Taiwan is seeking to lock in a deeper strategic role in the United States’ artificial intelligence push after clinching a sweeping trade and investment deal that ties tariff relief to massive new commitments by Taiwanese technology companies on U.S. soil.

According to Reuters, Vice Premier Cheng Li-chiun said on Friday that the agreement was framed not just as a trade bargain, but as a long-term partnership aimed at positioning Taiwan as a close AI ally of the United States at a time when Washington is racing to rebuild domestic chip capacity and secure supply chains critical to national security.

“In this negotiation, we promoted two-way Taiwan–U.S. high-tech investment, hoping that in the future we can become close AI strategic partners,” Cheng said at a press conference in Washington, broadcast live.

The deal, announced on Thursday, cuts tariffs on many Taiwanese exports while anchoring fresh investment into U.S. semiconductors, energy, and artificial intelligence. U.S. Commerce Secretary Howard Lutnick said Taiwanese firms would invest $250 billion directly in these sectors, a figure that includes $100 billion already committed by Taiwan Semiconductor Manufacturing Company in 2025, with further investment expected. Taiwan will also provide an additional $250 billion in credit guarantees to support future deals.

For President Donald Trump’s administration, the agreement fits squarely into a broader industrial strategy that has leaned heavily on allies with advanced manufacturing capabilities to re-shore production of chips that power AI systems, data centers, and defense technologies. Only about 10% of global semiconductors are currently produced in the United States, a gap Washington has repeatedly described as both an economic vulnerability and a security risk.

Taiwan, which produces more than half of the world’s semiconductors, sits at the centre of that strategy. Cheng described the agreement as “win-win,” stressing that it was designed to expand supply chains rather than hollow them out.

“We believe this supply-chain cooperation is not ‘move,’ but ‘build,’” she said. “We expand our footprint in the U.S. and support the U.S. in building local supply chains, but even more so, it is an extension and expansion of Taiwan’s technology industry.”

That reassurance is aimed partly at domestic critics. The deal will require ratification by Taiwan’s parliament, where opposition lawmakers have warned that closer alignment with U.S. industrial policy risks weakening Taiwan’s own chip ecosystem by shifting too much production offshore.

Taiwanese officials pushed back on those concerns, arguing that investment decisions are being led by companies responding to customer demand rather than government mandates. Cheng said Taiwanese firms would continue to invest at home even as they scale up abroad. Economy Minister Kung Ming-hsin added that new investments would also cover AI servers and energy infrastructure, though he said it was up to companies to disclose how much of the spending would be directly tied to chipmaking.

Markets appeared to welcome the deal. Taiwan’s benchmark stock index closed at a record high on Friday, buoyed by strong fourth-quarter earnings from TSMC and investor optimism that the tariff cuts would shield exporters from future U.S. trade actions.

Analysts said the agreement sends a clear signal about Taiwan’s standing in Washington. Chang Chien-yi, president of the Taiwan Institute of Economic Research, said the tariff terms underscored that the United States sees Taiwan as a core strategic partner in semiconductors and related technologies. He noted that Taiwan was the first country publicly identified by Washington as receiving preferential treatment for chips.

The geopolitical implications are harder to ignore. China, which claims democratically governed Taiwan as its territory, has long objected to high-level U.S.-Taiwan engagement. While Cheng acknowledged the sensitivities, she framed the deal as an economic necessity rather than a political provocation, rooted in global demand for AI and advanced computing.

TSMC, the linchpin of Taiwan’s chip industry and the world’s leading producer of advanced AI processors, struck a careful tone. In a statement, the company welcomed the prospect of “robust” U.S.-Taiwan trade arrangements but emphasized that its investment decisions were driven by market conditions.

“The market demand for our advanced technology is very strong,” TSMC said. “We continue to invest in Taiwan and expand overseas.”

Still, the scale of the commitments has sharpened debate about how far production could tilt toward the United States. Lutnick said the objective was to bring 40% of Taiwan’s entire chip supply chain and production capacity to the U.S., warning that chips not made domestically could face tariffs as high as 100%.

Kung said he was unsure how that figure was calculated, adding that Taiwan’s own estimates point to a much more modest shift: by 2036, an 80/20 production split between Taiwan and the United States for the most advanced chips.

“This round of deployment will strengthen the resilience of Taiwan–U.S. and global semiconductor supply,” Kung said, adding that some diversification was inevitable as the biggest AI orders increasingly come from the U.S. market.

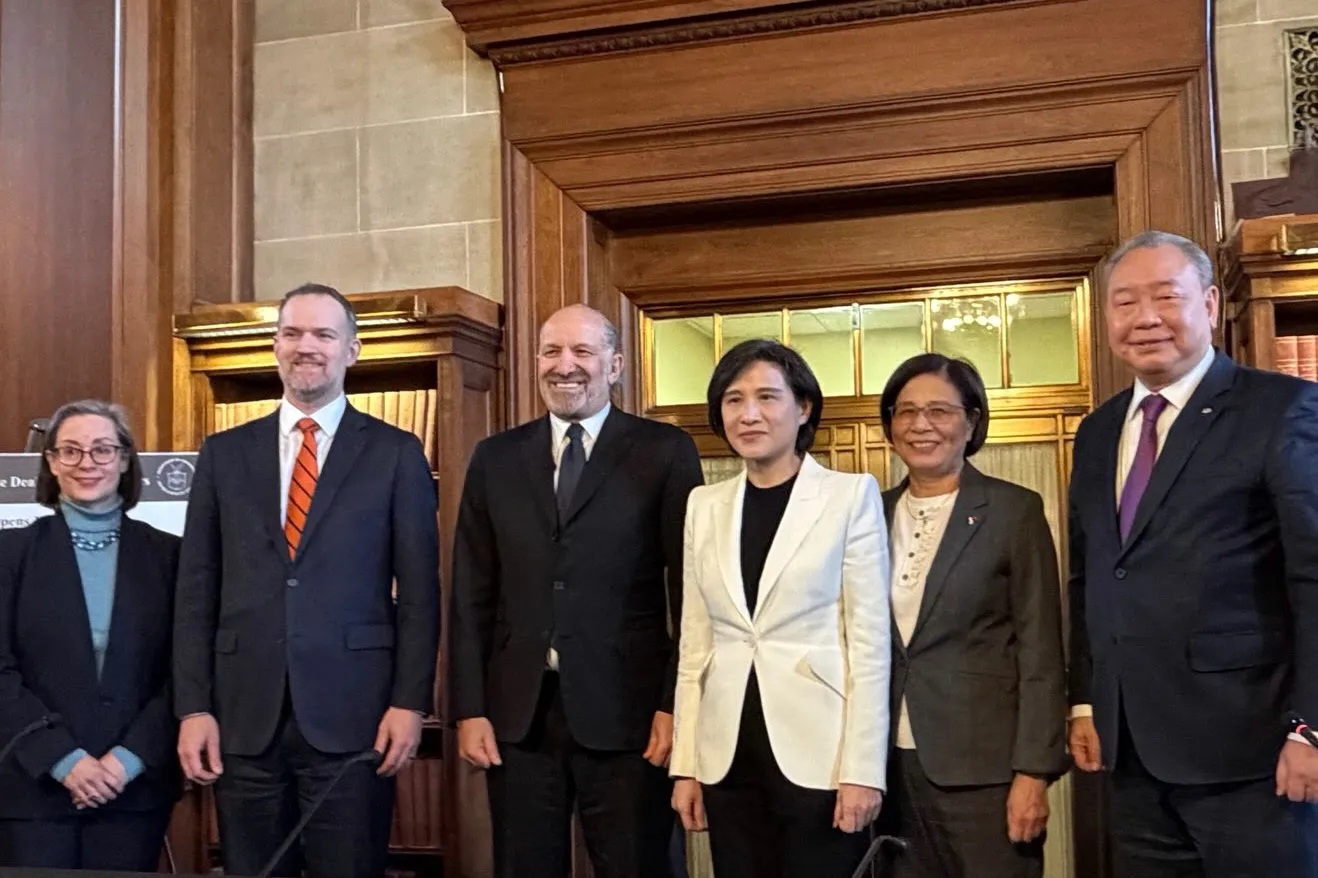

The deal is being billed as a milestone for the Trump administration. Lutnick described it as the largest semiconductor investment in U.S. history, sharing images of himself alongside Cheng, Taiwan’s top trade negotiator, Yang Jen-ni, and U.S. Trade Representative Jamieson Greer.

Taiwan’s Vice President Hsiao Bi-khim echoed that sense of momentum, writing on Facebook that the island had demonstrated its importance on the global trade stage.

“Taiwan may not be large in area, but we are agile and innovative,” she said. “We are an indispensable force for good within the global supply chain.”