Good People, I downloaded Instagram today. Logged in, and tried to find Threads, the Twitter-clone created my Meta. Within 10 minutes, I had deleted Instagram on the phone. It seems the thing does not have a web version. Since I hate mobile apps, it was not going to work for me.

So, you are not likely to find me there despite the 200 million users which I think is not technically correct. Also, there is no data which shows that the 200 million people migrated from Twitter to Threads. Rather, what happened was more people will stop using Instagram, spending more time on Threads.

If Instagram has about 2.5 billion users, I expect Threads to hit close to 500 million by the end of this quarter. But these are not Twitter users; most are Instagram users who see Threads as a new feature.

As an investor, I will not invest in the fact that Threads has 200 million users because it does not; what happens is that Instagram has a new feature which 200m people are using. More so, as that new feature becomes popular, most of those users will stop using Instagram.

The only way we can judge Threads if it was fully decoupled from Instagram, becoming a native and organic social media platform, instead of an add-on on Instagram. Today, when you login to use Threads, they will count you as an active user of Threads and Instagram; that is not how it works.

Good People, Twitter should be fine if it continues to execute. Threads is only going to cannibalize Instagram engagement because most of the users are not wholly dissatisfied Twitter users, but Instagram users who like a new feature! This is not to say that Twitter will not lose users. But Instagram will have lower engagement which may also cause trouble for Meta.

And the big one: do you think those photo-posting Instagram users can really engage in texts? Ask Google why it closed Google+. Twitter should focus on its fintechnolization strategy because that is the only way to secure its future.

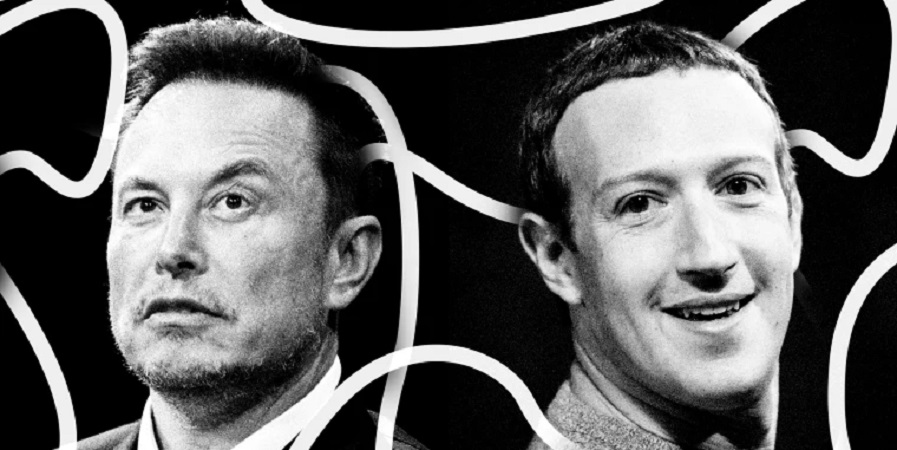

Elon Musk is his generation’s finest innovator: ”Twitter’s quest to become a payment company has taken its first major step with license acquisition. The company announced Wednesday that it has been granted money transmitter licenses by three US states namely: Missouri, Michigan, and New Hampshire.”

Today, Twitter as a fintech is born. As Meta (yes Facebook) is coming with Threads to challenge Twitter, the microblogging platform, Elon Musk has moved on, understanding that the natural stable state of all digital platforms is fintechnolization: “a construct that every digital platform must have a maturity state of offering a fintech solution.“

Threads will have its users but Instagram may lose engagement if Threads succeeds. Indeed, Mark can score a great goal and also allow a minor own-goal. Why? It is easier to monetize photos than texts! So, you are better off if those users are on Instagram, burning their hours!

Comment on Feed

Comment 1: And the romanticisation of Elon Musk continue, Prof., when will you call a spade a spade?, I know you like Elon Musk, but he made so many wrong decisions since owning Twitter ranging from firing the people who created the platform to become what it is, the builders, the verification monetisation, selected censorship, up until recently, limiting the number of tweets viewable by users under the pretext of precluding data scraping.

Note that, he did all of these things under the presumption that Twitter is king in its space, and it’s users are solidified. He def never saw Threads coming! The ultimate way to see Musk was shooked, and perhaps the beginning of destabilising Twitter’s dominance in text-based social media is the hurried cease and desist letter that Twitter engaged law firm sent to Meta.

I’m not a Meta fanboy, far from it. But we can’t continue to dispute the impact of Threads. It has over 1 million active users/profiles created within 30 minutes — the fastest in user generation post-launch of a public media platform. You have not accessed Threads, you only joined Instagram. You need to check Threads, and if you decide not to use Instagram to reach a wider audience, that’s 500 million active users you’ve said “no” to.

My Response: Thanks for putting your points. That is all that matters. I am not pro-anyone. Instagram is for photo-loving users; transitioning them to texts is not guaranteed, just like Google+ wanted to convert everyone in Google to use it. A real evaluation of Threads would have happened if it was a native app, without been tethered on Instagram.