Crypto markets are flashing mixed signals this week. Binance Coin price today has pushed higher from $787 to roughly $911, breaking out of a bearish formation and reclaiming key technical zones ahead of the upcoming Fermi hard fork. This upgrade is expected to cut block confirmation time to 0.45 seconds, improving overall BSC network performance.

At the same time, Zcash news highlights a 9% surge as whale wallets reduce selling pressure and leveraged long positions increase in anticipation of a breakout above $408. Both assets are reacting to trading activity and short-term catalysts, yet BlockDAG follows a very different path.

Instead of chasing momentum, BlockDAG is building a structural advantage. With BDAG priced at $0.001 in Batch 35 and a confirmed $0.05 launch price, adoption continues expanding across more than 3.5 million X1 mobile users and over 312,000 holders. Unlike BNB and ZEC, BlockDAG combines real infrastructure readiness with fixed-entry math, positioning it as the next crypto to explode.

Binance Coin Price Advances Ahead of Network Upgrade

Binance Coin price today has delivered steady upward movement, climbing from $787 in late November to near $911. This breakout pushed BNB above its 50-day moving average and flipped technical indicators bullish, signaling renewed market confidence.

Binance Smart Chain is scheduled to activate the Fermi hard fork on January 14, reducing block times from 0.75 seconds to 0.45 seconds. The upgrade is designed to boost transaction throughput and network stability, helping BSC remain competitive against chains like Ethereum and Solana.

Additional interest is coming from speculation surrounding a potential Grayscale BNB ETF application and an upcoming 1.3 million token burn. Both developments could tighten the circulating supply and strengthen price action.

Binance Coin price today continues reflecting growing optimism, with traders increasingly eyeing a possible push toward the $1,000 level as network improvements roll out.

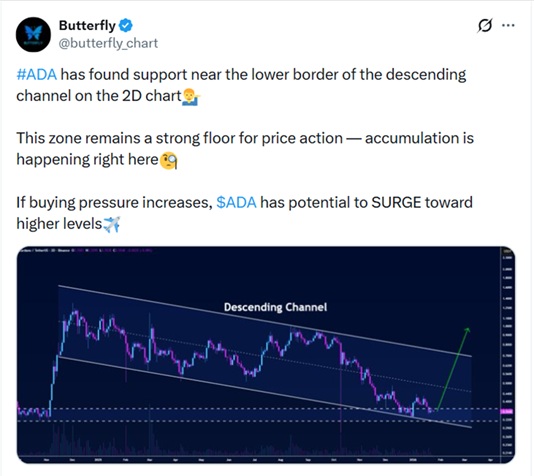

Zcash News: ZEC Climbs 9% as Whale Activity and Long Positions Increase

Zcash has recorded strong buying pressure, sending ZEC higher by approximately 9%. Large wallet holders have moved significant balances off exchanges, easing sell-side pressure, while leveraged traders have added long positions, signaling rising confidence in continued upside.

Price remains compressed within a multi-month triangle pattern, supported near $371 and capped around $408. This tightening structure often signals an upcoming breakout as volatility builds and positioning intensifies.

Open Interest across derivatives markets has also increased, confirming that more traders are preparing for larger moves. Top trader positioning currently leans bullish, with roughly 61% of accounts holding long exposure.

Zcash news continues pointing toward favorable conditions. With whale accumulation, improving technical structure, and growing speculative interest, ZEC may extend gains if volume and participation remain strong.

From $0.001 to $1: Why BlockDAG Could Become the Next 50× Crypto Story!

BlockDAG is now entering the final stretch of its presale, and the numbers continue to stand out. BDAG is currently available at $0.001 in Batch 35 for a limited time window. Once public trading officially begins on February 16 at the confirmed $0.05 launch price, early participants automatically secure a built-in 50× price difference based purely on a fixed pricing structure.

Opportunities that offer predefined upside like this are extremely rare, especially for a Layer-1 network that is already operational before exchange listings and public market exposure.

What truly separates BlockDAG from short-term hype cycles is its expanding real-world adoption. More than 3.5 million users actively mine through the X1 mobile platform, while over 312,000 holders already participate across the growing ecosystem.

Mining hardware sales have officially closed, reducing new supply inflows, while token availability continues to tighten. With only 2.43 billion coins remaining in the presale allocation, scarcity is becoming an increasingly important factor. Analysts view the $1 milestone as achievable not through speculation, but through accelerating network usage, developer onboarding, and user activity growth.

This is simple math rather than marketing narratives. The move from $0.001 to $0.05 is locked in by launch pricing mechanics. Beyond that level, sustained adoption could push BDAG toward a full Layer-1 breakout cycle. With the presale ending on January 26, the countdown is active. Once this window closes, fixed early access disappears permanently.

Final Thoughts

Across all three assets, Binance Coin price today and Zcash movements reflect trading-driven momentum supported by upgrades and accumulation trends. Both show technical strength, but neither offers the early-stage positioning advantage that BlockDAG provides.

BDAG’s $0.001 presale entry, combined with a confirmed $0.05 listing, establishes a built-in 50× baseline. The network is already operational, smart contracts are live on testnet, and millions of users remain active before public trading even begins. Analysts see the $1 milestone as achievable through continued ecosystem growth and expanding real-world usage.

For investors searching for the next crypto to explode, BlockDAG stands in a category of its own. With January 26 approaching fast, this window defines urgency, offering rare early exposure before the market takes full control of pricing and demand.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu