free video editing software has fundamentally reshaped the landscape of digital storytelling, turning what was once a highly specialized craft into a universal language of expression. In the early days of the internet, creating a high-quality video required an immense investment in hardware, expensive licensing fees for professional suites, and months of technical training. Today, that barrier has vanished. The rise of sophisticated, accessible tools has empowered a new generation of creators—ranging from independent filmmakers and corporate marketers to social media influencers—to produce cinematic content from virtually anywhere.

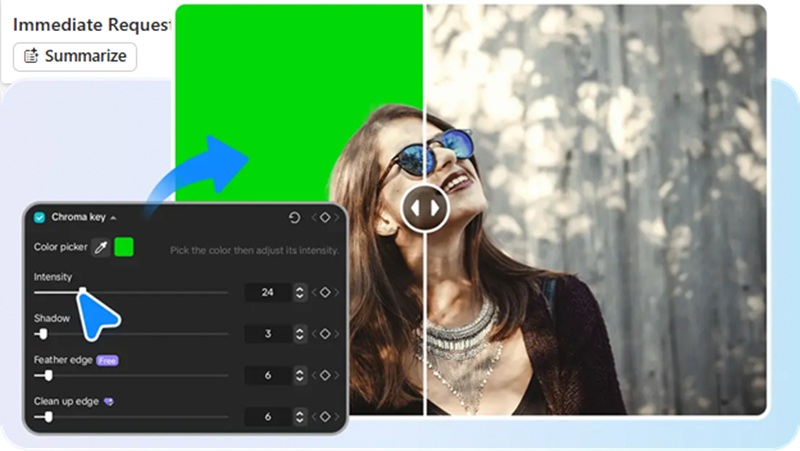

The impact of this democratization is most visible in the sheer volume and quality of content we consume daily. On platforms like YouTube, TikTok, and LinkedIn, visual quality is no longer just a luxury; it is a prerequisite for engagement. Audiences have become accustomed to high-definition visuals, seamless transitions, and professional-grade audio. To meet these expectations, creators are turning to robust desktop solutions that offer more than just basic trimming features. They seek advanced capabilities like keyframe animation, multi-track editing, AI-driven background removal, and complex color grading tools that allow them to give their footage a distinct “film-like” look.

The workflow of a modern creator, however, is rarely limited to moving pictures. There is a profound synergy between video production and graphic design. A compelling video often begins with a striking thumbnail or requires high-resolution overlays, title cards, and promotional graphics to convey a cohesive brand message. This is where the integration of photo editing becomes vital. When an editor can seamlessly transition between manipulating a video timeline and refining a static visual asset, the creative output becomes much more professional and consistent. This holistic approach to content creation ensures that the branding remains tight and the visual narrative is uninterrupted across different formats.

Efficiency is the heartbeat of modern creative work. As the demand for content increases, the time available for post-production decreases. Modern software addresses this challenge by incorporating artificial intelligence to handle repetitive and time-consuming tasks. AI can now automate the captioning of videos, perform smart scene detection, and even suggest the best musical beats for transitions. This allows the human editor to step back from the “grunt work” and focus on the high-level creative decisions—the pacing, the emotional resonance, and the narrative flow that truly connect with an audience.

Furthermore, the shift toward cross-platform compatibility has changed how we work. A creator might capture high-quality 4K footage on a smartphone but require the precision and processing power of a desktop application for the final polish. The ability to work across devices—syncing assets through the cloud—ensures that the creative process is never stalled by hardware limitations. This flexibility is especially important for the growing number of remote professionals and “digital nomads” who need to maintain a high standard of production while on the move.

The educational sector has also been a major beneficiary of these advancements. Teachers are moving away from static slides and embracing video as a primary teaching tool. By creating engaging, visual-first lessons, they can increase student retention and make complex topics more digestible. Similarly, students are using these tools to build impressive digital portfolios, preparing themselves for a job market that increasingly values “creative literacy” alongside traditional academic skills.

Beyond professional use, the personal value of these tools cannot be overlooked. People are using digital editing to preserve family histories, turning raw clips of vacations and milestones into cherished legacy projects. The ability to enhance the lighting of a dim shot or clear up the audio of a distant voice ensures that these memories are kept in the best possible quality for future generations. It turns every user into a historian of their own life, equipped with the tools to tell their story with clarity and beauty.

As we look toward the future, the boundaries between different digital disciplines will continue to blur. We are moving toward a reality where “content creation” is a unified field, combining video, audio, design, and interactive elements into a single creative pipeline. The tools that succeed in this new era will be those that prioritize user experience without sacrificing power—making professional-grade results accessible to anyone with an idea and the drive to share it.

In this fast-evolving digital world, the goal remains the same: to capture attention and deliver a message that sticks. Whether you are launching a global ad campaign or simply sharing a creative hobby, the tools you choose are the foundation of your success. By combining powerful motion tools with high-quality static graphics, you ensure your message is not just heard, but remembered. For those looking to elevate their visual presence with perfectly retouched assets and professional thumbnails, it is essential to explore high-quality pictures of editor.