Amongst Cryptocurrency Prices Today, notable gains have been observed in two prominent cryptocurrencies. Investors and enthusiasts tracking the latest trends will find these developments worth noting. Litecoin has experienced significant price increases, while Solana is displaying strong momentum in its upward trajectory. Additionally, a newcomer, BEASTS Coin (BEASTS), is currently running a distinctive presale, offering investors a unique opportunity to be part of its promising venture. As the cryptocurrency landscape continues to evolve, these developments highlight the dynamic nature of the market and the diverse investment opportunities it presents.

Solana Makes Big Gains

Solana (SOL) has shown significant growth recently, particularly in the past week, indicating strong momentum in the decentralized finance (DeFi) market. SOL is approaching a critical level of $20, which is closely watched by investors and market observers. Analysis shows SOL is currently priced at $19.31, with a 1.02% increase in the last 24 hours. The real highlight is the remarkable surge of 20.87% over the past week, making Solana an asset of interest in the crypto space.

Litecoin Rises In Hope

According to crypto trading experts, Litecoin’s recent chart patterns indicate a potential upward trend, although a temporary drop to $99-$102 is expected. CoinCodex’s machine algorithm predicts price increases in the near future, with estimates of $114.58 (+7.08%) in five days, $131.29 (+22.7%) in the next month, and $124.33 (+16.2%) in the next three months. Litecoin is currently trading above the 200-day simple moving average, with resistance at $120 and support at $95.09.

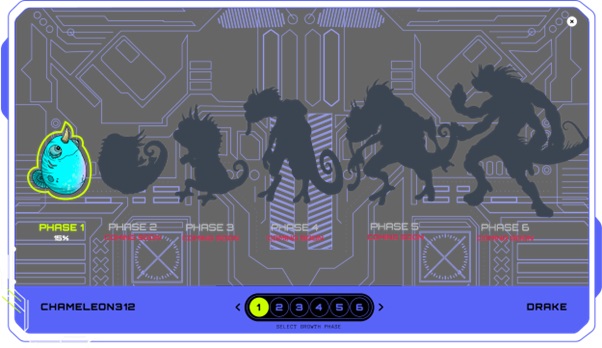

BEASTS Coin: The Rebels Arrive

BEASTS Coin (BEASTS) is not your average crypto project—it’s a mind-blowing mix of imagination, community involvement, and the endless possibilities of crypto. What makes BEASTS stand out is its genius referral program that takes passive income to a whole new level. Here’s how it rolls: When your buddy signs up using your special code, you instantly earn a sweet 20% of their deposit in popular cryptos like ETH, BNB, or USDT. Boom! That awesome reward lands straight into your crypto wallet. But wait, there’s more! Your friend, the one who used your code, also scores an exciting 20% bonus of BEASTS tokens. It’s a total win-win situation where both parties cash in on the incredible rewards of this thrilling adventure.

Get ready to plunge into the epic storyline of Rabbit 4001, a badass hero on a mission to assemble a squad of extraordinary BEASTS and lead a DeFi revolution. The tale unfolds as the presale progresses, paving the way for a mind-blowing NFT space that immerses investors in a one-of-a-kind experience. We’re all about creating an epic ecosystem with a lively community and unlocking a steady stream of passive income along the journey. Join the rebellion today and become part of the imminent crypto revolution that BEASTS is about to unleash.

The Takeaway

Looking at Cryptocurrency Prices Today, the market continues to captivate with notable gains in Litecoin and Solana, highlighting their growth potential. Additionally, the emergence of BEASTS Coin and its unique presale presents an exciting opportunity for investors to be part of a groundbreaking venture. As the crypto revolution unfolds, these developments demonstrate the dynamic nature of the market and the multitude of possibilities it holds for investors and enthusiasts alike.

Join the BEASTS Coin (BEASTS) Revolution

Website: https://cagedbeasts.com

Twitter: https://twitter.com/CAGED_BEASTS

Telegram: https://t.me/CAGEDBEASTS