Robinhood announced the listing of three new cryptocurrencies on its U.S. platform on October 16, 2025: Aster (ASTER), Plasma (XPL), and Virtuals Protocol (VIRTUAL).

This expansion aims to diversify Robinhood’s crypto offerings amid growing retail demand for DeFi, Layer 1 blockchains, and AI-integrated tokens.

ASTER; Native token of a Binance-backed decentralized exchange (DEX) on BNB Chain, specializing in perpetual futures trading with high-leverage options. Endorsed by Binance co-founder CZ.

Recently hit a $3.9B market cap peak; now trading around $1.25 down ~10% in the last 24 hours post-listing due to market volatility.

Plasma XPL; Token for a Bitcoin-secured, EVM-compatible Layer 1 blockchain focused on stablecoins and real-world assets (RWAs), backed by Tether. Enables on-chain settlement of US Treasuries and yield distribution.

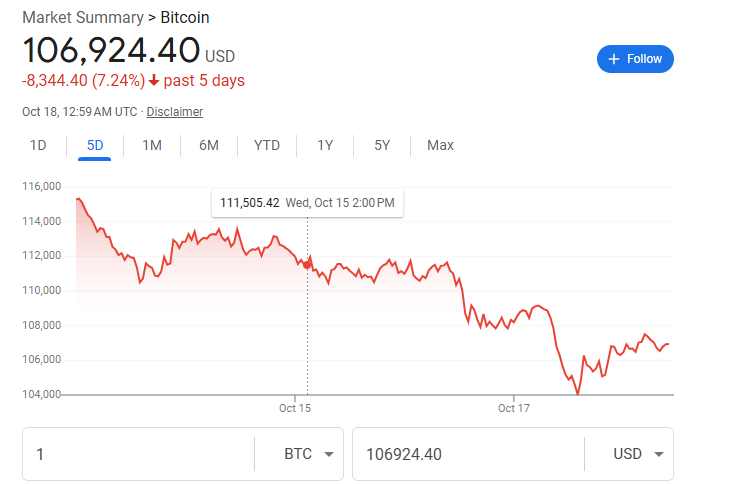

Attracted $6B in TVL shortly after September launch; briefly surged above $0.50 post-listing but retraced to ~$0.44 amid Bitcoin dipping below $110K.

Virtuals Protocol VIRTUAL; Native token powering an AI-agent infrastructure network, allowing deployment of autonomous digital agents for smart contracts, DeFi management, and tokenized economies.

Part of the rising AI-DeFi trend; saw initial post-listing buzz but faced broader market pullback. The listings sparked brief price jumps like ASTER up 5% and XPL up 7% initially, but volatility dragged gains back as the broader crypto market cooled.

These additions position Robinhood to compete more aggressively with platforms like Coinbase, especially for sophisticated traders interested in emerging ecosystems.

Listing on Robinhood, a platform with millions of retail users, introduces these tokens to a mainstream audience, potentially driving adoption and trading volume.

Robinhood’s user-friendly interface and zero-commission trading make it easier for new investors to access these emerging tokens, especially for those less familiar with decentralized exchanges.

Increased retail participation could enhance liquidity for ASTER, XPL, and VIRTUAL, stabilizing price volatility over time. The listings triggered initial price surges but subsequent pullbacks reflect profit-taking and broader market corrections as Bitcoin dipped below $110K.

Retail-driven platforms like Robinhood often amplify speculative trading, which could lead to price swings, especially for newer tokens like XPL and VIRTUAL.

If these projects deliver on their fundamentals like Aster’s DEX capabilities, Plasma’s RWA focus, Virtual’s AI-agent infrastructure, listings could support sustained price growth.

By adding innovative tokens tied to DeFi, Layer 1 blockchains, and AI, Robinhood strengthens its position against competitors like Coinbase and Kraken, appealing to traders seeking exposure to trending sectors.

The inclusion of ASTER (DeFi), XPL (stablecoin/RWA), and VIRTUAL (AI) aligns with growing retail interest in diverse crypto use cases, potentially increasing platform engagement.

Expanding crypto offerings may attract further regulatory attention, especially as U.S. authorities tighten oversight of retail crypto platforms.

Aster (ASTER) backed by Binance and CZ, the listing validates Aster’s role in the DeFi space, potentially accelerating adoption of its high-leverage perpetual futures trading platform.

Plasma (XPL) as a Tether-backed Layer 1 focused on tokenized real-world assets, the listing could draw institutional and retail interest in stablecoin and RWA markets, boosting its $6B TVL.

Virtuals Protocol (VIRTUAL) exposure on Robinhood could catalyze interest in AI-driven DeFi applications, positioning VIRTUAL as a leader in the emerging AI-agent economy.

The listings reflect growing retail appetite for DeFi (Aster, Virtual) and AI-integrated blockchain solutions (Virtual), signaling a shift toward more sophisticated crypto use cases.

Plasma’s inclusion highlights the rising prominence of tokenized real-world assets and stablecoin ecosystems, potentially bridging traditional finance and crypto.

Newer tokens like XPL and VIRTUAL are prone to sharp price swings, especially with speculative retail trading on Robinhood. U.S. regulations could impact token availability or trading conditions, particularly for projects tied to stablecoins (XPL) or DeFi (ASTER, VIRTUAL).

Robinhood’s listing of ASTER, XPL, and VIRTUAL enhances retail access to innovative crypto projects, potentially driving adoption and liquidity while positioning Robinhood as a competitive player in the crypto space.

Jupiter Announces Major Changes for the JUP Token

Jupiter, the leading decentralized exchange (DEX) aggregator on Solana, made headlines earlier in 2025 with transformative updates to its native governance token, JUP.

These changes, unveiled during the platform’s inaugural “Catstanbul 2025” event in January, aimed to enhance token scarcity, sustainability, and long-term value. Jupiter’s pseudonymous founder, “Meow,” revealed plans to burn 3 billion JUP tokens—valued at approximately $3.6 billion at the time.

This symbolic act, marked by the destruction of a large metal cat sculpture, reduces the total supply from 10 billion to around 7 billion tokens, addressing concerns over high fully diluted valuation (FDV) and emissions. The burn was part of a broader tokenomics overhaul, including a voluntary 30% cut to team allocations and emissions.

Starting in late January 2025, Jupiter allocated 50% of its protocol fees to repurchase JUP tokens from the market. These buybacks are locked for long-term holding initially three years, with the remaining 50% reinvested into ecosystem growth, strategy, and operations.

A dedicated dashboard was launched in February for real-time transparency on repurchases and locks. The announcements coincided with other expansions, including the beta launch of “Jupnet” an omnichain network, a $10 million AI fund with Eliza Labs, acquisition of a majority stake in meme coin launchpad Moonshot, and integration of portfolio tracker SonarWatch.

These position Jupiter as a multi-chain liquidity hub amid competition from projects like LayerZero. The immediate impact was a 40% surge in JUP’s price, from $0.90 to $1.27, though it later stabilized around $1.06. By mid-2025, further unlocks (e.g., 53.47 million tokens in July, worth $32 million) introduced some supply pressure, but the reforms have bolstered community confidence.

Analysts view these as bullish signals for JUP’s role in Solana’s DeFi growth, with price predictions for end-2025 averaging $1.03 ranging from $0.44 to $1.40.

Ongoing buybacks/locks to curb inflation. Trimmed by ~30% via burn , +40% spike; +60% YTD from buybacks. These updates reflect Jupiter’s shift toward deflationary mechanics and ecosystem dominance, though risks like token unlocks and governance pauses (e.g., DAO votes halted until 2026 due to trust issues) persist.

Ethereum Ranks as the #1 Ecosystem for New Developers in 2025

Fresh data from Electric Capital, analyzed by the Ethereum Foundation (EF), confirms Ethereum’s enduring appeal to builders. Through September 2025, the ecosystem attracted 16,181 new developers—the highest of any blockchain—bringing its total active contributors to 31,869.

This includes activity across Layer 1 and Layer 2 rollups— Polygon, Optimism, with deduplication to avoid double-counting multi-project devs. Ethereum’s numbers dwarf competitors, with Solana second at 11,534 new devs (17,708 active) and Bitcoin third at 7,494 new (11,036 active).

Ethereum accounts for ~75% of overall blockchain activity from June 2024–June 2025. Mature tooling, EVM compatibility, structured grants via Gitcoin, and Layer 2 scaling keep it attractive. Regional hubs like Singapore boost hiring, and core devs earn a median $140K—though 50-60% below market rates.

Crypto saw 39,148 new devs overall in 2024 down from 2023 peaks, but Ethereum’s monthly influx of ~400+ explorers signals resilience. Emerging chains like Aptos top 10 with ~2,000 new devs and Sui show diversification, but Ethereum’s liquidity and innovation edge prevail.

Despite Solana’s 83% YoY growth stealing some hype, Ethereum’s lead underscores its role as Web3’s innovation engine. Price correlation with Solana (0.96) ties their fortunes, but sustained dev inflows could drive 5–10% adoption gains, per analysts.

As EF notes, this momentum positions Ethereum for breakthroughs in DeFi, NFTs, and AI agents. This dev supremacy bodes well for Ethereum’s scalability and long-term value, even as narratives shift toward faster chains.