 1,137% to an unprecedented price high, making it one of the top 3 altcoins to buy in 2025.

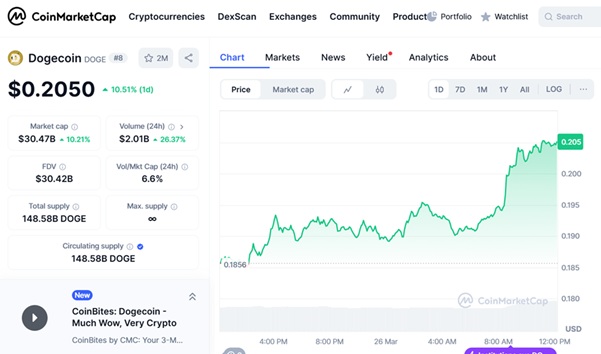

Dogecoin Witnesses Sudden Price Hike

Another altcoin that has made it to our list of the top 3 altcoins to invest in 2025 is Dogecoin. Dogecoin (DOGE), the industry’s biggest meme coin, is leading the altcoin rebound today following a surprising surge recently.

According to CoinMarketCap data, Dogecoin’s price has increased by more than 10% in the last 24 hours, sending the coin past the $0.20 resistance level.

DOGE frequently exhibits high market volatility. Currently, Dogecoin’s trading volume has increased by 16.95% overnight to $1.85 billion. This obvious interest in the altcoin has set it apart today, indicating a breakout push towards its multi-week high of over $0.23.

So far this year, Dogecoin has reached a high of $0.4159 before seeing a protracted fall amid volatility. DOGE’s open interest has steadily increased, indicating an obvious buildup to the present breakthrough.

All of these price movements make it stand out as one of the top 3 altcoins in the crypto market this year.

RCO Finance (RCOF): The Best Among the Top 3 Altcoins in 2025

As SHIB and DOGE compete for dominance, RCOF emerges as a stronger competitor among the top 3 altcoins in 2025, which coincides with the upcoming AI boom, which is expected to propel the finest AI coins to new heights.

RCOF is the native token of RCO Finance, a cutting-edge AI trading platform that will make it easier to trade cryptocurrency than ever before.

Specifically, RCO Finance provides numerous opportunities to both novice and skilled traders. New traders can benefit from the advantages offered by the cryptocurrency market without having to spend years learning, whereas experienced traders can automate their tactics and sit back and watch their portfolios develop.

The recent surge of over 7% in Pepe Coin (PEPE) demonstrates how the Robo Advisor can be utilized. This rise would have been highlighted by the Robo Advisor to help the cryptocurrency trader increase his earnings.

Because of this unique utility, the RCOF team is constantly working to improve the AI feature.

RCO Finance’s AI Robo Advisor makes all these fantastic features possible. It can completely automate trading methods without the trader’s scripting.

The Robo Advisor accomplishes this by questioning the trader about their goals, risk aversion, and market preferences before developing a personalized strategy based on those criteria.

Following that, the Robo Advisor will conduct trades using the technique, allowing new traders to profit significantly even if they have never traded before. Pro traders can also teach their methods to the Robo Advisor, automate them, and observe how they play out without having to intervene.

This type of trading has never been done before; hence, experts believe RCO Finance will exceed Shiba Inu and Dogecoin in Q2 2025.

The RCO Finance project has also established a new beta platform, allowing early investors to gain access to the platform’s AI capabilities.

Join The RCOF Presale And Make The Most of Your Trading

RCOF is currently in the fifth stage of its public presale, priced at $0.100000. Experts believe it will be launched between $0.4 and $0.6, with early investors earning more than 1,000% in presale returns.

Over 51.15% of the tokens allocated to this presale round have already been sold in a short amount of time, indicating trader interest in this rapidly expanding altcoin.

To further encourage crypto traders, SolidProof, a leading security firm, reviewed the RCOF smart contract to verify the security of investors’ funds.

Also, analysts believe that RCOF’s future will become even brighter when consumers without a cryptocurrency background discover they can finally use RCO Finance to make life-changing riches in the lucrative crypto market.

Even in the top 3 altcoins in 2025, there is obviously a leader, which turns out to be RCO Finance. Buy the RCOF token and be a part of the winning team today.

For more information about the RCO Finance (RCOF) Presale:

Visit RCO Finance Presale