Dutch semiconductor equipment company ASML shares climb to fresh record highs following TSMC’s blockbuster earnings, underlining a quiet but powerful truth in the global semiconductor race that no matter how fierce the competition among chip designers and manufacturers becomes, the real bottleneck — and leverage point — sits with the companies that control the tools.

Shares in the Dutch semiconductor equipment maker have risen about 7% since TSMC reported earnings on Thursday, pushing ASML’s market value above the $500 billion mark and making it only the third European company ever to cross that threshold. The stock is now up roughly 25% in 2026, extending a rally that has increasingly been driven less by hype around artificial intelligence and more by hard spending commitments from the world’s biggest chipmakers.

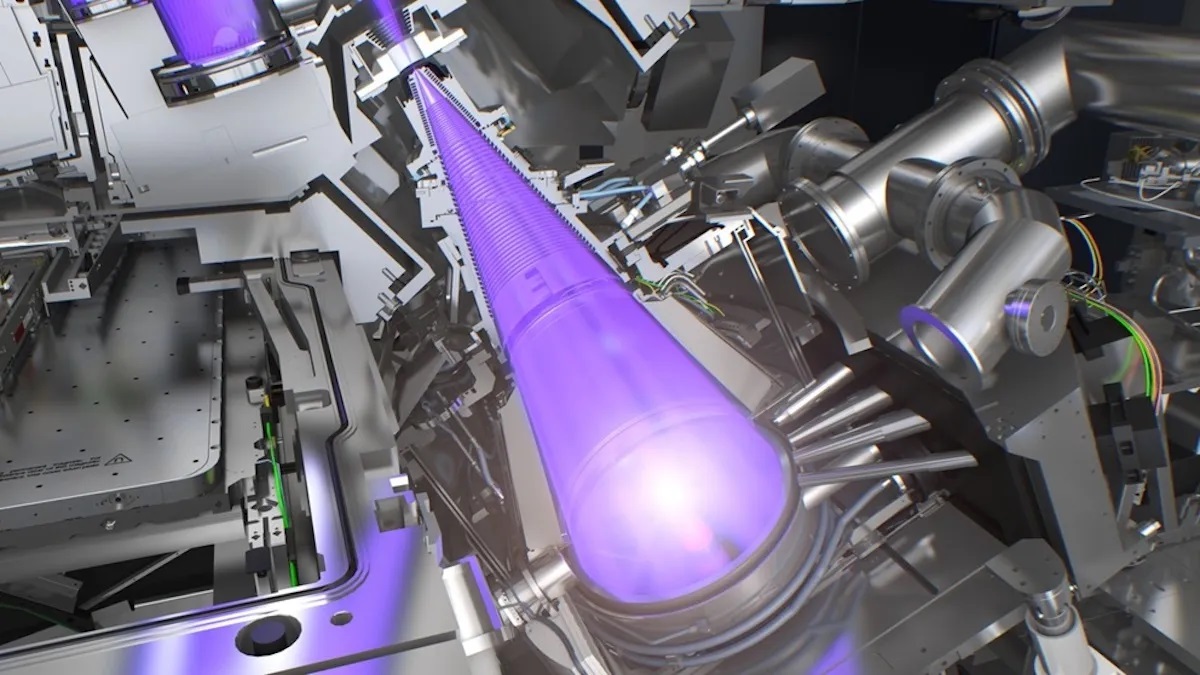

At the center of ASML’s appeal is not growth alone, but scarcity. The company remains the world’s only supplier of extreme ultraviolet lithography machines, the tools required to manufacture the most advanced semiconductors used in AI accelerators, data centers, and high-performance computing. No viable alternative exists at scale, and replicating ASML’s technology would take years, if not decades, even for well-funded rivals.

That monopoly is becoming more consequential as the AI race shifts from experimentation to infrastructure. TSMC’s capital expenditure guidance, which significantly exceeded expectations, sent a clear signal that demand for advanced chips is not peaking. Instead, it is spreading across industries and regions, forcing manufacturers to lock in long-term investment plans. Bank of America said this dynamic underpins near-term upside for ASML, as EUV and other advanced tools become essential for improving yields and energy efficiency at cutting-edge process nodes.

Morgan Stanley took the argument further, saying ASML shares could rise as much as 70% in a bullish scenario. The bank expects higher spending by foundries and memory producers into 2027, combined with better-than-feared demand from China, to drive earnings upgrades. Its base case price target sits at 1,400 euros, but its bull case envisions shares approaching 2,000 euros if tech valuations continue to expand and margins surprise to the upside.

The memory segment is a critical part of that story. AI chips rely heavily on fast, high-density memory, and demand for Dynamic Random Access Memory has surged alongside Nvidia and AMD’s most advanced processors. Counterpoint Research expects memory prices to rise by another 40% to 50% in the first quarter of 2026, adding urgency to capacity expansion plans. JPMorgan said Samsung, the only major DRAM producer with available clean room capacity, is likely to increase orders for equipment most aggressively, with TSMC also expected to place strong orders.

What makes ASML’s position even stronger is that this wave of investment is increasingly being shaped by geopolitics. Governments are no longer passive observers of the semiconductor cycle. The United States, Europe, and key Asian economies are actively steering where chips are made, how supply chains are structured, and which technologies are prioritized. TSMC received another boost this week after Washington said tariffs on Taiwan would be limited to 15%, following commitments by Taiwanese chip and technology firms to invest at least $250 billion in U.S. production capacity.

That policy push aligns neatly with ASML’s business model. Whether new fabs are built in Arizona, Texas, Germany, or Japan, they all require the same high-end lithography systems. For ASML, the location of production matters less than the scale and urgency of it. In effect, industrial policy has become an indirect demand engine for its machines.

Recent signals from the broader AI ecosystem reinforce the momentum. Foxconn, a key Nvidia partner and the world’s largest contract electronics manufacturer, reported a 22% surge in revenue in the final quarter of 2025, reflecting strong demand for AI servers used in data centers. Those servers ultimately house chips produced using ASML’s tools, tying the company’s fortunes to every layer of the AI buildout.

Yet the rally also comes with longer-term questions. ASML’s dependence on a small number of very large customers, particularly TSMC, means its outlook remains closely tied to the investment discipline of a handful of players. Export controls, especially those affecting sales to China, remain a risk, even as analysts note that demand has held up better than expected. At the same time, valuations across the AI supply chain are rising rapidly, raising the stakes for upcoming earnings reports.

ASML is due to report fourth-quarter results on Jan. 28, with investors expected to focus less on near-term revenue and more on order intake, backlog strength, and management’s view of customer spending beyond 2026. Confirmation that capital expenditure plans remain intact could reinforce the view that the current rally is not speculative, but structural.

What ASML’s ascent ultimately highlights is a shift in where strategic power sits in the AI economy. While attention often gravitates toward chip designers, cloud providers, and software breakthroughs, the constraints are increasingly physical. The ability to manufacture at the most advanced nodes has become the limiting factor, and ASML sits squarely at that choke point.

In a global race defined by speed, scale, and sovereignty, ASML is not just supplying machines. It is shaping the pace at which the AI future can be built.