Cardano (ADA), ranked 8th on the top ten cryptocurrency list, has experienced significant growth in recent years. Meanwhile, Ethereum Classic (ETC) demonstrates resilience by leveraging ETH and BTC’s upturn. Meanwhile, VC Spectra (SPCT) gained considerable attention after raising $2.4 million in its private seed sale, contributing to its growing reputation.

Let’s explore why ADA, ETC, and SPCT are the best investment opportunities with growth potential.

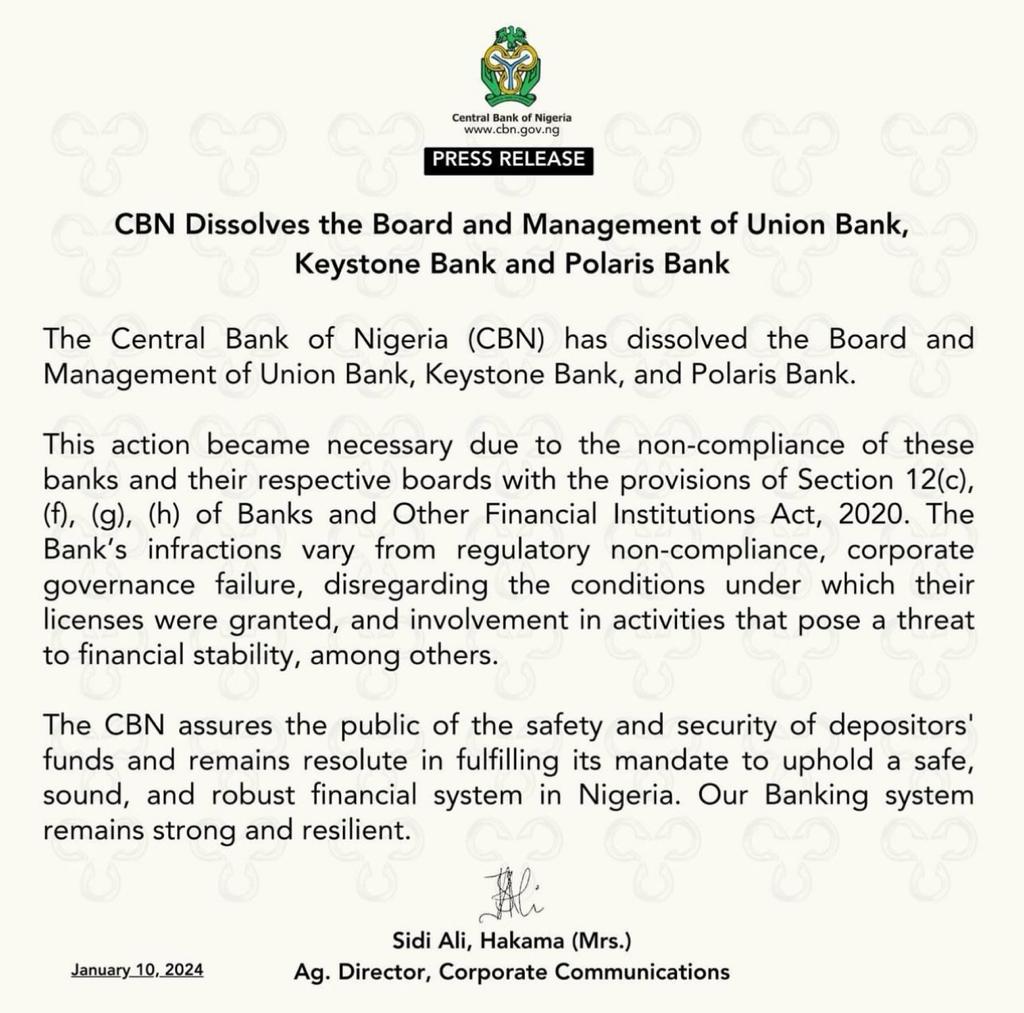

Summary

- Cardano’s (ADA) price could reach $1 by the end of 2024.

- VC Spectra’s (SPCT) last stage of its public presale has surged by 862.5%.

- Ethereum Classic (ETC) experiences increased institutional interest, with prices predicted to surpass $35 by the end of 2024.

Cardano (ADA) Could Experience a Resurgence of Its Bullish Trend to End 2023 Trading Above the $0.7 Level

Cardano (ADA) exhibited a commendable price trajectory during the fourth quarter of 2023, prompting questions like, how high can Cardano go?

Between October 1 and November 16, 2023, Cardano’s (ADA) price increased from $0.254 to $0.409. However, circumstances took an unexpected turn despite the positive ADA outlook and the anticipation of a promising Cardano price prediction.

According to Santiment data, approximately 98.1% of addresses holding 1 to 10 ADA led to a loss of small wallets on November 17, 2023. After the disclosure, Cardano’s (ADA) price declined to $0.355. Nevertheless, due to its resilience, ADA partially recovered from its losses and closed the day at $0.367.

Cardano (ADA) exhibited a consistent upward trend, culminating on December 13, 2023, when the price reached a yearly high of $0.68. The notable performance of ADA can be attributed primarily to the favorable trajectory observed in the cryptocurrency market as a whole.

However, Cardano’s (ADA) price has declined 25% to $0.50. Still, analysts express a positive outlook on the Cardano price prediction, anticipating that ADA will reach at least $1 by the end of 2024. The Cardano price prediction is due to optimism surrounding the approval of a Bitcoin spot ETF and its upcoming halving event.

VC Spectra (SPCT) Demonstrates Significant Potential as It Nears the End of Its Public Presale

VC Spectra (SPCT) is an innovative decentralized hedge fund transforming the fintech industry by leveraging artificial intelligence and blockchain technology. Additionally, VC Spectra’s (SPCT) platform leverages smart contracts to execute its functionalities.

Moreover, as one of the top DeFi projects, VC Spectra (SPCT) strongly emphasizes facilitating peer-to-peer trading by eliminating intermediaries. VC Spectra (SPCT) is inclusive and accessible to all individuals interested in investing in its highly profitable projects.

Additionally, VC Spectra (SPCT) employs algorithmic trading, artificial intelligence, and the expertise of highly knowledgeable venture capitalists to make informed investment decisions. Its investment policy prioritizes existing projects and new ICOs with high sustainability, trustworthiness, and security.

Furthermore, VC Spectra leverages its governance token, SPCT, as the fundamental guiding principle in its operations. The token is developed on the Bitcoin blockchain and adheres to the BRC-20 compliance standards. In addition, the deflationary characteristic of SPCT enhances its value by effectively managing the token supply.

VC Spectra (SPCT) is in the final stage of a highly successful public presale, with the token selling at $0.077. Investors who participated in Stage 1 by investing at $0.008 have experienced a return on investment (ROI) of 862.5%.

VC Spectra (SPCT) will be listed on major exchanges after the presale, resulting in potentially more significant gains than those observed during the presale period.

Due to the considerable demand for the SPCT token, rigorous investment policies, and advanced trading strategies, VC Spectra (SPCT) stands out as the best cryptocurrency investment in the current market.

Ethereum Classic (ETC) Rides on ETH and BTC Upturn to New Heights and an Optimistic Price Prediction

Ethereum Classic (ETC), one of the top altcoins, has experienced a dynamic fourth quarter of 2023, marked by a period of relatively stable trading. Ethereum Classic price surged from $14.70 to $21.75 between October 1 and December 8, 2023.

However, Ethereum Classic (ETC) experienced a price increase to $23.27 on December 9, 2023. Coincidentally, the Ethereum Classic price increased at the same time as Ethereum and Bitcoin, reaching $2,300 and $40,000, respectively.

In addition to exhibiting a correlation with BTC and ETH, Ethereum Classic (ETC) has experienced a notable increase due to institutional investors’ growing trust and confidence.

Analysts are optimistic about the potential growth of Ethereum Classic (ETC), citing the upcoming Bitcoin halving this year. They also project that scalability upgrades scheduled for testing and potential implementation on Ethereum in 2024 will lead to an optimistic Ethereum Classic price prediction.

From its current price of $20.95, analysts predict that Ethereum Classic (ETC) will surpass the $35 mark by the end of 2024.