At various forums, stakeholders in Nigeria’s sustainable growth and development project, encompassing all aspects of society and businesses, have consistently emphasized that strategic attention to innovation and its commercialization is imperative for progress. The unanimous consensus is that knowledge and skills play a pivotal role in fostering diverse forms of innovation and facilitating their successful commercialization.

However, despite this consensus, a series of previous analyses conducted and reported through various media outlets have shed light on the multidimensional nature of the challenges hindering innovation. These challenges range from weak institutional structures to a moderately supportive business and market environment, which collectively impede the cultivation of an innovation-driven culture. It is our firm belief that addressing these issues and aligning with the current administration’s intent, under President Bola Ahmed Tinubu, to promote economic growth through innovation and entrepreneurship demands a comprehensive approach. This approach should draw from the principles of system dynamics and quantum-like modeling techniques.

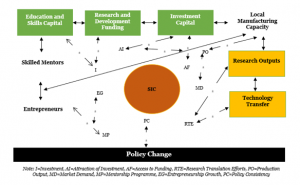

In this piece, after conducting various scenarios to assess the potential impact of different policies and strategies on the commercialization of innovation in Nigeria’s manufacturing and service industries, we present a quantum strategy for enhancing the commercialization of innovation in these sectors.

Financing education and skills

Investment in education and skills development is crucial to enhance human capital and research capabilities, fostering a well-educated and skilled workforce for driving innovation. Addressing infrastructure challenges, especially in digital connectivity and logistics, can reduce barriers to entry for startups and innovative businesses. Continued investment in research and development is necessary to enhance technology outputs. Collaboration between academia, research institutions, and the private sector can drive innovation. Exploring opportunities for global collaboration and partnerships can help leverage external expertise, funding, and markets for commercializing innovative products and services.

In any innovation-driven economy, the foundation is a highly skilled workforce. To build this foundation, Nigeria must invest in education and skills development. The model suggests a delicate balance. Increasing investments in education and skills capital steadily enhances the quality of the workforce, which in turn fuels more innovation. However, there exists a negative feedback loop where, as the stock of educated and skilled workers grows, the need for further investment may decrease. This calls for adaptive strategies that adapt to shifting skill demands.

Access to funding and investment

This is a key factor in the commercialization journey. Initiatives that connect with potential investors and provide platforms for pitching ideas are essential for scaling innovation. Regulatory compliance should not be overlooked. Engaging with regulatory bodies to streamline processes and ensure safety and quality standards are met is crucial for success. Simplifying regulatory procedures for startups can encourage innovation further. Networking and collaboration among professionals, research institutions, government agencies, and industry players are fundamental. Conferences and events dedicated to innovation can facilitate knowledge sharing and relationship building.

Funding for research and development is an area that demands attention. Advocacy for increased financial support, both from the government and private sector, is a priority. Specialized grant programmes aimed at nurturing innovative projects with commercial potential can provide the necessary impetus.

Access to capital is essential for innovation. Nigeria needs to attract investments while providing easier access to funding for budding entrepreneurs and businesses. The model showcases a feedback loop where increased investment capital attracts more investment, creating a positive cycle. On the other hand, too much competition for funds could lead to a negative loop. It is essential to strike a balance that encourages investments without stifling competition. The Startup Act should be a game changer for funding for innovation if it is implemented.

Promoting local manufacturing and production

Local manufacturing and production should be promoted, with incentives and support for startups looking to scale their products. Marketing, distribution, and access to distribution channels also play a pivotal role. Monitoring and evaluation of progress are essential to refining strategies and optimizing the ecosystem continually. Additionally, policy advocacy and reforms that favour innovation-driven businesses can create an enabling environment for innovation.

Local manufacturing and production capacity can drive economic growth and reduce import dependency. As manufacturing capacity increases, so does production output and local market demand. However, a negative feedback loop can occur when increased market demand discourages local manufacturing capacity due to increased competition. This emphasizes the importance of a well-calibrated approach to promote local manufacturing that aligns with market dynamics.

Establishing structured mentorship

Mentorship emerges as another vital component. Establishing structured mentorship programs where experienced guide and inspire early-career colleagues is seen as a way to bridge the gap between academia and industry. These mentors are committed to sharing their knowledge and experiences, ensuring that the next generation is well-prepared for the journey ahead.

Mentorship plays a critical role in nurturing innovative talent. The model highlights the significance of mentorship programs in growing a pool of skilled mentors and entrepreneurs. A positive feedback loop emerges as mentorship programs expand, fostering more entrepreneurs. Yet, as the mentor pool grows, the need for such programs may decrease, suggesting the importance of a phased approach to scaling mentorship.

Establishing research translation offices

For Nigeria, a nation teeming with untapped potential and a rich pool of talents, the journey from research to innovation commercialization has been a challenging one. However, in our data, we found a sense of optimism among seasoned professionals and early-career enthusiasts, who are determined to turn their research papers into tangible products.

The key message from these passionate talents is clear: commercialization does not always require grandiose beginnings. They firmly believe that, as the age-old saying goes, “A journey of a thousand miles begins with a single step.” In other words, every scientific discovery, no matter how small, has the potential to become a valuable product that can benefit society. Startups and entrepreneurship emphasize the importance of forging strong partnerships between educational institutions, research centers, and industry players. Such partnerships can lead to improved educational programs that focus not only on traditional pedagogy but also on innovation, entrepreneurship, and the intricacies of commercialization.

To facilitate the transition from research to commercialization, the establishment of research translation offices within academic institutions is recommended. These offices would serve as valuable resources for researchers, guiding them through the complex process of patenting, licensing, and product development. Furthermore, collaboration with existing innovation hubs and startup incubators can offer early-career researchers the mentorship and resources they need to take their innovations to the market. Additionally, a focus on intellectual property protection, market research, and validation ensures that innovators are well-equipped for success.

In the digital age, research drives innovation. Establishing research translation offices facilitates the transformation of research outputs into practical applications. A positive feedback loop indicates that increased translation efforts lead to more funding for research. However, a negative loop can arise when greater research output diminishes the urgency for translation efforts. The key lies in maintaining a proactive stance in translating research into practical solutions.

Ensuring policy stability

Stable and consistent policies provide a conducive environment for innovation and investment. Reducing policy changes fosters economic stability by encouraging investment and innovation. In contrast, a positive feedback loop emerges as policy changes increase, potentially leading to instability. The critical lesson is to embrace policies that offer long-term stability and adaptability. Nigeria’s path to economic prosperity lies in the effective commercialization of innovation in its manufacturing and service sectors.