Crypto markets are entering another euphoric phase, and meme coins are once again leading the charge. Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) are all gaining momentum as traders rotate back into high-volatility tokens that defined previous bull cycles. DOGE trades at $0.1782, SHIB at $0.000009901, and PEPE at $0.000006019, each showing renewed strength on social and technical indicators.

But while these tokens are riding a familiar wave of meme-fueled hype, the most compelling story in the market today isn’t another meme—it’s intelligence. Ozak AI (OZ), an AI-powered blockchain project, is rapidly emerging as the next big narrative, offering the potential for 100x growth and redefining what real utility looks like in crypto’s next evolution.

Dogecoin (DOGE) Overview

Dogecoin (DOGE) remains the most recognized meme coin in crypto history, a symbol of community-driven success. Currently trading around $0.1782, DOGE shows resistance at $0.194, $0.215, and $0.242, while support rests at $0.162, $0.145, and $0.129.

Dogecoin’s strength lies in its deep cultural influence and massive retail following. With major mentions by Elon Musk and potential integration for payments within the X ecosystem, DOGE retains powerful upside catalysts. Analysts believe that if market sentiment stays bullish, the coin could reach $0.25–$0.30, which would represent a substantial near-term gain.

owever, while Dogecoin’s meme momentum continues to thrive, its lack of evolving utility remains a limiting factor. Investors seeking long-term, technology-driven upside are increasingly turning to projects like Ozak AI, where real innovation—not hype—drives value.

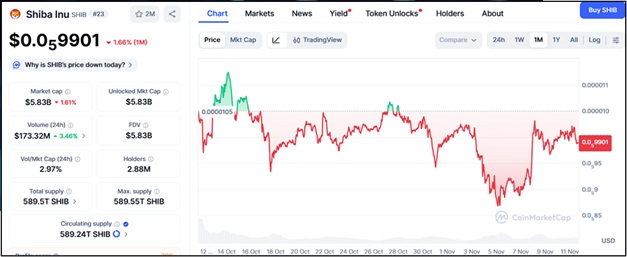

Shiba Inu (SHIB) Overview

Shiba Inu (SHIB) is building its next phase of growth on substance, not just sentiment. Trading near $0.000009901, SHIB is testing resistance at $0.0000115, $0.0000138, and $0.0000162, while support levels sit at $0.0000087, $0.0000076, and $0.0000069.

The token’s evolution beyond its meme origins is evident through Shibarium, its Layer-2 scaling solution designed for faster, cheaper transactions, as well as ShibaSwap, its decentralized exchange. Combined with ongoing burn mechanisms to reduce supply, SHIB’s fundamentals are improving each quarter.

If Shibarium adoption accelerates and broader retail sentiment returns, analysts predict SHIB could 20x by 2026. Still, while it remains a strong community asset, its upside is capped by competition and market maturity—especially when compared to the disruptive potential of AI-based blockchain projects like Ozak AI.

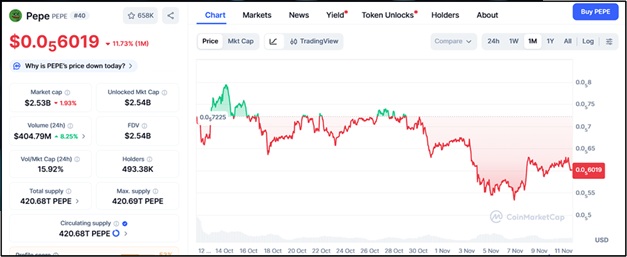

Pepe (PEPE) Overview

Pepe (PEPE), the newest of the top meme coins, has shown resilience and speculative strength since its explosive debut. Now priced at $0.000006019, PEPE faces resistance at $0.0000069, $0.0000078, and $0.0000093, with support at $0.0000054, $0.0000048, and $0.0000041.

PEPE thrives on retail speculation and social media virality, often leading market rallies fueled by memes and trading volume surges. Many traders anticipate a potential 15x–25x run if meme mania peaks again. However, PEPE—like its predecessors—lacks long-term innovation, and its sustainability depends heavily on social hype rather than technological progress.

This contrast is exactly why investors and analysts alike are now turning their attention toward Ozak AI (OZ), a project that combines real-world AI utility with blockchain scalability, representing the next evolutionary leap beyond memes.

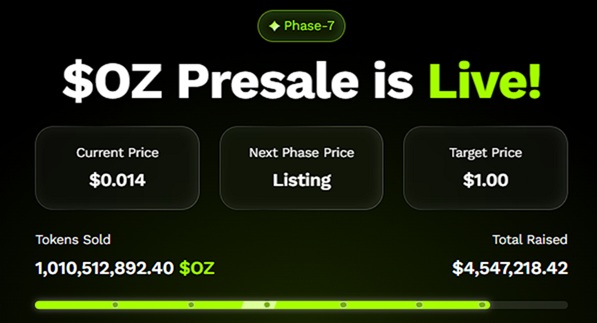

Ozak AI (OZ) Overview

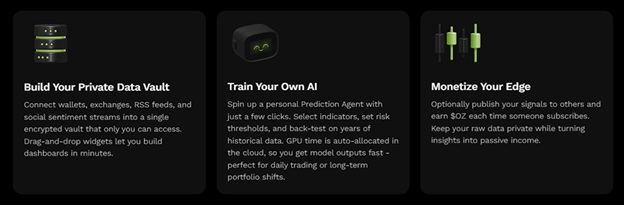

Ozak AI (OZ) stands apart as a project redefining what “smart crypto” really means. Built at the convergence of artificial intelligence, predictive analytics, and blockchain automation, Ozak AI creates a self-learning decentralized ecosystem capable of analyzing data, predicting trends, and executing automated decisions.

Currently in its 7th OZ presale stage, Ozak AI has already raised over $4.5 million and sold more than 1 billion OZ tokens, showing significant early investor confidence. Its ecosystem is powered by AI prediction agents—autonomous digital entities that process blockchain and off-chain data to drive actionable intelligence in DeFi, trading, and governance.

Ozak AI’s robust partnerships include:

- Perceptron Network’s 700,000+ nodes for scalable AI computation.

- HIVE’s 30 ms signal processing for ultra-fast predictive analytics.

- SINT’s cross-chain AI agents and voice-driven systems for real-time interoperability.

Audited by CertiK and Sherlock, and listed on CoinMarketCap and CoinGecko, Ozak AI offers both credibility and transparency—a rare combination for a presale project. Analysts forecast that Ozak AI could reach $1 per token, translating to a 100x return from its current presale valuation of $0.012.

From Memes to Machines—The Market’s Next Big Rotation

While Dogecoin, Shiba Inu, and Pepe are once again generating headlines and short-term profits, Ozak AI represents the next major leap in crypto’s evolution—from viral communities to intelligent ecosystems. Meme coins thrive on emotion, but Ozak AI thrives on automation, intelligence, and data—the true drivers of the next bull cycle.

Investors who made fortunes flipping DOGE, SHIB, and PEPE are now looking for the next asymmetric play, and Ozak AI checks every box: cutting-edge tech, early entry, and long-term scalability. In 2021, memes defined crypto culture. In 2025, AI will define crypto’s future—and Ozak AI is leading that transformation.

About Ozak AI

Ozak AI is a blockchain-based crypto venture that offers a technology platform that focuses on predictive AI and advanced records analytics for monetary markets. Through machine learning algorithms and decentralized network technologies, Ozak AI permits real-time, correct, and actionable insights to help crypto fanatics and companies make the precise choices.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi