Magacoin Finance has now crossed the $16.5 million mark in its presale, while Blazpay’s AI-based DeFi rollout is about 75% complete. Yet, market focus is shifting rapidly. Projects once seen as experimental are becoming new presale leaders. With attention moving fast, one question stands out: Are you ready before the next big wave hits? The FOMO countdown has started, and many are keeping a close eye on what unfolds next.

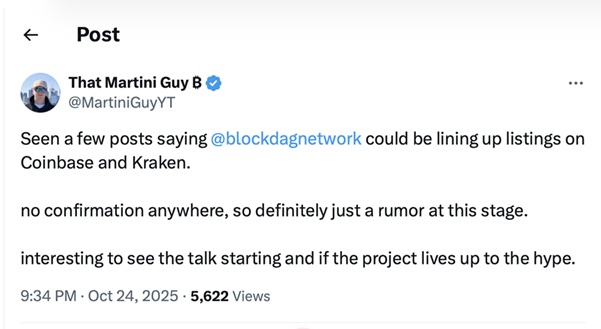

That Martini Guy recently hinted at what could define 2025, the rumored Coinbase and Kraken listings for BlockDAG (BDAG). Internal sources indicate this might not be just talk but a structured plan with liquidity setup, marketing funds, and complete KYC documentation. If validated, this could push BlockDAG ahead as the best presale crypto in 2025.

Leak Sparks Speculation Around BlockDAG’s Exchange Launch

That Martini Guy’s leak about BlockDAG’s potential listings on Coinbase and Kraken has set the market buzzing. What started as a rumor now appears credible, as documents point to pre-launch agreements with both exchanges. The Kraken deal reportedly involves $300,000 for liquidity and another $300,000 for marketing, while Coinbase’s memorandum includes BDAG/USDT and BDAG/USD trading pairs, along with a possible spot in Coinbase Earn. These developments, paired with KYC verification and dual audits, make BlockDAG stand out as one of the best presale crypto projects of 2025 with strong institutional preparation.

Beyond these listing talks, BlockDAG’s performance speaks volumes. The presale has raised over $433 million, selling more than 27.2 billion coins across 31 batches. Over 312,000 holders have joined ahead of its mainnet launch, which is priced at $0.05. The TGE phase still lets users obtain BDAG at $0.0015, suggesting a strong potential upside.

Its verified audits by CertiK and Halborn reinforce transparency at a stage where few projects can claim such validation. If Coinbase and Kraken listings are confirmed, BDAG would move from presale success to full Tier-1 liquidity, making it a leading contender for the best presale crypto in 2025 before official trading begins.

Magacoin Finance Reaches $16.5M Milestone in Its Presale Journey

Magacoin Finance has gained traction with a presale that recently crossed $16.5 million, making it one of the most discussed community projects this quarter. Running on Ethereum and audited by CertiK and HashEx, it promotes transparency, limited supply, and verified security, features not often seen in meme-based coins.

Its early presale price stayed below $0.01, supported by a 50% PATRIOT50X bonus for first-round buyers. With over 16,000 backers already on board and rising global attention, Magacoin Finance is emerging as a strong name among the best presale crypto in 2025.

Aside from presale excitement, the team has confirmed full KYC checks and third-party audits, adding more reliability to its profile. Analysts predict growth ranging from 30× to 100× after listings, linking this to the project’s liquidity structure and long-term market strategy. With exchange listings expected soon and the presale nearing its final phase, Magacoin Finance stands at a turning point that could decide if its strong start leads to lasting success among the best presale crypto in 2025.

Blazpay’s AI DeFi Project Closes in on 75% Completion

Blazpay is drawing attention by combining artificial intelligence with decentralized finance to simplify crypto payments and trading across chains. The presale began in October 2025 at $0.006 and entered Phase 2 at $0.0075, now nearing 75% completion.

The project has already gathered about $800,000 and formed partnerships with Pilot AI for conversational wallet support and ArtGIS Finance for real-world asset connectivity. Its upcoming ecosystem will feature multi-chain wallets, automated trading, and smart liquidity routing, placing it among the best presale crypto in 2025 for its AI-led model.

Blazpay’s appeal also comes from its transparent roadmap and CertiK-verified contracts. The team has shared plans for a Token Generation Event in early 2026, with prices expected to rise in future stages. By focusing on low entry costs, easy access, and interoperability with Ethereum and Solana, Blazpay is reaching those who want greater flexibility and automation in DeFi. Though still developing, its AI-driven framework and detailed presale data make it a notable contender among the best presale crypto in 2025.

The Best Presale Crypto in 2025

Magacoin Finance and Blazpay are both shaping discussions around 2025’s most promising presales. Magacoin’s $16.5 million achievement and double audit show that meme projects can still maintain structure, while Blazpay’s AI-powered DeFi model adds technology depth to the list. Each has drawn attention for its unique approach and early engagement, securing spots among the best presale crypto in 2025.

However, BlockDAG currently leads the conversation. Talks around its potential Coinbase and Kraken listings, combined with a presale that has raised over $433 million and sold more than 27.2 billion coins, set it apart from other contenders. If those exchange integrations are confirmed, BlockDAG could move from presale growth to major exchange visibility, placing it firmly among the best presale cryptos expected to make waves in 2025.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu