The launch of treasury strategy tokens tied to popular collections like BoDoggos and Claynosaurz on what appears to be the bands.fun platform is a play on or variant of “pump.fun,” the Solana-based memecoin and NFT launchpad known for rapid token deployments.

This fits into the booming “NFT Strategy Token” ecosystem, where tokens are designed to automate treasury management, yield generation, and flywheel mechanics for NFT holders.

What Are NFT Strategy Tokens?

These are innovative ERC-20 or Solana SPL tokens linked to specific NFT collections. They function like a “perpetual machine”.

The token treasury buys NFTs from the collection at market price, relists them at a premium (e.g., 1.2x), and uses sale proceeds to buy and burn more strategy tokens—creating self-sustaining growth and yield for holders.

Trading fees often 8-10% on DEX swaps like Uniswap or Raydium feed the treasury; royalties from NFT sales add more fuel. With NFT trading volumes rebounding up 150% YoY per recent OpenSea data, these tokens bridge DeFi and NFTs, turning passive holdings into active income generators.

Early adopters like PunkStrategy ($PNKSTR) have hit $87M market caps since September 2025 launches. This model exploded in late September 2025 when TokenWorks integrated them with OpenSea, enabling seamless trading and a 20 ETH rewards pool for top performers.

The BoDoggos and Claynosaurz Launches on Bands.fun

BoDoggos Treasury Strategy Token BoDoggos is an established Solana PFP collection 8,888 dog-themed NFTs launched in June 2023, with a focus on crypto entertainment and collectibles via their site.

The new strategy token automates treasury buys of BoDoggos NFTs, channeling fees into a K9-themed yield strategy recently revealed, per crypto news outlets. This includes staking rewards and podcast tie-ins from their “Morning Show.”

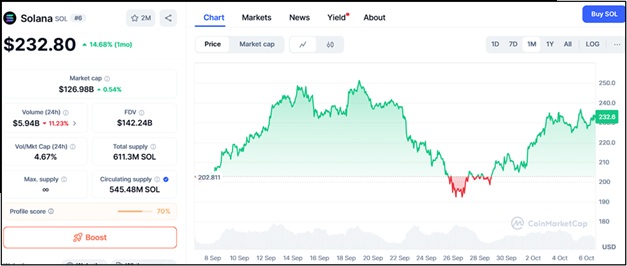

Rolled out in early October 2025 on bands.fun, coinciding with Solana’s memecoin surge. Early volume spiked 300% post-launch, with treasury holdings already at 50+ NFTs.

Aimed at “choosing rich” via meme-dog vibes—think BONK meets DeFi. Floor price for base BoDoggos NFTs is ~0.5 SOL, up 20% since the token drop.

Claynosaurz is a vibrant Solana NFT collection 10,000+ animated 3D dinosaur PFPs, launched in 2023, known for utilities like staking and metaverse access.

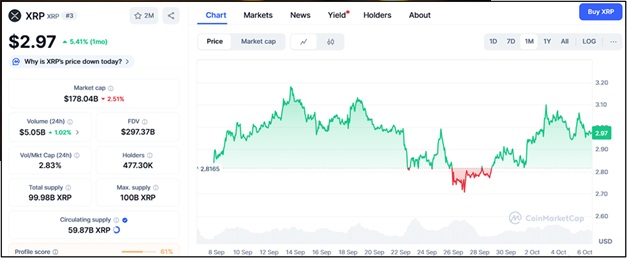

This strategy token focuses on “dino treasury raids,” using swap fees to acquire rare traits (e.g., golden scales) and burn supply for scarcity. Delphi Digital highlights it as a top Solana play in their 2025 NFT report.

Simultaneous with BoDoggos on bands.fun, October 4-5, 2025. Initial treasury seeded with 100 ETH equivalent in SOL. Floor price charts show a 15% uplift to ~2.2 SOL per NFT. It’s positioned for gaming integrations, with rumors of a Claynosaurz GameFi expansion.

These launches on bands.fun a fun, community-driven launchpad emphasizing “band” narratives like music/meme collabs mark a shift from pure memecoins to utility-driven NFT treasuries. No major glitches reported yet, unlike some pump.fun rollouts.

5 New NFT Strategy Tokens Launching This Week

Building on the momentum, bands.fun and TokenWorks are deploying 5 fresh strategy tokens tied to high-profile collections. These are set for sequential launches October 7-11, 2025, with airdrops for early BoDoggos/Claynosaurz holders.

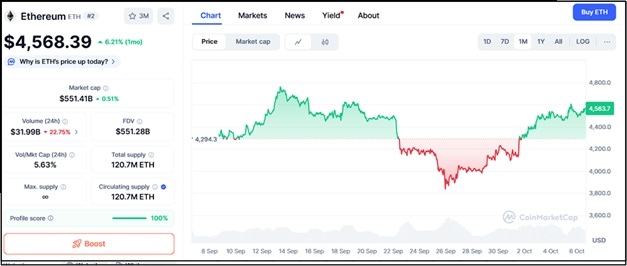

Pudgy Penguins buys rare penguins; 1% royalty boost; ETH treasury focus. Bored Ape Yacht Club (Ethereum) Ape-specific staking; integrates BAYC metaverse yields; 10% swap burn.

Moonbirds (Ethereum) Toad trait farming; nests 5+ birds per cycle; DeFi nesting yields. Moonbirds variant Bird-exclusive; burns 1.5% supply on sales; community-voted buys.

Azuki an Anime ecosystem tie-in; auto-buys Elementals; $8M seed treasury. All feature the flywheel buy-relist-burn loop, 8-10% DEX fees to treasury, and OpenSea listings for liquidity. Total rewards pool: 50 ETH across the batch.

High volatility (e.g., $PNKSTR dipped 2% daily but +392% monthly). DYOR—focus on collections with >$10M floor volume. Trade on Uniswap/Raydium; stake for 4-6% APY yields.

This wave could push NFT strategy tokens to a $1B+ sector by EOY 2025, per DappRadar forecasts, rivaling soulbound tokens (SBTs) in utility. BoDoggos and Claynosaurz add meme + gaming flavor, differentiating from ETH-heavy plays like PUNKSTR.