The cryptocurrency space is buzzing with innovation and potential, and if you’re trying to get ahead of the curve, you’ve got to know which projects are going to lead the charge in the coming years. If you’ve been paying attention to blockchain trends, you’ve probably already heard of some exciting projects that are making waves. Qubetics, SEI, and Polkadot are three of the best cryptos to watch in 2025, each offering unique features and groundbreaking advancements that could change the future of digital finance.

Many blockchain projects focus on speed, scalability, or security, but Qubetics, SEI, and Polkadot go further, tackling key adoption challenges. Qubetics’ Non-Custodial Multi-Chain Wallet, backed by partnerships with SWFT Blockchain and 1inch, is set to lead in 2025. SEI’s push for decentralized applications and Polkadot’s cross-chain interoperability further strengthen their positions. Here’s why these three are among the top cryptos to watch in 2025.

Qubetics: The Non-Custodial Multi-Chain Wallet Revolutionizing DeFi

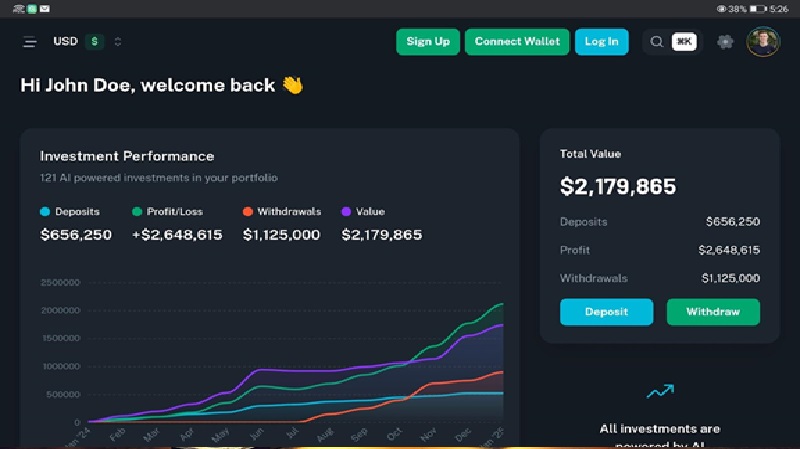

Qubetics has been quietly building a foundation that’s set to disrupt the blockchain space. This isn’t just another cryptocurrency project; it’s an ecosystem. At the heart of Qubetics’ offering is its Non-Custodial Multi-Chain Wallet. With the latest technological advancements, Qubetics has made managing assets across multiple blockchains easier than ever.

Unlike many other wallets that are locked into one chain, the Qubetics wallet allows seamless transactions across Ethereum, Binance Smart Chain, Solana, and other major blockchain networks. This cross-chain compatibility isn’t just a nice-to-have feature; it’s a game-changer for both individuals and businesses looking to interact with the blockchain without restrictions.

Qubetics Presale Update

- Currently in its 24th crypto presale stage, raising over $14.7 million.

- 497 million tokens sold to 22,500+ holders.

- Strong partnerships, including with DeFi aggregator 1inch.

Integration with 1inch provides access to DEXs for optimized pricing, liquidity, and trading. Positioned as a top crypto for long-term growth.

Additionally, Qubetics’ wallet solution comes with top-notch security protocols, ensuring that users’ assets are safe while enjoying lightning-fast transactions. This combination of convenience, security, and multi-chain support makes Qubetics a standout contender among the best cryptos to watch in 2025.

SEI: Building a Stronghold for Decentralized Applications (dApps)

Another exciting project in the blockchain space is SEI—a network designed specifically to meet the needs of decentralized applications (dApps). What sets SEI apart is its focus on building a platform that provides both high-speed transaction processing and developer-friendly tools. SEI’s architecture is optimized to support high-performance dApps, offering low-latency and high throughput, making it an ideal choice for developers and enterprises looking to build decentralized solutions at scale.

For anyone who’s considering the best cryptos to watch in 2025, SEI is definitely one to keep an eye on. With its developer-first approach, cutting-edge scalability, and commitment to DeFi innovation, SEI is positioning itself as a strong player in the next wave of decentralized applications. If you’re looking for a blockchain that can handle complex applications without sacrificing performance, SEI is one project that should be at the top of your radar.

Polkadot: The Blockchain Interoperability Pioneer

Polkadot has been one of the most talked-about projects in the blockchain space, and for good reason. At its core, Polkadot’s focus is on interoperability, aiming to connect different blockchains to work together seamlessly. Polkadot allows for cross-chain communication, meaning that data and assets can flow between different blockchains without the need for a centralized intermediary. This feature is crucial for the future of blockchain adoption, as it eliminates silos and enables the broader blockchain ecosystem to function more cohesively.

As one of the best cryptos to watch in 2025, Polkadot is not only enabling the next generation of blockchain interoperability but also pushing forward the idea of a more interconnected digital ecosystem. With the potential to connect a multitude of blockchains, Polkadot is paving the way for the future of decentralized applications and services.

Conclusion: Which is the Best Cryptos to Watch in 2025?

As we look toward 2025, it’s clear that the blockchain space is evolving at a rapid pace. Whether it’s Qubetics’ cross-chain wallet, SEI’s high-speed decentralized applications, or Polkadot’s interoperability, these three projects are pushing the boundaries of what blockchain can do. For anyone looking for the best cryptos to watch, these projects are not just worth keeping an eye on—they’re worth getting involved in.

Qubetics, in particular, offers an innovative solution for managing a diverse portfolio of assets across multiple blockchains. With its recent partnership with 1inch and SWFT Blockchain, Qubetics is positioned to lead the way in decentralized finance. If you’re looking to get ahead of the curve, this is one project that’s definitely on the radar for 2025.

It’s time to look beyond the noise and focus on projects that solve real-world problems and deliver tangible value. Whether you’re a developer, a business, or just a blockchain enthusiast, these three projects have the potential to shape the future of digital finance.

For More Information:

Qubetics: https://qubetics.com

Telegram: https://t.me/qubetics

Twitter: https://x.com/qubetics

FAQs

Why is Qubetics one of the best cryptos to watch in 2025?

Qubetics offers a multi-chain wallet with cross-chain functionality, making it easier than ever to manage multiple digital assets seamlessly and securely.

What makes SEI stand out in the blockchain space?

SEI focuses on high-speed transaction processing and scalable decentralized applications, making it a strong choice for developers and DeFi platforms.

How does Polkadot enable blockchain interoperability?

Polkadot connects multiple blockchains via its parachains, allowing them to communicate and share data seamlessly.

What makes Qubetics’ partnership with 1inch important?

The integration with 1inch allows Qubetics users to access optimized trading and liquidity across multiple decentralized exchanges, enhancing their DeFi experience.

Why are Qubetics, SEI, and Polkadot the best cryptos to watch in 2025?

These projects are innovating in critical areas like interoperability, decentralized finance, and scalability, positioning them for long-term success.

ALT TEXT

- Best cryptos to watch in 2025

- Qubetics presale

- Polkadot interoperability

- SEI blockchain

- Decentralized finance

- Multi-chain wallet

- Cross-chain functionality

- 1inch integration

- High-speed blockchain

- Blockchain scalability