Cryptocurrencies have challenged the idea of how we see investments and money.

However, the industry still faces roadblocks, especially when it comes to demonstrating its relevance in everyday purchases.

SpacePay ($SPY) changes this. With its MVP ready and close to $1 million raised in the ongoing presale, the new crypto payment solution demands attention.

Before we dive deep into the project, let’s find out the key challenges that stand in the way of crypto adoption in mainstream retail.

Why Crypto Payments Haven’t Gone Mainstream

Crypto payments have yet to gain widespread adoption. The reasons are clear.

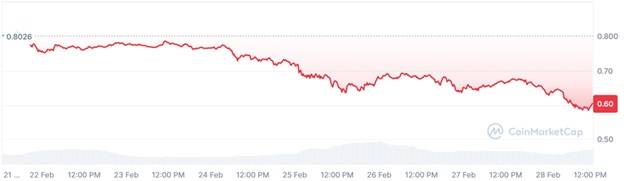

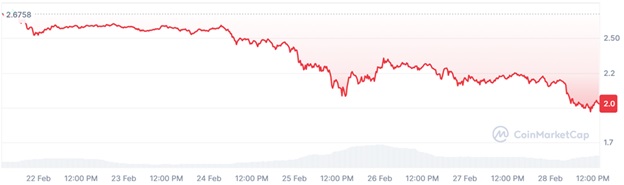

First, crypto prices can fluctuate wildly in minutes. Merchants are hesitant to access Bitcoin as a payment, as there is always the risk of seeing its value drop before cashing out. That’s not a profitable way to run a business.

Now, let’s say the business decides to accept only stable coins. There are still challenges. For example, most crypto payment solutions require businesses to install new hardware or undergo complicated integration processes.

While large brands like Tesla and Gucci can afford to experiment with crypto payments and the growing new demographic of crypto users, the case is different for small and medium-sized businesses (SMBs). They can’t afford the hassle.

Businesses are also concerned that traditional blockchain transactions can take longer than credit card payments. Crypto payment processors charge hefty fees during active markets, which can significantly eat into business profits.

For crypto to be used as easily as cash or cards, these concerns should be efficiently addressed. SpacePay does just that. The London-based fintech startup is designed to make crypto payments effortless for both businesses and consumers.

More than a token, $SPY is the ultimate gateway to rewards, governance, and exclusivity.

? Loyalty Airdrops

? Voting Power

? Early Feature Access

? Revenue Sharing

?? Charitable Donations

?? Exclusive WebinarsJoin our revolution! pic.twitter.com/69dfaPZBwv

— SpacePay (@SpacePayLtd) February 21, 2025

How SpacePay Solves These Problems

A prominent feature of SpacePay is real-time fiat conversion. Here, customers can pay in crypto by scanning a QR code. Merchants instantly receive the exact amount in their local currency.

Instant conversion and payment settlement eliminate the risk of volatility. As a result, businesses don’t have to worry about market fluctuations affecting their earnings.

Unlike other payment solutions that require costly hardware, SpacePay is an affordable solution. It is compatible with existing Android-based POS (Point of Sale) systems.

Businesses can start accepting crypto without investing in new technology, making adoption seamless and cost-effective.

While traditional credit card transactions charge merchants anywhere between 1.5% and 3.5% per sale, SpacePay charges a flat 0.5% transaction fee.

Payment providers enjoy zero integration costs.

Crypto payments can be risky, with fraud and hacks being common concerns. SpacePay secures its ecosystem with fast, irreversible transactions with strict protocols. It provides peace of mind to both businesses and users.

A Community-Driven Ecosystem with $SPY

At the heart of SpacePay’s payment network is the $SPY token.

It plays a crucial role in the ecosystem beyond just transactions.

$SPY holders have voting rights, which allows them to influence platform upgrades and decisions. The decentralized governance ensures that the community has a say in SpacePay’s future direction. Few traditional financial platforms can claim this feature.

$SPY holders can also earn loyalty rewards and unlock exclusive platform features, making it more than just a speculative asset.

$SPY Presale Nears $1 Million – What’s Next?

The SpacePay presale is moving fast.

The project is closing in on its first major milestone–$1 million raised.

Currently, $SPY is selling for $0.003126. The price is set to increase at every stage. Investors looking to enter early have limited time before the token lists on major exchanges.

The SpacePay tokenomics is structured for sustainable growth, with 18% allocated to marketing and 10% reserved for development. They fund ongoing upgrades and ecosystem expansion.

As a project that tackles the very issues that have prevented crypto payments from going mainstream, SpacePay is a top altcoin to watch now.

Once the $SPY token hits exchanges, the price is expected to surge exponentially. Now is the chance to get in at a discounted rate before the wider market catches on the trend.

The presale supports purchases using cryptocurrencies like ETH, USDC, USDT, and fiat cards.

To learn more about SpacePay and the ongoing presale, visit the official website. Follow the community on Twitter and Telegram for the latest presale and project updates.