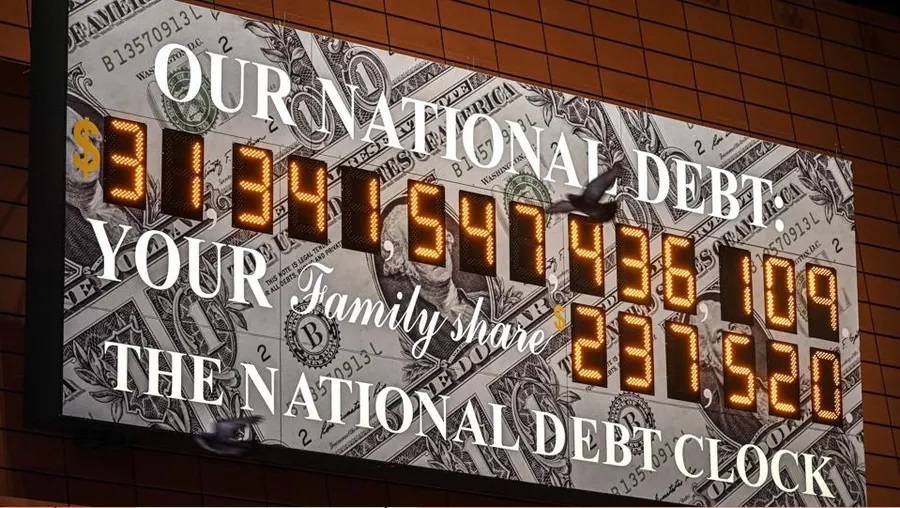

The US national debt has hit a new record of $34.1 trillion in January 2024, according to the latest data from the Treasury Department. This is an increase of $4.3 trillion from January 2020, when the debt was $29.8 trillion.

The debt has been growing rapidly due to the unprecedented fiscal stimulus and relief measures enacted by the federal government in response to the COVID-19 pandemic and its economic fallout. The debt-to-GDP ratio, which measures the debt relative to the size of the economy, has also reached a historic high of 153%, surpassing the previous peak of 119% in 1946, after World War II.

The rising debt poses significant challenges and risks for the US economy and its future prospects. Some of the potential consequences include:

Higher interest payments: As the debt grows, so does the cost of servicing it. The Congressional Budget Office (CBO) projects that net interest payments will rise from $345 billion in 2020 to $914 billion in 2030, accounting for 3.1% of GDP. This means that more tax revenues will have to be diverted to pay for the interest, leaving less room for other spending priorities or tax cuts.

Reduced fiscal space: A high debt level limits the government’s ability to respond to future crises or emergencies, such as wars, natural disasters, or recessions. The government may face difficulties in borrowing more money from investors, who may demand higher interest rates or lose confidence in the US’s creditworthiness. Alternatively, the government may have to resort to printing more money, which could lead to inflation and currency depreciation.

Lower economic growth: A high debt level may also have negative effects on the long-term growth potential of the economy. Some studies suggest that a high debt-to-GDP ratio can reduce the rate of economic growth by crowding out private investment, lowering productivity, and creating uncertainty and instability.

Given these challenges and risks, many economists and policymakers have called for a comprehensive and credible plan to reduce the debt over time and restore fiscal sustainability. However, there is no consensus on how to achieve this goal, as it involves difficult trade-offs and choices among competing objectives and interests. Some of the possible options include:

Raising taxes: Increasing tax revenues can help reduce the deficit and slow down the growth of the debt. However, raising taxes can also have adverse effects on economic activity, especially if they affect incentives to work, save, invest, or innovate. Moreover, raising taxes can be politically unpopular and face resistance from various groups and constituencies.

Cutting spending: Reducing spending can also help reduce the deficit and slow down the growth of the debt. However, cutting spending can also have negative impacts on social welfare, public services, infrastructure, national security, or research and development. Moreover, cutting spending can be politically difficult and face opposition from various groups and beneficiaries.

Reforming entitlements: Reforming entitlement programs, such as Social Security, Medicare, and Medicaid, can help reduce the long-term pressures on the budget and the debt. These programs account for a large and growing share of federal spending and are projected to increase significantly as the population ages and health care costs rise.

However, reforming entitlements can also entail significant changes in benefits, eligibility, or contributions for current or future recipients. Moreover, reforming entitlements can be politically contentious and face resistance from various groups and stakeholders.

The US national debt has reached a new all-time high of $34.1 trillion in January 2024, reflecting the unprecedented fiscal response to the COVID-19 pandemic and its economic consequences. The high debt level poses significant challenges and risks for the US economy and its future prospects, such as higher interest payments, reduced fiscal space, and lower economic growth.

To address these challenges and risks, a comprehensive and credible plan to reduce the debt over time and restore fiscal sustainability is needed. However, such a plan involves difficult trade-offs and choices among competing objectives and interests, such as raising taxes, cutting spending, or reforming entitlements.