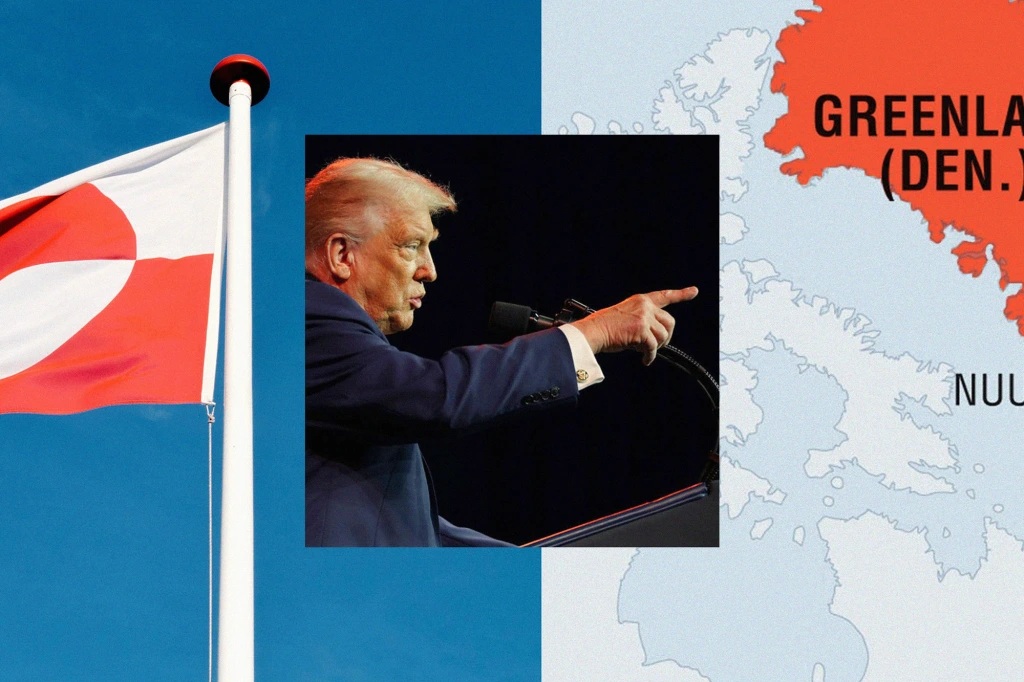

The European Union faced mounting pressure on Sunday to deploy its most powerful and never-before-used trade defense tool after U.S. President Donald Trump threatened sweeping tariffs on European allies in a bid to force the sale of Greenland, sharply escalating an already tense transatlantic dispute.

The situation is fast becoming a stress test of Europe’s economic sovereignty, alliance politics, and willingness to deploy hard trade power against its closest security partner.

Trump’s declaration on Saturday that he would impose escalating tariffs on a group of European countries until the United States is allowed to buy Greenland marked a sharp departure from conventional trade disputes. By explicitly linking punitive economic measures to a territorial demand involving a NATO ally, Washington has pushed the disagreement beyond commerce into the realm of strategic coercion, prompting alarm across European capitals.

At the heart of the EU’s deliberations is whether this moment warrants the first-ever use of the bloc’s Anti-Coercion Instrument, a legal framework designed precisely for situations where a third country seeks to force policy changes through economic pressure. Adopted after years of debate and shaped by earlier disputes with China, the tool was intended as a deterrent. Its possible activation against the United States underscores how dramatically transatlantic relations have shifted.

Diplomats say Sunday’s emergency meeting in Brussels, convened by Cyprus as holder of the EU’s rotating presidency, reflected both urgency and unease. While there is broad agreement that Trump’s approach crosses a line, consensus on how to respond remains elusive. Some governments argue that failure to react forcefully would weaken the EU’s credibility and invite further demands. Others fear that retaliation could spiral into a trade confrontation that Europe, given its export dependence, would struggle to contain.

France has emerged as a leading voice for a robust response. Officials close to President Emmanuel Macron argue that the Greenland episode strikes at the core of European autonomy, not only in trade but in foreign policy. In Paris, the concern is that allowing tariffs to be used as leverage over territorial or security issues would normalize a practice that could later be turned inward against EU decision-making on defense, technology, or industrial policy.

Germany’s industrial lobby has reinforced that view, framing the dispute as a precedent-setting moment. Export-oriented manufacturers, already under pressure from weak global demand and lingering trade barriers, warn that acquiescence would expose European companies to chronic uncertainty. Business leaders stress that the issue is no longer about tariff levels but about whether economic rules can be bent to serve unrelated political goals.

Yet divisions within Europe are real. Italy’s more cautious stance reflects a broader calculation shared by some southern and eastern member states: that keeping channels open to Washington, even in a crisis, may yield better long-term outcomes than immediate retaliation. Prime Minister Giorgia Meloni’s direct call with Trump highlights an alternative strategy centered on personal diplomacy and de-escalation, though its effectiveness remains uncertain.

Britain’s position adds another layer of challenge. While no longer an EU member, London is directly targeted by the tariff threat and has its own limited trade deal with Washington at stake. UK officials have signaled reluctance to escalate, mindful of their dependence on the U.S. relationship in trade, security, and intelligence. That restraint, however, risks leaving Britain isolated if the EU chooses a harder line.

The economic implications are potentially significant. Trump’s threat calls into question the viability of the trade agreements struck last year with both the EU and Britain, deals that were already politically fragile. In Brussels, there is growing skepticism that the European Parliament can proceed with planned tariff reductions for U.S. goods while Washington is openly threatening new duties. Suspending or shelving the agreement would deal a blow to efforts to stabilize transatlantic trade ties after years of friction.

Beyond immediate trade flows, the dispute feeds into a larger debate about Europe’s place in a more transactional global order. The Anti-Coercion Instrument was conceived as part of a broader strategy to equip the EU with tools comparable to those wielded by major powers. Using it against the United States would be a dramatic statement that Europe is prepared to defend its interests regardless of the partner involved, but it would also mark a psychological break in the post-war assumption that transatlantic disputes can always be managed quietly.

The timing has sharpened the contrast in Europe’s external strategy. As Trump’s tariff threat reverberated, the EU was finalizing its free trade agreement with Mercosur, its largest ever. European Commission President Ursula von der Leyen has framed that deal as evidence that Europe remains committed to open, rules-based trade even as others turn to tariffs and pressure. For some policymakers, that makes standing firm against Washington all the more important to preserve the EU’s credibility on the global stage.

However, the bloc is trying to balance deterrence and diplomacy for now. EU officials say no decision has been taken on activating the Anti-Coercion Instrument, but the fact that it is being openly discussed signals how seriously the threat is being taken.

It is not clear whether Europe will ultimately choose retaliation or restraint. What is clear is that the Greenland dispute has already altered the tone of transatlantic relations, exposing fault lines that extend far beyond tariffs and into the future shape of the alliance itself.