My old thesis (2018) was that despite having about 200 million citizens, Nigeria’s monetizable population for most tech services and products was about 30 million people. Yes, from most indicators, those were people who earned decent incomes to buy some tech services; food and healthcare covered the full population. Read here

“For most analyses, across industries, I like to work with 30 million people since that number is close to the total unique bank account users in Nigeria. Technically, anyone that does not have a bank account in Nigeria at the moment is largely poor. And when I do models for markets, for most products, I rely on this 30 million because those are the full market potential at the moment, unless the product is free or in some sectors like food. Most banks excluding First Bank which has about 14 million customers have lower than 10 million customers. That is not what you expect in a country of 180 million citizens. Yes, everyone is circling around 30 million people.”

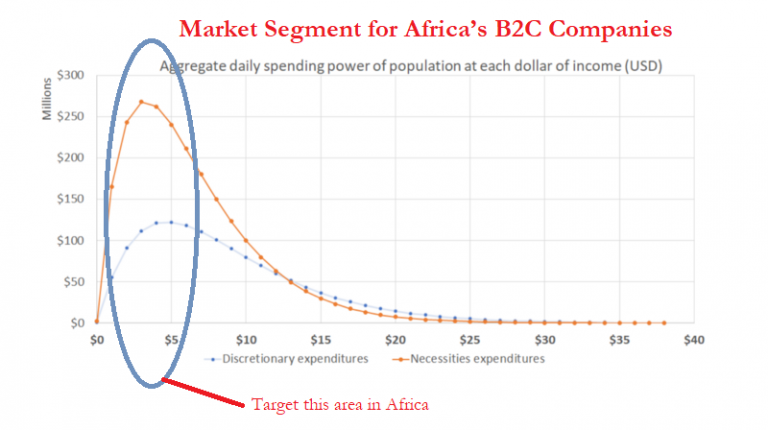

There was also the postulation that in B2C (business to consumer) products, the largest customer base falls within people who make between $4 to $8 per day: “the most significant opportunity for African B2C startups lies with consumers who earn between $4 — $8 per day … This is largely because that income band holds the highest concentration of discretionary spending power on the continent, as the graph below shows.” Outside that range, capturing value becomes harder. Read here

Now, the big question: what do you think the monetizable population is right now for most tech solutions in Nigeria? Greater than or lesser than 30 million? And WHY?

Comment on Feed

Comment on Feed

Comment 1: 30m for monetised market maybe ambitious Ndubuisi Ekekwe

My Response: If you use the 41 million personal federal income payers, 30M is not that far away. Add state workers and SME owners, you can be hitting 60m. Discount by 50% as most are not up to decent income, to care about tech services, that 30m may even look low right now.

Comment 2: According to the data released by the Nigeria Inter-Bank Settlement System (NIBSS) in 2021, it showed that the number of active bank accounts in Nigeria increased to 133.4 million. (Nairametrics).

My only issue with the data is that we are far from reality in data analysis in Nigeria. However,

quite a number of them are only encouraged by the recent Fintech introduction like opay, palmpay etc.

Given the minimum wage of $35-$40 that we maintain in Nigeria at the current exchange rate and with less than 2% being able to save over N500,000.00 in their bank account, which shows that quite a large number of the population of bank users are living largely from hand to mouth especially in this crucial time when the savings we have is the one saving us.

Monetization of tech products may not work very well in Nigeria. Except for data consumption and some other few cheap and important products depending on the population preference.

Like you said, except for health and self development products, tech products will still largely have low patronage if monetized especially in this critical time where everyone is careful of spending.

Comment 3: Prof Ndubuisi, I do believe it’s higher. It should be about 55million because as of may this year BVN enrolment was at 57.4million according to CBN data. Therefore, most of these account owners can actually be reached with one sort of tech solution or another. From payments, to insurance, cheap communications mechanism, eCommerce, entertainment, edutainment, education, etc. Moreover why can’t we have a way of allowing people at scale to buy voucher and use it to make payment without need for bank account?