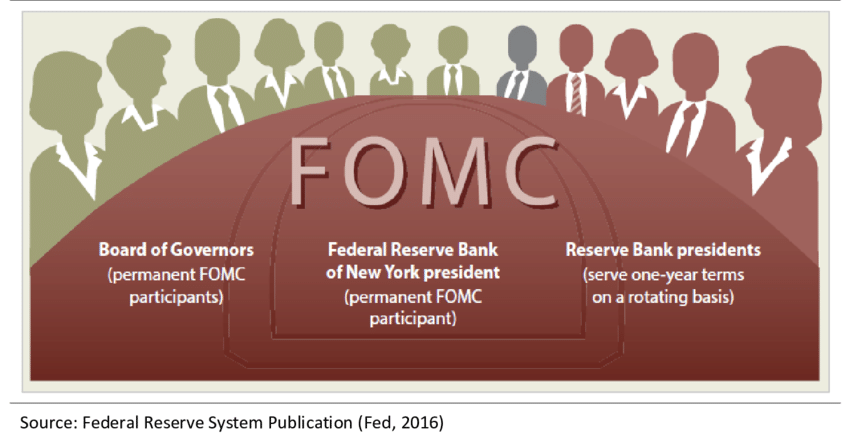

The Federal Open Market Committee (FOMC) is the monetary policy-making body of the US Federal Reserve. It meets eight times a year to review economic conditions and decide on the appropriate level of the federal funds rate, which is the interest rate that banks charge each other for overnight loans. The FOMC also sets the target range for the Fed’s balance sheet, which is the amount of assets that the Fed holds, such as Treasury securities and mortgage-backed securities.

The FOMC’s decisions have significant implications for the global financial markets, especially the cryptocurrency markets, which are highly sensitive to changes in interest rates and liquidity conditions. In this blog post, we will analyze the main takeaways from the recent FOMC meeting held on December 13-14, 2023, and discuss their potential impact on the crypto markets for 2024.

The main highlights of the FOMC meeting were:

The FOMC raised the federal funds rate by 25 basis points, from 0.25% to 0.5%, marking the first-rate hike since June 2019. The FOMC also indicated that it expects to raise rates three more times in 2022, and three times in 2023, bringing the federal funds rate to 1.75% by the end of 2023.

The FOMC announced that it will accelerate the tapering of its asset purchases, reducing them by $30 billion per month starting in January 2022, instead of $15 billion per month as previously planned. This means that the Fed will end its asset purchases by March 2022, instead of June 2022.

The FOMC revised its economic projections for 2022 and 2023, reflecting a more optimistic outlook for growth and inflation. The FOMC expects the US economy to grow by 4% in 2022 and 3.5% in 2023, up from 3.8% and 2.5% respectively in September. The FOMC also expects inflation to moderate from 5.3% in 2021 to 2.6% in 2022 and 2.2% in 2023, down from 4.2% and 3.0% respectively in September.

The FOMC’s actions and projections signal a more hawkish stance than expected, reflecting the Fed’s confidence in the strength of the economic recovery and its determination to contain inflationary pressures. The FOMC’s message was well received by the stock market, which rallied after the meeting, as investors interpreted the Fed’s moves as a sign of credibility and stability.

However, the crypto market reacted negatively to the FOMC’s announcement, as higher interest rates and lower liquidity tend to reduce the attractiveness of riskier assets such as cryptocurrencies. The crypto market also faced headwinds from regulatory uncertainty, as several countries announced or implemented stricter rules or bans on crypto activities.

As a result, the total market capitalization of cryptocurrencies dropped by about 15% in the week following the FOMC meeting, from $2.4 trillion on December 14 to $2 trillion on December 18, according to CoinMarketCap. Bitcoin, the largest and most influential cryptocurrency, fell by about 13%, from $48,000 to $42,000.

What does this mean for the crypto market outlook for 2024? We believe that there are several factors that will shape the future of crypto in the next two years:

The pace and magnitude of the Fed’s monetary policy normalization will be a key driver of crypto market sentiment and volatility. If the Fed raises rates faster or higher than expected, or if it signals a shift to a more restrictive policy stance, this could trigger a sell-off in crypto assets, as investors seek safer and higher-yielding alternatives.

Conversely, if the Fed maintains a gradual and cautious approach, or if it revises its policy outlook due to unexpected shocks or slowdowns in the economy or inflation, this could support crypto prices, as investors perceive crypto as a hedge against monetary uncertainty or inflation.

The evolution of regulation and innovation will be another crucial factor for crypto adoption and growth. On one hand, regulation can pose challenges and risks for crypto investors and users, as it can limit their access or choice of crypto services or products or impose higher costs or taxes on their transactions or holdings. On the other hand, regulation can also provide clarity and legitimacy for crypto actors and activities, as it can establish clear rules and standards for compliance and security or create new opportunities and incentives for innovation and collaboration.

The development of technology and infrastructure will be a third important factor for crypto performance and potential. Technology can enable new features and functions for crypto assets and platforms, such as scalability, and interoperability.

Significant shifts in the Blockchain Ecosystem

The blockchain ecosystem is constantly evolving and undergoing significant shifts that affect the development and adoption of decentralized applications (DApps). In this blog post, we will explore some of the recent trends and challenges in the blockchain space and how they impact the design and implementation of DA solutions.

One of the major trends in the blockchain ecosystem is the emergence and growth of layer-2 solutions, which aim to improve the scalability, performance, and user experience of DApps by moving some of the computation and storage off the main chain. Layer-2 solutions can be classified into two categories: state channels and rollups.

State channels allow users to open a channel between themselves and perform transactions off-chain, only settling on the main chain when the channel is closed. Rollups, on the other hand, aggregate multiple transactions into a single batch and submit it to the main chain, reducing the gas cost and increasing the throughput.

Layer-2 solutions offer several benefits for DA solutions, such as faster confirmation times, lower fees, and enhanced privacy. However, they also introduce new challenges and trade-offs, such as increased complexity, security risks, and interoperability issues. For instance, state channels require users to lock up funds in a smart contract and trust that the other party will not cheat or go offline.

Rollups rely on a centralized operator or a set of validators to process transactions off-chain and submit proofs to the main chain, which may introduce a single point of failure or corruption. Moreover, layer-2 solutions may not be compatible with each other or with existing DApps on the main chain, limiting the composability and network effects of DA solutions.

Another significant shift in the blockchain ecosystem is the rise of cross-chain interoperability, which enables different blockchains to communicate and exchange value with each other. Cross-chain interoperability can be achieved through various mechanisms, such as bridges, sidechains, pegged zones, and polkadot. Bridges are smart contracts that connect two blockchains and allow users to transfer tokens or data between them.

Sidechains are independent blockchains that are linked to a main chain and inherit some of its security and functionality. Pegged zones are special zones within a blockchain that can host tokens or assets from other blockchains. Polkadot is a network of heterogeneous blockchains that can interoperate through a shared relay chain.

Cross-chain interoperability opens up new possibilities and opportunities for DA solutions, such as accessing a larger pool of users, assets, and services across different blockchains, enhancing the diversity and innovation of DApps, and creating cross-chain composability and synergy. However, cross-chain interoperability also poses new challenges and risks for DA solutions, such as increased complexity, latency, and security vulnerabilities.

For example, bridges may require users to trust a third party or a multisig scheme to custody their assets on another chain. Sidechains may have lower security guarantees than the main chain or may not be compatible with other sidechains. Pegged zones may have different governance models or consensus mechanisms than the original chain. Polkadot may face scalability issues or governance conflicts among its parachains.

In conclusion, DA solutions are influenced by significant shifts in the blockchain ecosystem, such as layer-2 solutions and cross-chain interoperability. These shifts offer new benefits and opportunities for DA solutions but also introduce new challenges and trade-offs. Therefore, DA solution developers need to carefully evaluate their needs and goals and choose the best platform and architecture for their DApps.

Like this:

Like Loading...