Bitcoin, the leading cryptocurrency by market capitalization, has been on a steady rise in 2023, outperforming most traditional assets such as stocks and bonds. We will explore some of the factors that have contributed to Bitcoin’s impressive performance this year, and what the outlook is for the future.

One of the main drivers of Bitcoin’s growth this year has been the increasing adoption by institutional investors, who see it as a hedge against inflation and currency devaluation.

According to a recent report by Chainalysis, a blockchain analytics firm, institutional investors accounted for 63% of all Bitcoin transactions in the first half of 2023, up from 44% in 2022. Some of the notable institutions that have added Bitcoin to their portfolios include Tesla, MicroStrategy, Square, PayPal, and Morgan Stanley.

Another factor that has boosted Bitcoin’s value this year has been the innovation and development in the crypto space, especially in the areas of decentralized finance (DeFi) and non-fungible tokens (NFTs). DeFi is a term that refers to various applications that use blockchain technology to provide financial services such as lending, borrowing, trading, and investing, without intermediaries.

NFTs are unique digital tokens that represent ownership of various assets such as art, music, games, and collectibles. Both DeFi and NFTs have created new use cases and demand for Bitcoin, as well as increased its network effect and liquidity.

Finally, Bitcoin has also benefited from the regulatory clarity and support that it has received from some governments and central banks around the world. For instance, in June 2021, El Salvador became the first country to adopt Bitcoin as legal tender, allowing its citizens to use it for everyday transactions and tax payments.

In September 2023, Ukraine followed suit and passed a law that recognized and regulated Bitcoin as an asset class. Moreover, some central banks such as the European Central Bank (ECB) and the Bank of England (BoE) have announced plans to launch their own digital currencies, which could potentially increase the public awareness and acceptance of Bitcoin and other cryptocurrencies.

Bitcoin has shown remarkable resilience and growth in 2023, outpacing most traditional assets in terms of returns. While there are still challenges and risks ahead, such as volatility, security breaches, and regulatory uncertainty, the outlook for Bitcoin remains positive, as more investors, developers, and users embrace it as a store of value, a medium of exchange, and a platform for innovation.

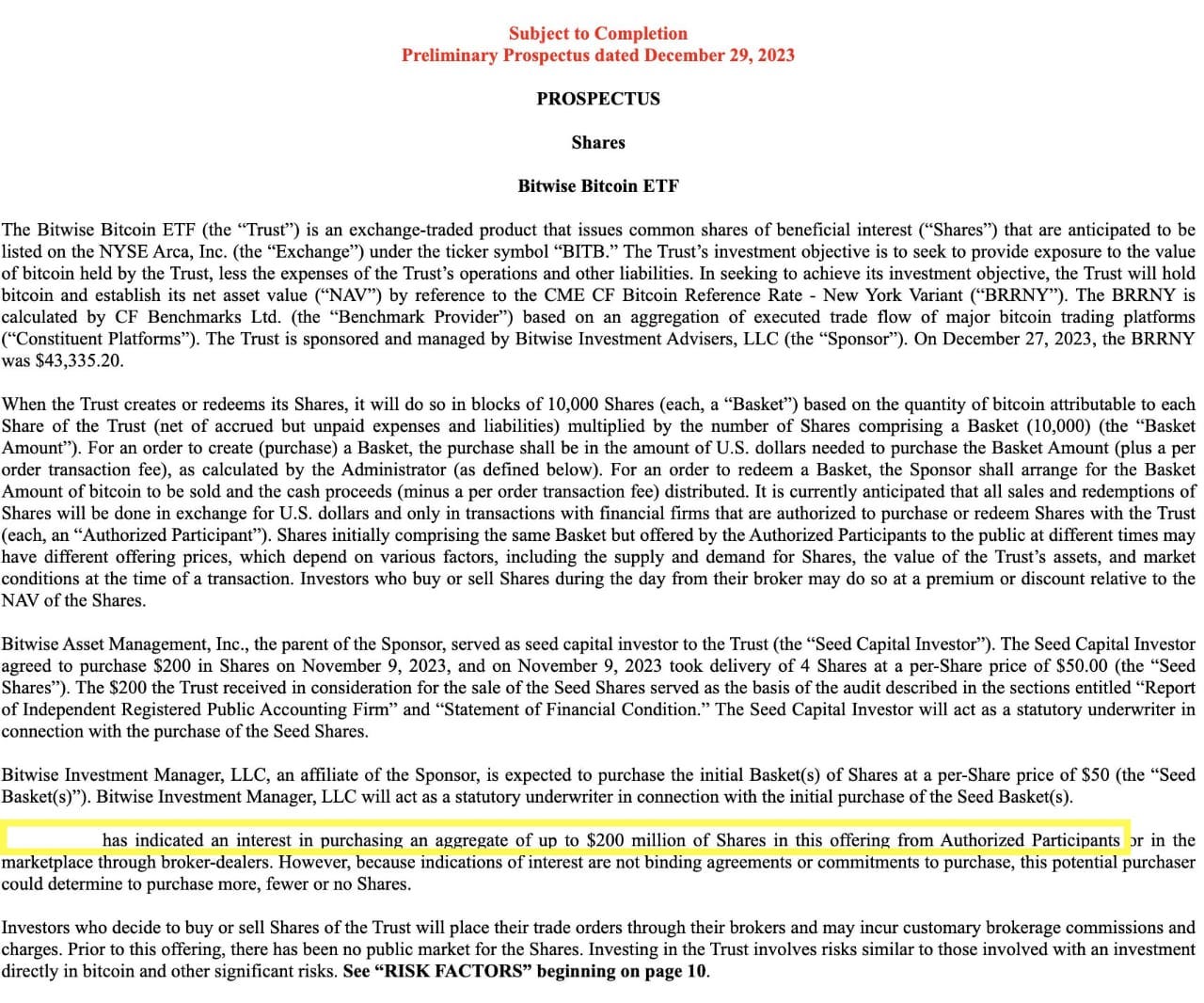

A major milestone for the cryptocurrency industry could be reached as early as next week, according to a Reuters report. The U.S. Securities and Exchange Commission (SEC) may give the green light to several Bitcoin exchange-traded funds (ETFs) that have been waiting for approval for months.

Bitcoin ETFs are investment products that track the price of the leading digital currency and trade on traditional stock exchanges. They offer investors a convenient and regulated way to gain exposure to Bitcoin without having to buy and store it directly.

The SEC has been reluctant to approve Bitcoin ETFs in the past, citing concerns about market manipulation, fraud, and investor protection. However, the agency has recently signaled a more open stance, as it has not blocked several applications that use Bitcoin futures contracts as their underlying assets.

Bitcoin futures are contracts that allow traders to bet on the future price of Bitcoin. They are traded on regulated platforms such as the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE). Unlike spot Bitcoin, which is traded on unregulated and often opaque exchanges, Bitcoin futures are subject to strict oversight and reporting requirements.

The Reuters report, citing unnamed sources familiar with the matter, said that the SEC may notify some of the Bitcoin ETF applicants as soon as Tuesday or Wednesday that they have met the regulatory standards and can launch their products the following week. The report did not specify which applicants were likely to receive the approval but noted that there were at least four contenders in the race.

The news comes amid a strong rally in the Bitcoin market, which has seen the price of the cryptocurrency surge above $60,000 for the first time since April 2021. Many analysts and investors believe that the launch of Bitcoin ETFs will boost the demand and liquidity for Bitcoin, as well as attract more institutional and mainstream investors to the space.

The approval of Bitcoin ETFs in the U.S. would also follow similar developments in other countries, such as Canada and Brazil, where several Bitcoin ETFs have already been launched and have attracted significant inflows. The U.S., however, remains the largest and most influential market for ETFs, with over $6 trillion in assets under management.

If the Reuters report is confirmed, it would mark a historic moment for the cryptocurrency industry and a major validation for Bitcoin as an asset class. It would also open up new opportunities and challenges for both investors and regulators in the rapidly evolving digital economy.