The abuse of common pain relief medications, such as panadol, paracetamol, ibuprofen, and aspirin, is a growing concern in many societies, including Nigeria. Information-seeking behaviour through the Internet using the Google Search Engine shows that between January 1, 2023, and October 15, 2023, Nigerians with access to the Internet sought information about these medications.

In our analysis, we discovered that the more they sought information about paracetamol, the less they did for panadol. A similar insight was discovered for aspirin and paracetamol. However, the more they sought information about Aspirin, the more they did for Panadol. This indicates that paracetamol and panadol are considered the most useful drugs for solving pain problems in their bodies or seeking information about them for the purpose of determining how they constitute part of the most misused or abused drugs in Nigeria. We further discerned that the more they developed an interest in knowing how aspirin can cure their pains, the less they had a similar interest in knowing the extent to which ibuprofen can perform the same function.

Overall, our analysis shows that panadol, paracetamol, and ibuprofen were more associated with solving pain problems during the period than aspirin. Despite this outcome, our analyst notes that Nigeria is really battling with the abuse of all four medications. His position is premised on the outcomes of a series of analyses of the policies and strategies of control agencies as well as the media response to the menace that has shown that concerned stakeholders are still struggling to solve the abuse of various painkiller medications.

This is mainly based on the complexity of the system of abuse, which involves many hidden micro and macro actors who take solace in distributing and prescribing the drugs without a medical examination report that reveals the need for the drugs by patients. It is common knowledge that as soon as people feel pain in their bodies, the only solution that comes to mind is to use the mentioned medications without a medical examination. In this regard, individuals exist in various states regarding their relationship with painkillers, from responsible use to dependency.

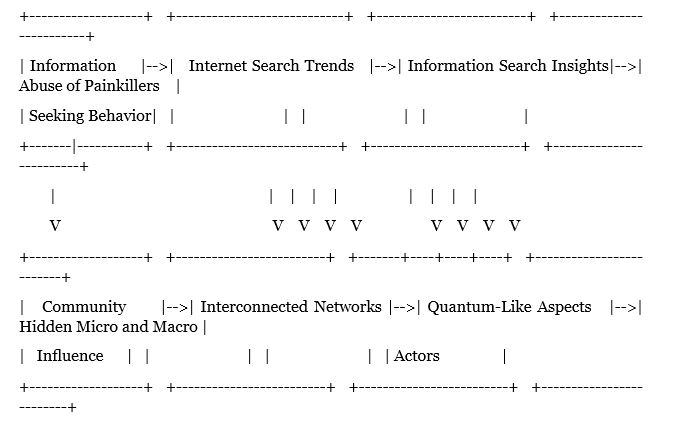

Exhibit 1: Pain Relief Medications Information-Seeking Driven Abuse Analytical Framework

In this analytical framework (see Exhibit 1), information-seeking behaviour through the internet influences the search trends related to common pain relief medications, highlighting the dynamics between different medications. These trends are affected by users’ interests and preferences, which, in turn, influence the abuse of these medications. The complexity of the system is underscored by hidden actors and the interconnected networks that drive the normalization of abuse. Finally, quantum-like aspects such as uncertainty and the impact of public awareness campaigns are essential elements in understanding and addressing the issue of painkiller abuse.

However, the behaviour of one individual influences that of another, creating interconnected networks of users. For example, nursing mothers cannot do without any of these medications. As soon as their children complain of pain, the first solution they usually think of is the application of any of the medications. Medicine stores in rural and urban areas are also not helping the government stamp out misuse or abuse of the medications with their poor attitude towards requesting medical reports from their customers. Recognising this entanglement is crucial for implementing effective prevention programmes.

In quantum physics, Heisenberg’s Uncertainty Principle states that we cannot precisely know both the position and momentum of a particle. Similarly, predicting who may fall into the trap of painkiller abuse is challenging. However, through data analysis and behavioural patterns, we can reduce uncertainty and identify risk factors.

As noted previously, the more individuals misuse painkillers, the more they normalise such behaviour in a community. Identifying these loops is crucial to breaking the cycle of abuse. Promoting responsible painkiller use through public awareness campaigns can be a high-leverage strategy.