ZCash price prediction appears bleak, with the coin down nearly 18% this quarter. Polygon has managed a modest 7% gain supported by increased on-chain payment activity, yet both assets show signs of weakening momentum.

ZCash lacks near-term catalysts to reinvigorate growth, while Polygon’s staking rewards remain flat and fail to encourage wider participation. These limitations highlight the challenges traditional altcoins face in sustaining buyer interest.

Offering a more tangible model is BlockDAG (BDAG), combining presale rewards with immediate user incentives. Over $425 million has been raised, more than 27 billion coins sold, and ROI has reached 2940% from Batch 1 to Batch 31. The TGE code further enhances early engagement ahead of Genesis Day on November 26.

POL Faces Adoption Gains: Reward Structures Remain Flat

Polygon’s price surge has shown resilience against market volatility, benefiting from higher transaction throughput and increased usage in gaming and enterprise payments. This 7% surge highlights the network’s growing adoption and strengthens its presence in key sectors. Strong partnerships and ongoing scalability updates indicate that Polygon is focusing on long-term utility.

Despite these developments, staking rewards have remained flat, and no new incentive mechanisms have been introduced. The static reward system may limit broader participation and reduce the appeal for long-term holders. Without changes, upside potential could remain constrained even as payment volumes grow.

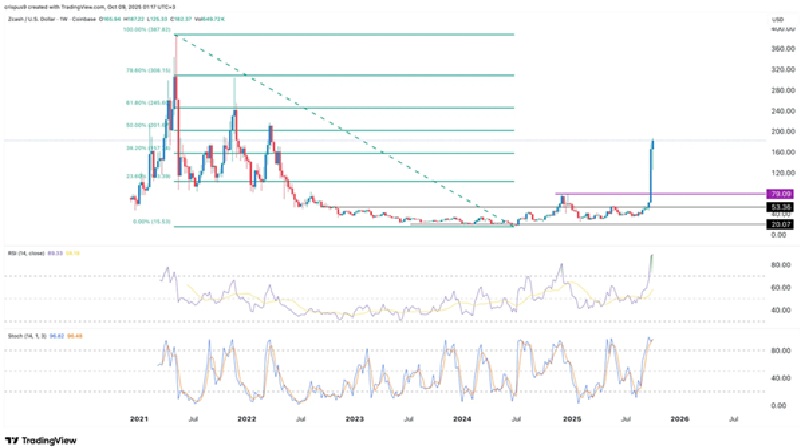

ZCash Confronts Weak Momentum Amidst Market Pressure

ZCash has seen its recent price action reflect declining buyer confidence. Once valued for privacy and anonymity, it now faces challenges in maintaining relevance as regulatory scrutiny and competition increase. Speculative momentum has become the primary driver, leaving the coin vulnerable to further declines.

Overall, ZCash’s technology remains strong, but the lack of new utility or exchange developments has slowed growth. Decreasing liquidity on major platforms adds pressure on holders. Without structural catalysts or enhanced rewards, ZCash risks testing lower price levels, potentially falling below $20 if the current trend continues.

BlockDAG Combines Measurable Rewards with Real-World Momentum

While ZCash and Polygon face challenges from stagnant incentives and buyer uncertainty, BlockDAG has structured its presale around clear, reward-driven fundamentals. The Leaderboard TGE system ranks participants by total purchase volume between October 7 and November 26, determining the timing of their coin airdrops at launch. Higher ranks result in faster payouts, merging transparency with tangible benefits and encouraging active participation throughout the presale period.

The presale numbers demonstrate this traction. Over $425 million has been raised with more than 27 billion BDAG coins sold. Since Batch 1, the project has delivered a 2940% ROI, signaling unprecedented engagement. Batch 31 currently trades at $0.0304 per coin, while a limited-time opportunity to secure BDAG at $0.0015 has fueled rapid adoption. Over 3 million mobile miners are already contributing to network activity, and real hardware is deployed to support ongoing operations, giving the ecosystem a sense of measurable progress.

BlockDAG’s global presence is reinforced by its Formula 1® partnership with BWT Alpine, which spans events in Singapore and Austin. This collaboration brings visibility and legitimacy rarely seen in presale projects, helping the network reach audiences far beyond typical crypto communities.

In addition, Keynote 4, “The Launch Note,” outlines the roadmap to Genesis Day, ensuring participants can track the journey from presale to live operations. By combining structured incentives, tangible milestones, and real-world partnerships, BlockDAG contrasts sharply with speculative projects like ZCash and incremental updates like Polygon, presenting a presale built on verifiable engagement and practical utility.

Quick Breakdown

The contrast between ZCash, Polygon, and BlockDAG highlights a shift in buyer priorities, emphasizing tangible functionality over speculative forecasts. ZCash’s technical challenges and Polygon’s flat incentive model illustrate projects that have slowed despite solid foundations. BlockDAG has taken a different path by pairing presale performance with measurable rewards, building both community engagement and buyer confidence.

With over $425 million raised, more than 27 billion coins sold, and the TGE code reshaping early participation, BlockDAG sets a new standard for presale credibility. As Genesis Day nears, the focus is on systems that deliver transparency, real traction, and structured benefits rather than mere price speculation.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu