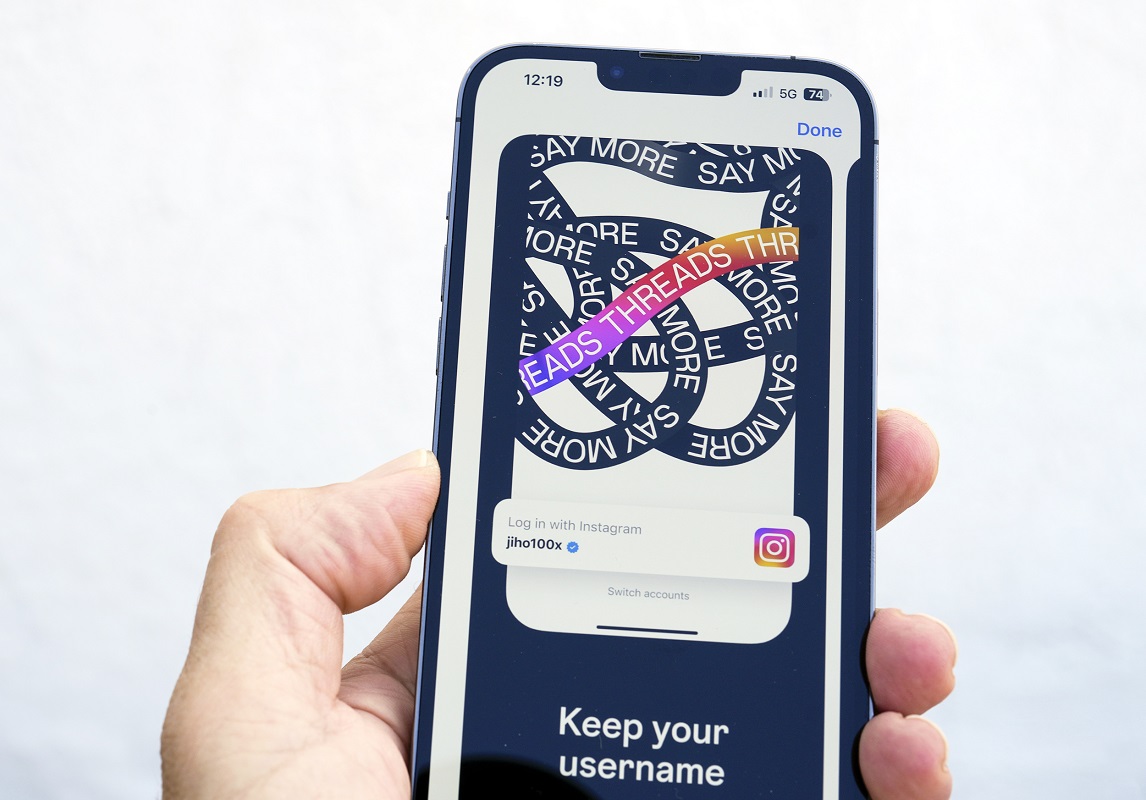

Meta’s Twitter-like platform Threads, has debuted on China’s App Store, ranking fifth in the social networking category.

Currently, the app is trailing behind Chinese social media giants like Xiaohongshu, WeChat, QQ, and Weibo, all of which boast hundreds of millions of active users.

Threads’ entry into China has defied the ban placed on Meta platforms by the Chinese government. This implies that despite being banned in the country, several Chinese citizens are using VPNs and other censorship-circumvention tools to access it.

GreatFire (GreatFire.org) an advocacy group that helps internet users inside China bypass blocks on censored content, indicated that the domain www.threads.net has been blocked in China since the 4th of July before its launch. How threads evaded through the organization’s firewall is still uncertain.

The unexpected debut of Threads on China’s Apple App Store no doubt signifies the growing population of the app and the traction it has continued to gain across countries where it is present.

While it remains to be seen how Chinese censors will tackle Threads, past experiences with Western social apps suggests that once they gain substantial traction, they tend to attract the attention of the Chinese authorities.

As Threads app achieves one of the top 5 positions on Apple’s China App Store, trailing only after Chinese social giants, all eyes are on the app, as it has surprisingly carved out a space for itself in the competitive Chinese social media landscape.

It is only a matter of time before the Chinese government takes notice and likely demands that Apple take down Threads from China’s app store. Apple is known to regularly comply with China’s demands to remove software from the App Store, which includes News, VPNs, and Social media apps.

Meanwhile, experts disclose that Censoring Threads could be tricky because the app plans to operate on a decentralized infrastructure powered by ActivityPub, the protocol that powers another Twitter competitor Mastodon.

Notably, Threads has been listed in the US and the UK but has no foreseeable launch date in the EU yet as the company worries about the bloc’s privacy regulations.

The app is not yet running in the EU, and they might never run, as the bloc has stricter privacy rules than most other countries, and it has given Meta a few problems to cope with in recent years.

The release of Threads in the European Union was postponed amid regulatory uncertainty about how the app will use personal data. This is because of the E.U.’s Digital Markets Act, which includes provisions for sharing user data across multiple platforms.

According to the app’s data privacy disclosure, Threads can collect information about a user’s health, finance, contacts, search history, location, and other sensitive information via their digital activity.

Meta must therefore await approval from the European Commission, the E.U.’s executive arm before it can launch Threads in E.U. countries.

Sources close to Meta said that the company isn’t offering the app in the union’s member states because it’s not sure about the requirements set out by the Digital Markets Act (DMA), the EU’s new competition rules governing how large online platforms use their market power.

Cross-border payments are a vital part of the global economy, but they are often slow, costly and inefficient. Traditional payment systems rely on intermediaries, such as correspondent banks, that add fees, delays and complexity to the process. Moreover, these systems lack transparency and standardization, making it hard for customers to track their transactions and ensure compliance.

Ripple is a blockchain-based platform that aims to solve these problems by providing a fast, secure and low-cost way to send and receive money across borders. Ripple connects banks, payment providers, digital asset exchanges and corporates through its network, called RippleNet, which enables them to exchange value using a common ledger and a native digital asset, XRP.

Bank Of America (BOA), one of the largest financial institutions in the world, has recently praised Ripple for its impact on cross-border payments. In a report titled “The Future of Payments”, BOA highlighted how Ripple can help its customers improve their payment experience and reduce costs. The report stated:

“Ripple offers a solution that leverages blockchain technology to streamline cross-border payments. It allows banks to provide real-time, end-to-end visibility into the status of a payment, from the moment it is sent until it is confirmed. It also reduces the number of intermediaries involved, which lowers the cost and risk of errors.”

BOA also noted that Ripple can help its customers access new markets and offer new services, such as on-demand liquidity (ODL). ODL is a service that uses XRP as a bridge currency to eliminate the need for pre-funding accounts in foreign currencies. This frees up capital and reduces exchange rate risk. BOA stated:

“Ripple’s ODL service allows banks to support cross-border payments without holding foreign currency in nostro accounts. This reduces the amount of trapped capital and enables banks to offer more competitive pricing and faster settlement times.”

BOA is not the only financial institution that recognizes the benefits of Ripple. According to Ripple’s website, more than 300 customers across 40+ countries and six continents are using its platform to process over $10 billion in transactions per day. Some of these customers include Santander, Standard Chartered, MoneyGram, American Express and SBI Remit.

Ripple is clearly making a positive impact on the cross-border payments industry, and BOA is one of its biggest supporters. By leveraging Ripple’s technology, BOA can offer its customers a better way to send and receive money across borders, while saving time, money and resources.