THE DRAMA

The moment I saw this statement by Diane Hirsh Theriault, I immediately thought of the Nigerian phrase: ‘It is well’

In Nigeria, only a complete ‘JJC’ oyibo (foreigner) directly off a plane will accept ‘It is well’ on face value.

The phrase can mean several things, depending on context, but the most common interpretation is resigning oneself to the acceptance of circumstances that are less than ideal, with a somewhat lacklustre willingness to move on.

As a leader, never accept ‘It is well’ as any indication that ‘Team <company name>’ is moving forward on your agenda. The core problem isn’t solved. At best, you’ve kicked the can a little further down the road, and how far, that’s another question. (fuh 9ja pesin – it no dey be dat kine ‘how far’).

There is no real way forward to provide a ‘sanitizing’ brief against this statement for Google. Despite the charges in the document, it is hard to think they would be so stupid to try it, because it’s only going to dig a hole for themselves and endorse for public benefit, that Diane Hirsh Theriault’s perception as a Google Insider, is Super Accurate.

It is exactly like accepting ‘It is well’ on face value. Not a good move.

There has been a lot of layoffs in the sector. This isn’t especially a Google thing. There is absolutely no value in releasing a statement painting Diane as a disgruntled employee.

It won’t work, and the global public will know the ‘It is well’ doesn’t mean so. Anything released, irrespective of wording, heads to a single point of interpretation, which is code for…

‘We completely screwed up, and we are completely incapable of any acceptable management of a business of this magnitude’.

So… it is better to just not respond at all.

The ‘It is well’ code been busted … sorry (not). Moving forward, the better approach would be to focus on this statement from Dianne –

‘Google has not launched one single successful executive-driven thing in years’

Rather than ‘briefing’ against it, actually do something concrete.

THE MELTDOWN

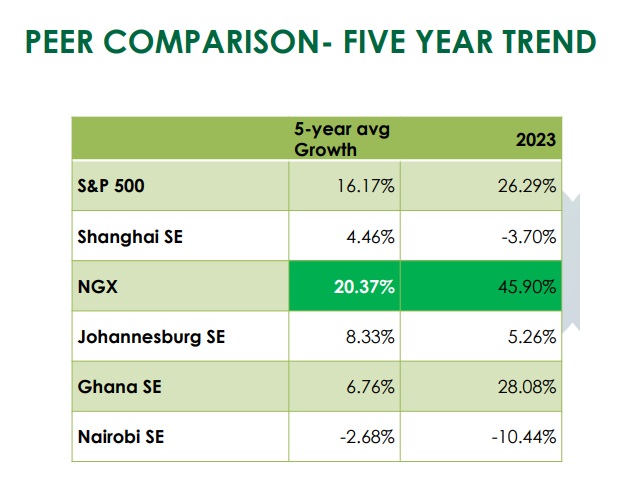

Not too long ago… I was confident in the position that Google was the dominant search engine…

98% of the market was dominated with Chrome.. most of what was left were browsers built on top of the Chrome opensource ‘engine’ (although that’s not a revenue source – which is all important). Chrome is an aggregation strategy, because the more Chrome browsers and their ilk being used, the more likely people are to plum for the ‘resident’ search engine, Google Search… and that is where the money starts rolling in.

But things are no longer simple when trying to monetize information onboarding while using the ‘Alphabet’.

Simply put, letters are not everything, and as MS’s Bing incorporates ChatGPT, while the Bard has lost a sense of verse, numbers rather than words are speaking louder!

The $160bln Alphabet valuation seems to have vanished as if some obeah or juju.

Shareholders are distinctly unsettled.

Google has lost the initiative in the AI integration race and isn’t getting it back soon.

THE SOLUTION

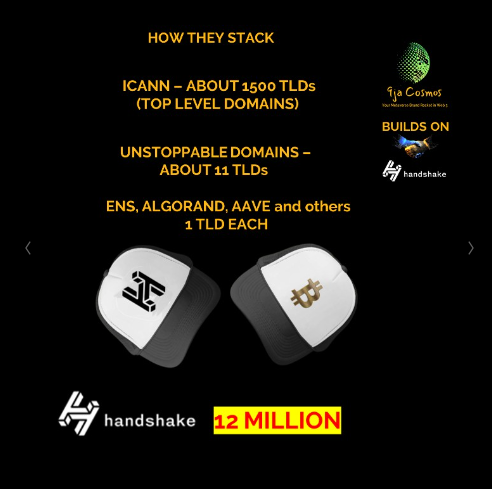

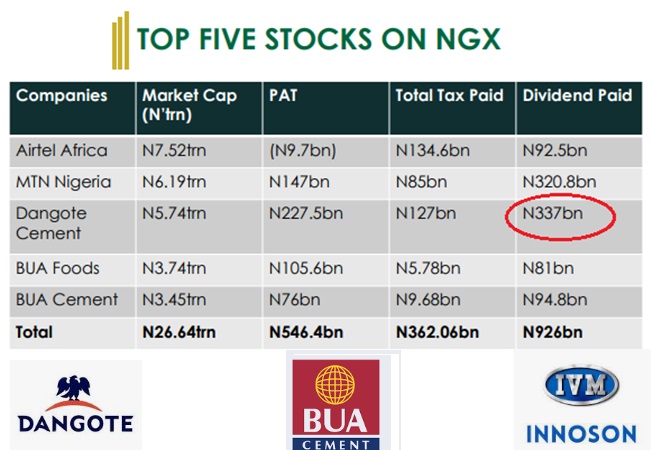

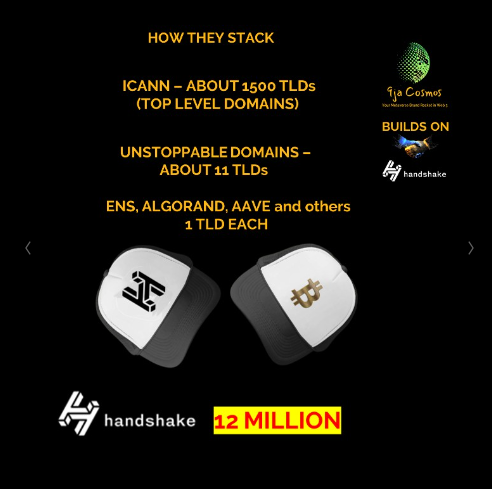

9JA Cosmos builds on Handshake as everyone knows. While Handshake Tokens can be used for many things, the most commonly publicized use is as a Web 3 Top Level Domain (TLD), which they are specifically coded for.

Google Chrome chooses not to have a native resolver to support Handshake Domains. There are currently 12 million of them, and 9ja Cosmos currently owns about 13k of them. We are one of the bigger owners.

Since 9ja Cosmos products cannot enter the Google Ecosystem, 9ja Cosmos reciprocates by not allowing Google Products to enter its Ecosystem. This means we have @gmail email addresses blacklisted on all our servers. We also do not accept invitations to accept video calls over Google Meet.

The Handshake Ecosystem is by far the biggest domain system in existence. ICANN is the second biggest, which relies on legacy technology and presides over domains like .com , .org, .io and .xyz. It also presides over the country allocation system like .fr (France) and .es (Spain)

9ja Cosmos issued the first country Web 3 TLD in the world – .9jacom for Nigeria in September 2022.

Perhaps not all of the owners of the 12 million Handshake TLDs that are out there, choose to comply with the ‘reciprocal’ initiative, but all members of the community are, at a minimum, aware of it, and new adoption comes all the time.

It would seem to make sense to me, that Google could turn a liability into an asset by firstly, adopting resolution of Handshake Domains natively, and secondly, but amending the google base engine open source policy so that users (such as Brave, MS Edge, AVG and others), adopt it.

This would increase capacity, open up a new activity stream, and silence critics in a way nobody could have imagined.

With 9ja Cosmos now adopting NFT-Web Domain- AI bridge products with the advent of the Sinosignia /Sino Amazon collection, the opportunity for Google to reposition itself with Handshake Blockchain integration couldn’t be more obvious.

I have the ear of key directors, and I am happy to talk.

9ja Cosmos is here…

Get your .9jacom and .9javerse Web 3 domains for $2 at:

.9jacom Domains

.9javerse Domains

Visit 9ja Cosmos LinkedIn Page

Visit 9ja Cosmos Website

Preview our Sino Amazon/Sinosignia releases

Like this:

Like Loading...