Crypto traders realize that bull markets create exceptional opportunities—however, how capital is located could make all of the difference between precise returns and life-changing ones. Bitcoin stays the most relied on and dominant asset within the market, able to deliver consistent and dependable profits as institutional demand grows.

But even as BTC can double in value all through a robust cycle, early-stage projects often supply the most important multipliers. That’s why many investors and whales are looking to allocate a slice of their Bitcoin profits into Ozak AI, a rising AI-pushed project with 100x ability.

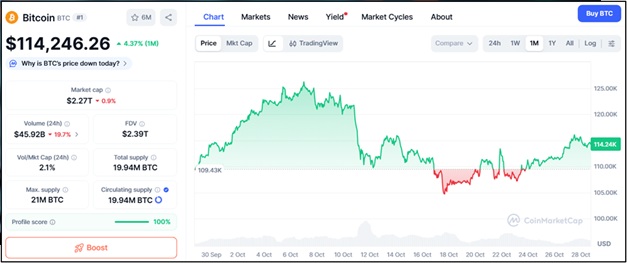

Bitcoin (BTC)

Bitcoin is presently trading around $114,246 and displaying robust bullish momentum. Key resistance levels sit down at $120,000, $132,500, and $150,000, even as solid support holds at $107,000, $101,800, and $96,000.

This price structure reflects a healthy and growing market, fueled by way of institutional inflows, ETF demand, and increasing macro confidence in BTC as a store of price. Many analysts trust Bitcoin ought to realistically double in the next bull leg, probably accomplishing or surpassing the $125K–$150K variety. For buyers searching for stability and dependable returns, Bitcoin remains a cornerstone asset.

Why Investors Look Beyond Bitcoin for Bigger Gains

While Bitcoin is powerful, it’s rarely the top-performing asset during a bull run. Historically, once BTC rallies, profits often rotate into altcoins with higher upside. This happened with Ethereum, Solana, and even Shiba Inu in previous cycles.

Investors who positioned early in such assets saw returns many multiples higher than those who stayed solely in BTC. That’s why smart money is now scanning for early-stage projects with explosive potential—and Ozak AI is increasingly at the center of that conversation.

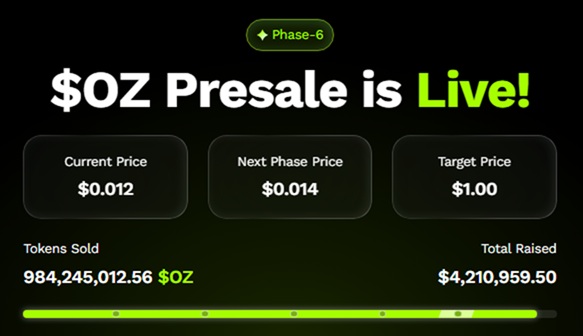

Ozak AI’s Presale Creates Rare Early Presale Entry

Ozak AI is currently in its 6th OZ presale stage at $0.012, having already raised over $4.2 million and sold more than 980 million tokens. What’s driving this momentum isn’t just hype but a powerful AI + crypto narrative with real utility.

Ozak AI’s AI-powered prediction agents are designed to deliver real-time trading signals, intelligent market insights, and automated strategies, giving traders a competitive edge. Early-stage pricing means that even modest allocations can turn into massive upside if the project performs as expected.

Ozak AI’s growing credibility is backed by its partnerships with Perceptron Network, HIVE, and SINT. These alliances enhance its predictive infrastructure, expand data processing power, and ensure deeper integration into blockchain ecosystems. This isn’t just a speculative token—it’s a project with a technological foundation and a clear growth vision that appeals to both retail investors and whales.

$10K in BTC vs. $10K in Ozak AI

A $10,000 investment in Bitcoin could reasonably double to $20,000 if BTC reaches the upper end of its next target range. That’s a solid return for a blue-chip crypto. But the same $10,000 allocated to Ozak AI at its early presale price carries the potential to 100x, turning it into $1 million if the project performs as forecasted. This asymmetric risk-reward profile is why whales are quietly rotating a portion of their BTC gains into early-stage altcoins like Ozak AI.

As the 2025 bull run approaches, the smartest investors aren’t abandoning Bitcoin—they’re leveraging it as a base while positioning themselves into high-upside projects. Ozak AI is fast becoming one of the most promising plays in that category, offering both narrative strength and technological substance to back its explosive growth potential.

About Ozak AI

Ozak AI is a blockchain-based crypto project that offers a technology platform that specializes in predictive AI and advanced facts analytics for financial markets. Through machine learning algorithms and decentralized community technology, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the precise decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi