U.S. President Donald Trump has signed into law a one-year extension of the African Growth and Opportunity Act (AGOA), temporarily preserving one of the most consequential trade arrangements between the United States and Sub-Saharan Africa.

This comes amid Washington’s signal that the programme will be reshaped to fit a tougher, America First trade framework.

The extension runs through December 31 and takes effect retroactively from September 30, 2025, when AGOA had lapsed, a gap that left exporters, investors, and governments across Africa in a state of limbo. The law’s expiration had threatened hundreds of thousands of jobs tied to duty-free exports to the U.S., particularly in apparel, agriculture, automotive components, and light manufacturing.

U.S. Trade Representative Jamieson Greer said the administration would work with Congress this year to update AGOA in a way that expands market access for U.S. businesses, farmers, and ranchers, while aligning the programme more closely with Trump’s trade priorities. That framing suggests the extension is less a renewal of the status quo and more a holding pattern as Washington rethinks how Africa fits into its broader trade and geopolitical strategy.

AGOA, first enacted in 2000, grants eligible Sub-Saharan African countries duty-free access to the U.S. market for more than 1,800 products, on top of existing preferences under the Generalized System of Preferences. For many African economies, it has served as a gateway into global value chains, especially in textiles and apparel, where countries such as Kenya, Ethiopia, and Lesotho built export industries anchored on preferential access to the U.S. market.

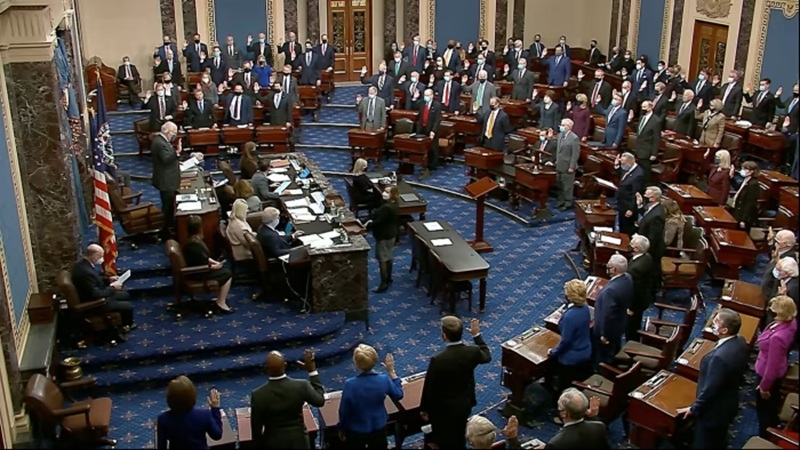

The political path to the extension underscored divisions within Washington over how far and how long the programme should run. While the House of Representatives initially passed a bill extending AGOA for three years, the Senate pared that back to a single year. The House later accepted the shorter timeline, paving the way for Trump’s signature but also leaving African partners with limited long-term certainty.

That uncertainty comes at a moment when relations between the United States and South Africa, Africa’s largest economy and a major AGOA beneficiary, have been strained. Trump last year boycotted a Group of 20 meeting hosted by South Africa during its rotating presidency and later said Pretoria would not be invited to G20 meetings hosted by the U.S., which assumed the presidency in December. The tensions have raised questions about how political considerations could influence trade preferences going forward.

South Africa’s Trade Minister Parks Tau welcomed the extension, saying it would provide certainty and predictability for African and American businesses that rely on the programme. For exporters already grappling with weak global demand, currency volatility, and rising logistics costs, even a short-term reprieve reduces the immediate risk of cancelled orders and factory closures.

Still, trade experts note that a one-year extension limits the programme’s ability to attract new investment. AGOA’s original strength lay in its longer time horizons, which allowed companies to commit capital to factories, supply chains, and skills development. With the clock now reset for just 12 months, investors may adopt a wait-and-see posture until Washington clarifies whether AGOA will be overhauled, extended again, or replaced by bilateral or regional trade arrangements.

The Office of the U.S. Trade Representative said it would work with relevant agencies to implement changes to the Harmonized Tariff Schedule resulting from the reauthorization. Eligibility conditions remain stringent. Countries must demonstrate progress toward a market-based economy, the rule of law, political pluralism, and due process. They are also required to remove barriers to U.S. trade and investment, pursue poverty-reduction policies, tackle corruption, and uphold human rights.

Those conditions have long made AGOA both an economic and political instrument. Over the years, several countries have been suspended or reinstated based on Washington’s assessment of governance and policy reforms. With the Trump administration openly tying trade policy more closely to U.S. domestic interests, analysts expect eligibility reviews to become more pointed, particularly where access to African markets for U.S. goods and services is concerned.

For Africa, the extension offers breathing space but little clarity. Many governments are already recalibrating their trade strategies around the African Continental Free Trade Area, aiming to deepen intra-African commerce and reduce reliance on external preferences that can shift with political winds. At the same time, AGOA remains one of the few channels through which African manufacturers can compete in the U.S. market on preferential terms.