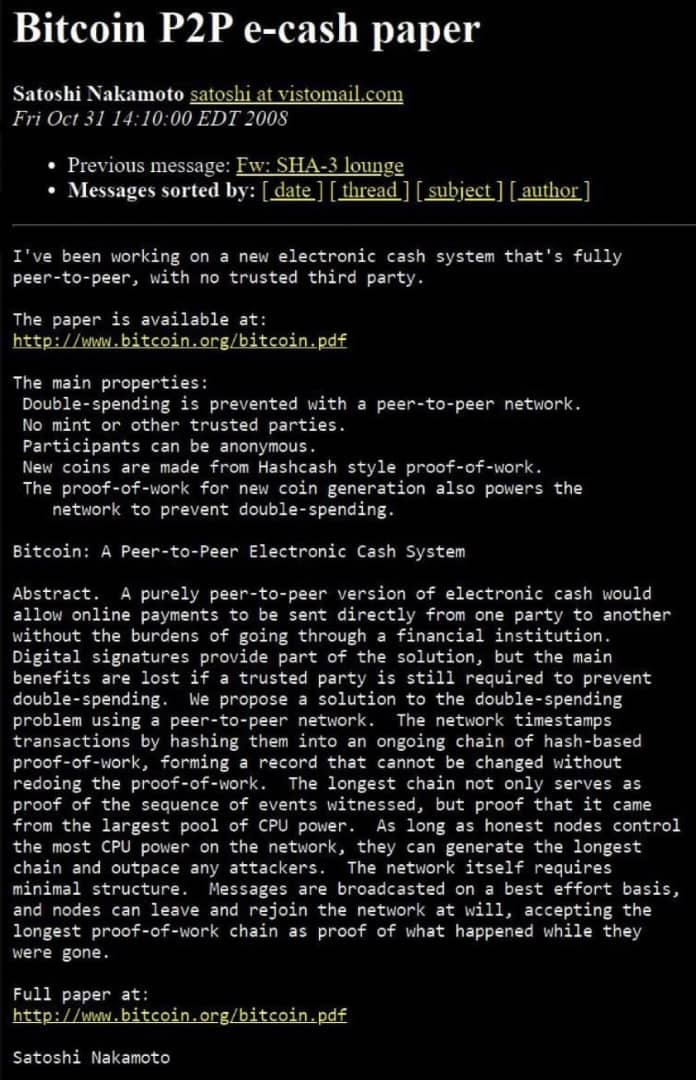

On October 31, 2008, a mysterious person or group using the pseudonym Satoshi Nakamoto published a nine-page document titled “Bitcoin: A Peer-to-Peer Electronic Cash System”. This document, now known as the Bitcoin whitepaper, laid out the foundation for a revolutionary new form of money that is decentralized, censorship-resistant, and trustless.

The Bitcoin whitepaper explained how a network of computers, called nodes, could maintain a shared ledger of transactions, called the blockchain, without relying on any central authority or intermediary. The whitepaper also introduced a novel solution to the problem of double spending, which is the risk that a digital currency can be spent more than once. The solution, called proof-of-work, is a mechanism that requires nodes to perform complex mathematical calculations in order to validate new blocks of transactions and compete for newly minted bitcoins as a reward.

The Bitcoin whitepaper sparked a wave of innovation and experimentation in the field of cryptography, computer science, and economics. It inspired thousands of developers, entrepreneurs, and enthusiasts to join the Bitcoin network and contribute to its growth and development. It also paved the way for the emergence of other cryptocurrencies and blockchain platforms that aim to improve or expand on the original vision of Bitcoin.

The problem with traditional electronic payments

The whitepaper starts by identifying the problem with the current system of electronic payments, which relies on trusted third parties such as banks, payment processors or online platforms to verify and facilitate transactions. These third parties charge fees, impose restrictions, create bottlenecks and introduce risks of fraud, censorship and reversal. Moreover, they require users to share their personal and financial information, which can be compromised or misused.

The whitepaper then proposes a solution to this problem: Bitcoin, a peer-to-peer electronic cash system that allows users to send and receive payments directly to each other without the need for any intermediary. Bitcoin uses cryptographic techniques to ensure the security, integrity and validity of transactions. Bitcoin also uses a novel mechanism called proof-of-work to create a distributed consensus among the network participants about the state of transactions and balances.

The whitepaper explains the key components of the Bitcoin system, which are:

A transaction is a transfer of value between two or more Bitcoin addresses. A transaction consists of inputs and outputs, where inputs are references to previous outputs that are being spent, and outputs are new outputs that are being created. Each output has a value and a script that defines the conditions for spending it. Transactions are signed by the owners of the inputs using digital signatures, which prove that they have the right to spend them.

An address is a string of alphanumeric characters that represents a potential destination for a payment. An address is derived from a public key, which is part of a key pair that also includes a private key. The private key is used to sign transactions, while the public key is used to verify signatures. The private key must be kept secret, while the public key can be shared with others.

A block is a collection of transactions that have been validated by a node (a computer running the Bitcoin software) and broadcasted to the network. A block also contains a header, which includes metadata such as the timestamp, the difficulty target, the nonce and the hash of the previous block. The hash of the previous block links each block to its predecessor, forming a chain of blocks that records the history of transactions.

Proof-of-work: Proof-of-work is a process that requires nodes to perform a computationally intensive task in order to create new blocks. The task involves finding a nonce (a random number) that makes the hash of the block header start with a certain number of zeros. The difficulty target adjusts every 2016 blocks (about two weeks) to ensure that one block is created every 10 minutes on average. The proof-of-work serves as a way of securing the network against attacks by making it costly and impractical for anyone to modify or replace existing blocks.

The network is composed of nodes that communicate with each other using a peer-to-peer protocol. Nodes can act as full nodes or lightweight nodes. Full nodes store and validate the entire blockchain, while lightweight nodes only store and validate a subset of it. Nodes relay transactions and blocks to each other using a gossip protocol, which ensures that information propagates quickly and efficiently throughout the network.

The incentive is the reward that nodes receive for creating new blocks and securing the network. The reward consists of two parts: newly created bitcoins (the block subsidy) and transaction fees (the sum of fees paid by users in each block). The block subsidy halves every 210,000 blocks (about four years), until it reaches zero after 64 halvings (about 130 years). The transaction fees are expected to become the main source of income for miners in the future.

The whitepaper concludes by highlighting some of the benefits of Bitcoin over traditional electronic payment systems, such as: Low transaction costs: Bitcoin eliminates the need for intermediaries and their fees, making transactions cheaper and faster. High security: Bitcoin uses cryptography and proof-of-work to prevent double-spending, fraud and censorship.

High privacy: Bitcoin allows users to transact anonymously without revealing their identities or financial information. High scalability: Bitcoin can handle millions of transactions per day with minimal resources and bandwidth. High innovation: Bitcoin enables new applications and services that were not possible before.

Today, 15 years after the publication of the Bitcoin whitepaper, Bitcoin is widely recognized as the first and most successful cryptocurrency in history. It has a market capitalization of over $1 trillion and is accepted by millions of merchants and users around the world. It has also proven to be a resilient and robust system that has survived multiple attacks, forks, and controversies. Despite its challenges and limitations, such as scalability, volatility, and regulation, Bitcoin continues to evolve and adapt to the changing needs and preferences of its users and the broader society.

The Bitcoin whitepaper is more than just a technical document. It is a manifesto for a new era of money that is open, inclusive, and empowering. It is a testament to the power of human creativity and collaboration. And it is a reminder that we can shape our own destiny with code.