Today, as players search for a Pinoy Tongits app download to enjoy the classic card game, they aren’t just looking for a way to pass the time. They’re searching for something that feels familiar, trustworthy, and respectful of the game’s character.

Mobile gaming has made Tongits accessible to more people than ever before. A few taps can recreate what once required a deck of cards and a shared table. But convenience, while welcome, has also introduced a new dilemma.

With so many download options available, such as official apps, altered installers, and modified files, the act of choosing where to play has become part of the strategy itself.

Tongits teaches players to think ahead. To weigh outcomes. To avoid unnecessary risks. Yet many abandon those instincts the moment they reach the download button.

In doing so, they invite problems that have nothing to do with the game and everything to do with how it’s delivered.

A Tongits experience shaped by instability, privacy concerns, or unfair mechanics loses its essence. What remains may look like the game, but it no longer behaves like one.

This feature explores why the way you download Tongits matters, why shortcuts quietly erode the experience, and why some players are choosing environments that reflect the values the game has always stood for.

Because Tongits doesn’t reward haste. It rewards discernment.

The Quiet Assurance of Official Platforms

There’s a reason official app stores still matter, even in a digital culture obsessed with alternatives. For players seeking a reliable Pinoy Tongits app download, the Google Play Store continues to offer something rare: accountability.

Apps listed on the Play Store exist within a system designed to protect users. Developers are identifiable. Updates are mandatory.

Security protocols are enforced. These aren’t just technical requirements but safeguards that preserve trust between the game and the player.

Well-known Tongits titles such as Tongits Go, Tongits Star, Tongits ZingPlay, and other variants operate within this framework. They’re maintained, patched, and adjusted over time, ensuring that the game evolves without breaking.

This consistency becomes especially important as devices and operating systems change. An app downloaded from an official platform adapts alongside those changes. Bugs are addressed. Performance improves.

Players aren’t left wondering whether a sudden crash or error signals the end of their progress.

Transparency also plays a key role. Official Tongits apps clearly outline how progression works, how rewards are earned, and what in-game currencies represent. There are no hidden alterations quietly shifting the balance of play.

Equally important is restraint. Official apps request only the permissions they need to function. In an era where phones store personal conversations, financial information, and daily routines, that restraint matters.

Choosing an official Pinoy Tongits app download is not about limiting options. It’s about preserving the stability and fairness that allow Tongits to remain what it has always been, a game of judgment, not chance.

The False Promise of Modified APKs

Modified Tongits APK files often present themselves as solutions. They promise speed, abundance, and advantage. Unlimited coins. Faster progress. Enhanced features. To an impatient player, the appeal is obvious.

But Tongits has never favored impatience.

APK files distributed outside official platforms bypass the safeguards that protect users from malicious code. Security risks are immediate and often invisible.

Malware, spyware, and intrusive advertising software can be embedded directly into the app, operating quietly once installed.

Privacy risks follow close behind. Many modified apps request permissions unrelated to gameplay, such as access to contacts, storage, microphones, or cameras. Granting these permissions opens doors that cannot easily be closed.

Even from a purely gameplay perspective, the experience becomes fragile. Accounts may be flagged or banned without warning. Progress can vanish after updates.

Apps may stop functioning entirely when official versions change. With no support and no accountability, players are left to fend for themselves.

What makes this especially unnecessary is that official Tongits apps already offer flexibility. Offline modes, daily rewards, adjustable betting, and steady progression are standard features.

There is no real-world value tied to in-game currency, removing the urgency to chase artificial advantages.

In choosing an APK shortcut, players trade certainty for illusion. They gain speed at the cost of stability and convenience at the expense of control.

Tongits, by its nature, punishes that kind of trade.

When These Pinoy Tongits App Download Tips Become Tedious

For some players, the discussion around downloads eventually reaches a different conclusion. Instead of choosing between official apps and risky alternatives, they begin looking for an environment that treats Tongits with greater seriousness.

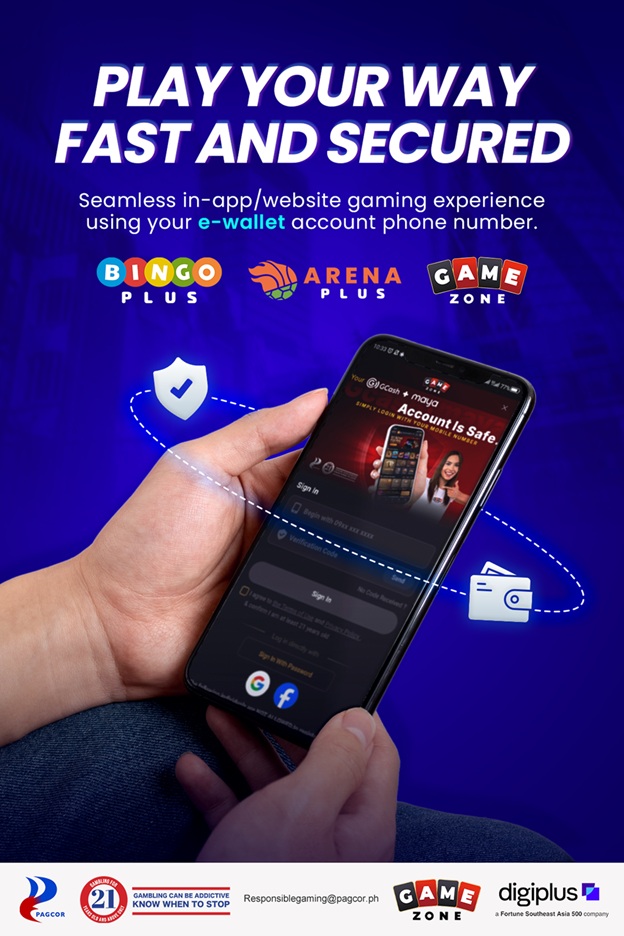

This is where platforms like GameZone enter the conversation.

Rather than focusing on installation, GameZone focuses on experience. It offers Tongits in a regulated, competitive environment where players face real opponents under transparent systems.

There are no altered files, no hidden mechanics, and no ambiguity about how outcomes are determined.

Here, Tongits feels deliberate again. Every move carries weight. Every decision reflects skill and timing rather than artificial boosts. The tension comes from competition, not from uncertainty about the system.

Security is embedded into the platform itself. Transactions follow regulatory standards. Responsible gaming tools are in place to help players stay in control.

Instead of worrying about device safety or unstable downloads, players can focus entirely on the game.

For those who see Tongits as more than a casual diversion, this approach restores its identity. It honors the discipline and judgment the game demands while embracing the advantages of digital play.

Sometimes, the most thoughtful alternative to a Pinoy Tongits app download is choosing a platform that removes risk before play even begins.

What Your Pinoy Tongits App Download Ultimately Reveals

How a player approaches Tongits often reveals how they approach decisions in general. The game rewards patience, observation, and restraint. It quietly discourages shortcuts.

The same values apply to how Tongits is played today. Whether through official apps or structured platforms like GameZone, the best experiences come from choices grounded in trust and intention.

In a digital landscape filled with promises of speed and abundance, Tongits remains stubbornly traditional. It asks players to slow down, to think, and to choose carefully.

That may be why it has endured.

FAQ

Q: What is Tongits?

A: Tongits is a Filipino rummy-style card game focused on meld formation, discard management, and strategic timing.

Q: Do Tongits apps change how the game is played?

A: Most apps follow the same core rules, with differences mainly in rewards, matchmaking, and progression.

Q: What is an APK file?

A: An APK is an Android app installation file used outside official app stores.

Q: Why are APK files discouraged?

A: They carry risks such as malware exposure, excessive permissions, unstable gameplay, and account bans.

Q: What is GameZone?

A: GameZone is a regulated online platform offering Tongits matches against real players.

Q: How can I start playing on GameZone?

A: Players can register directly on the platform and complete standard verification steps.